The Japanese National Tax Agency (NTA) has significantly ramped up its tax investigations, especially in emerging sectors like the sharing economy and cryptocurrencies. But how intense is this crackdown, and what does it mean for taxpayers in these fields? Let’s break down the trends.

Tax Audits Double: A Closer Look at the Numbers

From fiscal years 2020 to 2022, the NTA’s on-site investigations nearly doubled, rising from 24,000 to 46,000. This sharp increase is largely due to the easing of COVID-19 restrictions and the resumption of normal investigative activities.

However, beyond pandemic recovery, the NTA is also laser-focused on new economic frontiers:

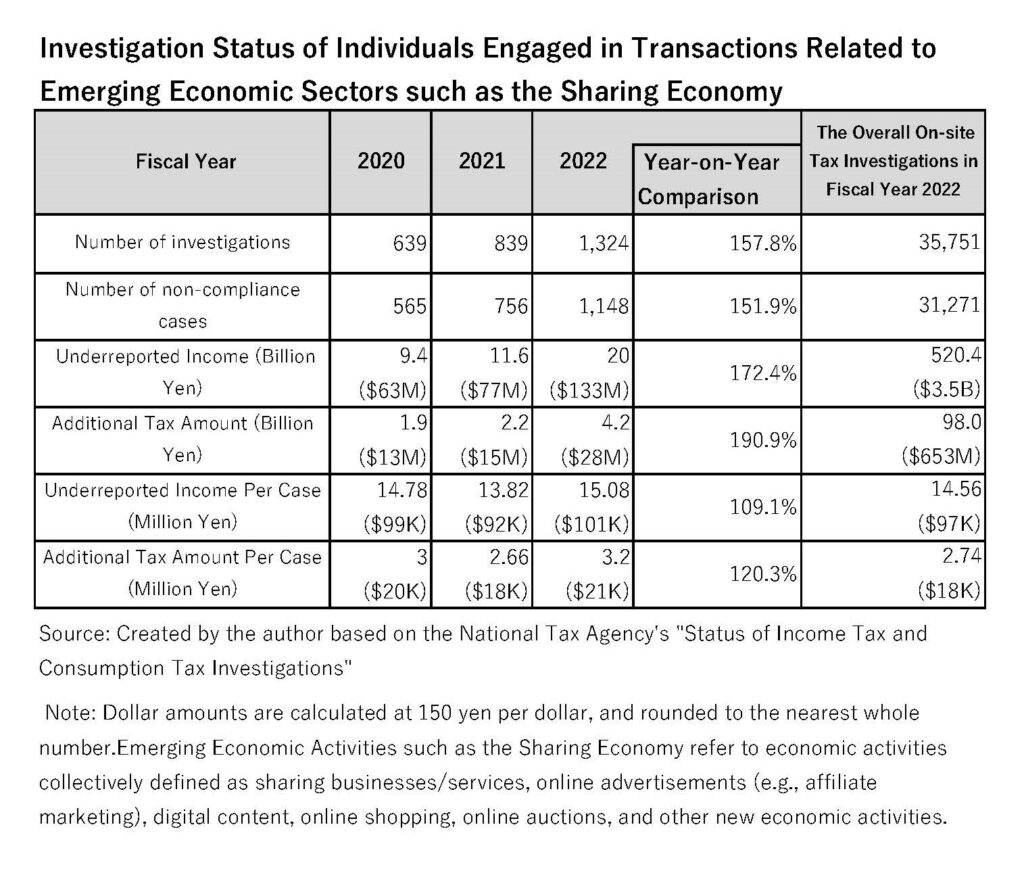

- Sharing Economy: In fiscal year 2022, the NTA conducted 1,324 investigations, uncovering ¥20 billion ($133 million) in underreported income.

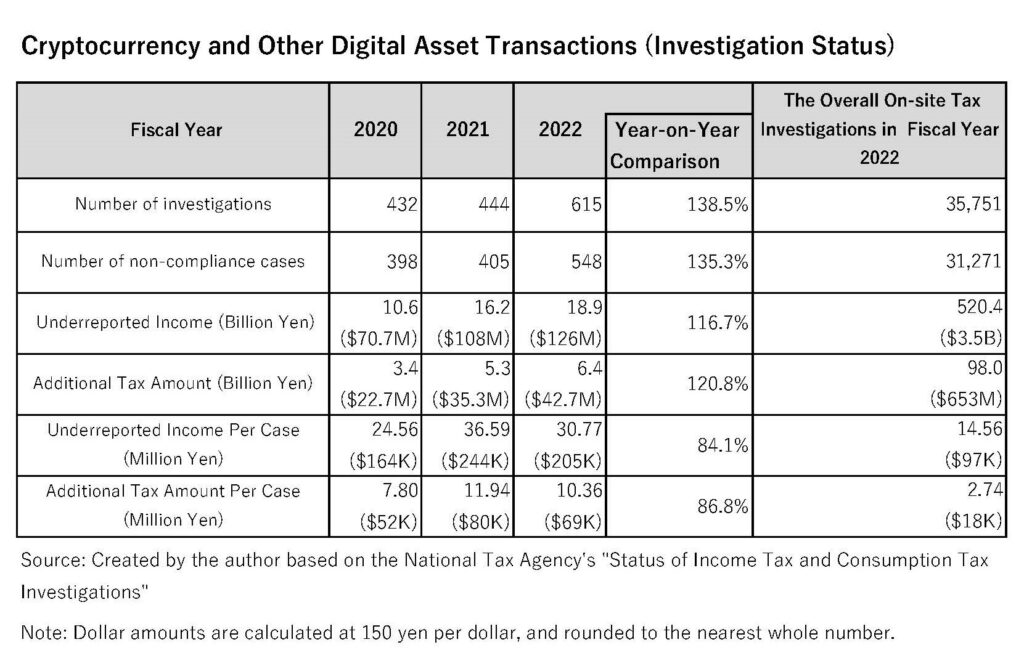

- Cryptocurrencies: Audits also surged, with 615 investigations identifying nearly ¥19 billion ($126 million) in underreported income.

While these figures may reflect a general uptick in tax audits following the pandemic, they also suggest that the NTA is paying closer attention to these industries.

Cryptocurrency Audits: Are You in the Crosshairs?

While tax authorities worldwide are increasingly focusing on cryptocurrencies, Japan’s NTA is still finding its footing in this area. Currently, most crypto audits are likely centered around:

- Suspected underreporting, based on data from cryptocurrency exchanges

- Taxpayers linked to tax evasion advisory companies

These cases typically arise from:

- Comparing information provided by cryptocurrency exchanges with the taxpayer’s filings

- Utilizing information obtained through tax investigations of others

- Acting on tip-offs regarding tax evasion

However, as the NTA’s expertise grows, we can expect more sophisticated audits, possibly leveraging international information exchanges and blockchain analysis to detect discrepancies.

So, What Does a Cryptocurrency Audit Involve?

During a crypto audit, the NTA will assess whether you have accurately calculated your profits and losses (income) from cryptocurrency transactions and properly reported them. If you’ve been diligent with your filings, there’s little to worry about. However, any discrepancies could raise red flags and lead to further scrutiny.

Crypto Tax Compliance: Your Shield Against Audits

To ensure you’re prepared for any audit, here are two essential points:

- Accurate Profit/Loss Calculation: Ensure you include all transactions, from cryptocurrency to NFTs and other digital assets. Track every transaction carefully and compute your profits and losses precisely.

- Know the Law, Follow the Law: Ensure your crypto earnings are reported accurately and that taxes are calculated in accordance with relevant tax regulations.

This often requires understanding both of blockchain fundamentals and tax law. Keeping meticulous transaction records and staying up-to-date on crypto tax regulations is your best defense.

Pro tip: Staying compliant and proactive with your tax filings is the surest way to avoid a tax audit nightmare. Don’t let your crypto gains vanish due to poor record-keeping!