Are you feeling anxious about potential tax investigations related to cryptocurrencies, NFTs, or other tokens?

We frequently receive questions such as:

“What is the process of a tax investigation?”

“What happens during a tax audit?”

“Can tax authorities track my transactions on overseas exchanges or decentralized exchanges (DEXs)?”

“How much additional tax might I owe after an investigation?”

In this guide, we outline the essential steps for individuals and corporations trading or holding cryptocurrencies to prepare for tax inspections effectively.

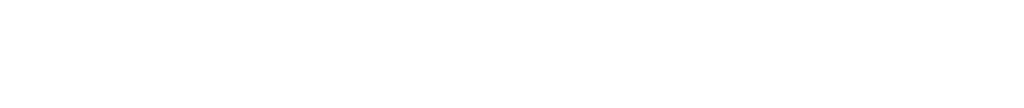

Key Requirements for Proper Tax Reporting

During a tax audit, inspectors will review whether you have accurately calculated your profits and losses (income) and the corresponding tax amounts for cryptocurrency transactions in your tax filings.

If your tax filings are accurate, there’s no need to fear a tax audit.

The two most critical aspects of proper tax reporting are:

1 Accurate profit and loss calculations for token transactions.

2 Compliance with tax law to ensure correct calculation and reporting of tax amounts.

To meet these requirements, you’ll need:

・Basic knowledge of cryptocurrencies and blockchain technology.

・Skills for calculating gains and losses from token transactions.

・Proficiency with crypto profit and loss calculation tools.

・Understanding of tax law and related laws.

・Access to a complete and accurate transaction history.

Essential Steps You Can Take Today

1 Managing Your Transaction History

Before diving into trading:

・Verify that your chosen exchanges (both centralized and DEX) are compatible with your tax calculator

・Confirm API integration capabilities and CSV export options

・Document when you began trading and your investment objectives

It’s also helpful to record the date and time you began trading on the exchange, as well as your trading objectives. This information will streamline the tax filing process and reduce stress during tax audits.

For transactions not fully supported by your profit and loss calculator—such as wallet-to-wallet transfers (which do not impact profit and loss calculations) or unsupported exchanges—you should manually record the following details:

・Date and time of the transaction

・Counterparties involved (if applicable)

・Purpose of transactions

・Token value (rate) at the time of the transaction

Pro Tip: Exchanges occasionally face issues with data retrieval. To avoid data loss, download and back up your transaction history regularly—ideally every three months.

For further guidance, refer to our book, “Understanding NFTs and Cryptocurrencies Tax Implications Through Examples.”

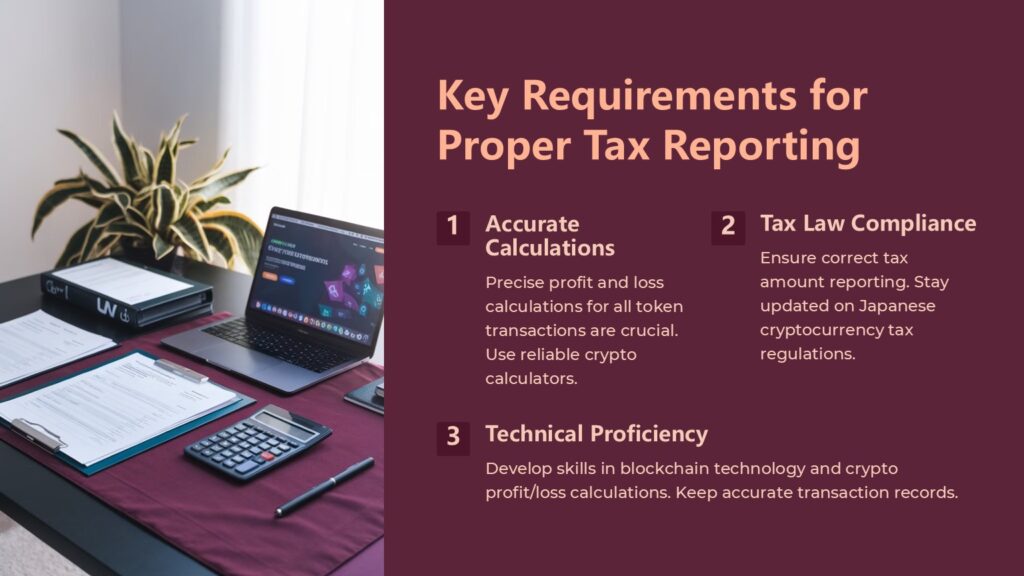

2 Year-End Balance Checklist

At the end of each year, document the balance (quantity) of all cryptocurrencies, NFTs, and tokens you hold. Compare this with your recorded balance to ensure accuracy.

Taking screenshots of your wallet or exchange balances on your computer or smartphone can streamline profit-and-loss calculations later.

When to Seek Professional Help

1 Complex Calculations

Even with advanced crypto calculation tools, it’s not always possible to ensure every transaction is accurately accounted for. Common challenges include:

・Forgetting to import transaction histories from certain exchanges.

・Struggling to distinguish between transactions that impact profit and loss (e.g., sales) and those that do not (e.g., lending or fund transfers).

In these cases, consulting a tax accountant with expertise in cryptocurrencies is highly recommended. A skilled professional can help resolve issues and ensure accurate profit and loss calculations.

2 Handling Complex Tax Issues

Many cryptocurrency transactions raise unresolved questions regarding tax treatment, such as:

・Activities on DEXs, including liquidity provision, wrapping for cross-chain bridges, and lending.

・Managing multiple exchanges and wallets.

・Earnings from blockchain games.

・Participation in DAOs.

The National Tax Agency has yet to provide clear guidance on many of these matters. Consulting a tax accountant with specialized knowledge in cryptocurrency taxation can provide clarity and peace of mind.

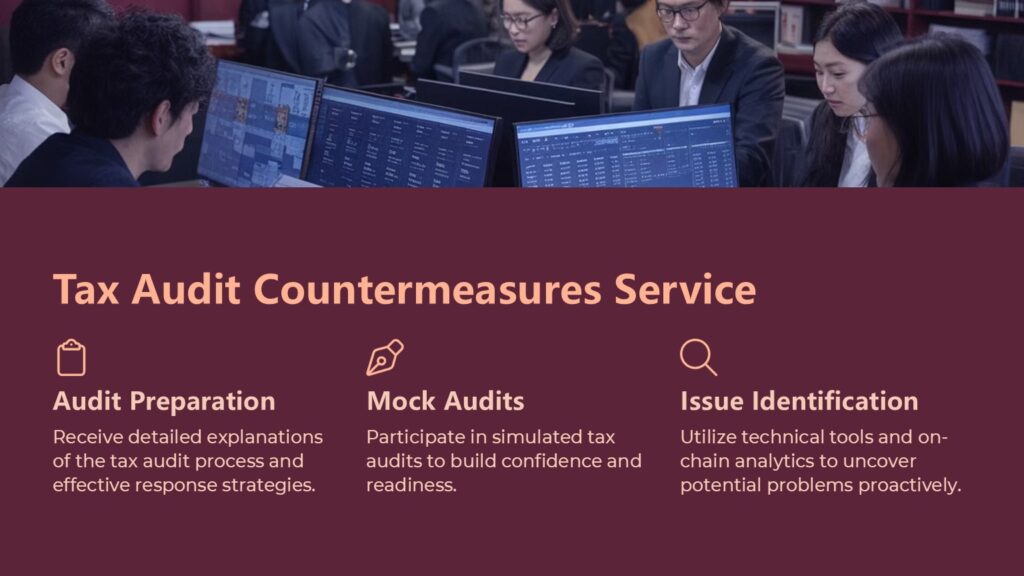

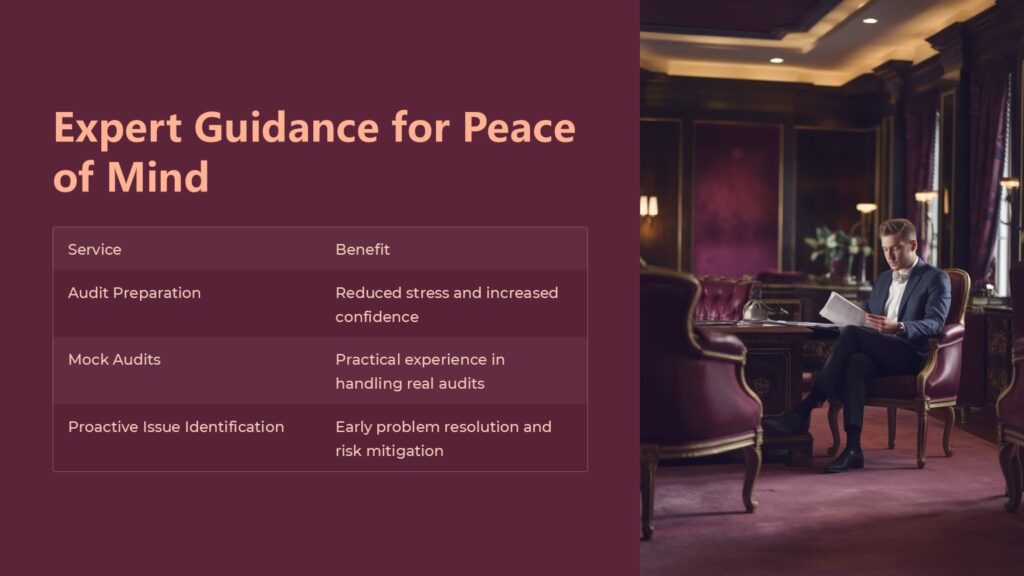

Our Tax Audit Countermeasures Service

Tax audits can be stressful, but our team is here to help. Our expert tax accountants, well-versed in profit and loss calculations, tax audits, and tax law, offer the following services:

・Audit preparation: Detailed explanations of the tax audit process and how to respond effectively to inspectors.

・Mock audit simulations: Simulated tax audits and role-playing exercises to build confidence and readiness.

・Proactive issue identification: Using technical tools and conducting on-chain analytics to uncover potential problems before an inspection.

Whether you’re currently under audit, seeking a second opinion, or just want to be prepared, our team of cryptocurrency tax experts is ready to assist you.

Feel free to contact us for expert guidance and tailored support!