Q. How is Personal Income Tax Calculated in Japan?

A. Personal income tax in Japan is determined by applying a tax rate to the tax base, which is the income earned by an individual during the year.

In other words, the amount of income tax is basically calculated by applying a tax rate to the amount remaining after subtracting deductions and exemptions from “gross income”. In practice, further tax credits are applied to the tax amount calculated by this method.

Income is subject to taxation regardless of the source from which it is derived. There is no definition of income in the articles of the Income Tax Act. Although the Income Tax Act does not provide a specific definition of income, we can consider it as any broad economic benefit that an individual earns or something that could be considered an economic benefit for an individual.

Simply put, “gross income” is first calculated by deducting necessary expenses from revenue. This calculation is done separately for each type of income. From this “gross income”, various deductions and exemptions, such as the spouse exemption and medical expense deduction, are subtracted. The resulting taxable income is then subject to a progressive tax rate to calculate the amount of tax.

But the tax amount calculated here is something like “the preliminary tax amount”.

The amount of tax credits, such as the special credit for housing loans, is then subtracted from the resulting tax amount. The final amount of tax due, after applying all eligible tax credits, is the amount that the individual owes.

The calculation process involves several steps and begins with recognizing the revenue earned.

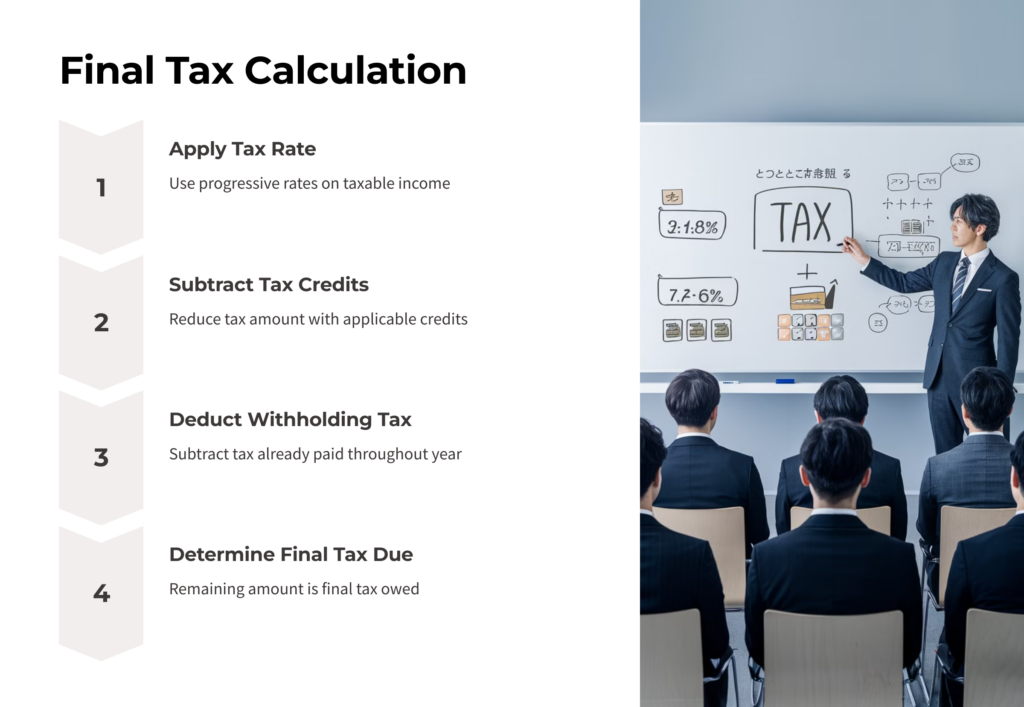

Steps to Calculate Personal Income Tax:

1. Determine Total Amount of Gross Income:

Calculate the total amount of gross income earned from various sources such as salaries, business income, and investments. This is calculated by first subtracting the necessary expenses from the revenue for each income type, then summing the resulting income for each of those types.

2. Apply Deductions from Gross Income to Determine Taxable Income:

Deductions and exemptions from gross income include a spouse exemption, a medical expense deduction, and a basic exemption. The remaining amount after applying these deductions and exemptions is the taxable income.

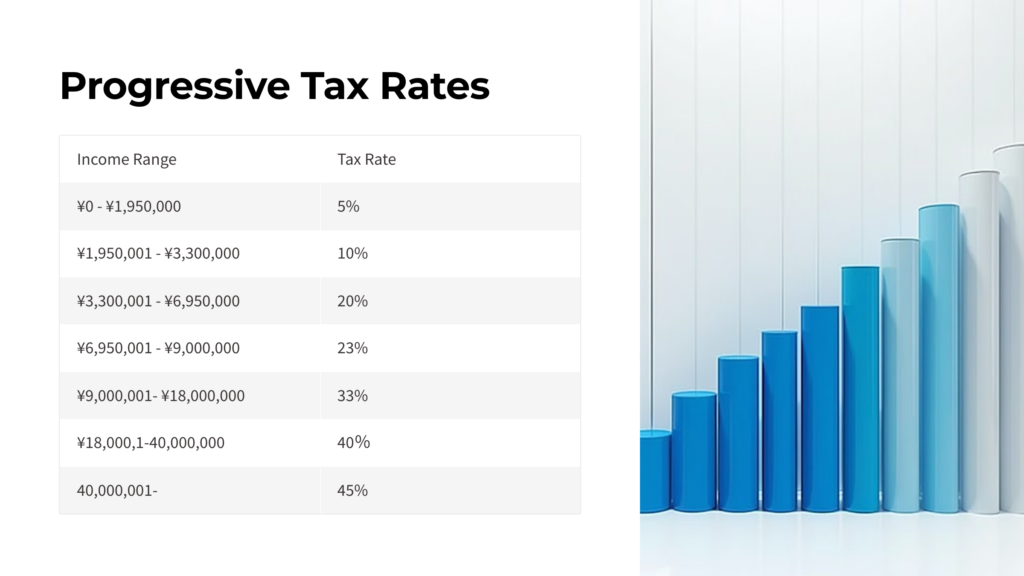

3. Apply Progressive Tax Rates to the Taxable Income to Calculate the Tax Amount:

Taxable income is then subject to progressive tax rates. Japan uses a progressive tax system, meaning the tax rate increases as the taxable income rises.

4. Subtract Applicable Tax Credits to Find the Final Tax Due:

Apply any eligible tax credits, such as the special credit for housing loans, to reduce the calculated tax amount. The remaining amount is the final tax due, which is the actual amount of tax that the individual owes after applying tax credits. Furthermore, any withholding tax that has already been paid throughout the year is subtracted from the final tax due.

Non-Resident Taxation:

The explanation regarding “Classification for residential status” is omitted here, but any individual who is not a Japanese resident, does not have a domicile in Japan, or has not resided continuously in Japan for one year or more, is classified as a non-resident for income tax purposes. Individuals classified as non-residents are subject to income tax only on their Japan-sourced income. The specific tax treatment depends on the type and source of income, among other factors.

You are considered a non-resident in Japan for tax purposes unless you have a domicile in Japan or have had a residence continuously for one year or more.