2024 Edition

A TEXTBOOK ON JAPANESE

TAX ADMINISTRATION

National Tax College

Below is a document on Japan’s tax system that was prepared by the National Tax Agency of Japan and obtained through a public information request.

This article introduces the 2024 English edition of A Textbook on Japanese Tax Administration, prepared by the National Tax Agency of Japan and the National Tax College. The document was obtained through a public information disclosure request and is used in international tax administration training and technical cooperation programs.

The textbook provides a detailed, practice-oriented explanation of Japan’s tax administration, covering income tax, corporate tax, consumption tax, property tax, tax audits and investigations, taxpayer remedies, and collection procedures. It also explains Japan’s self-assessment system, criminal tax enforcement, and recent digitalization initiatives such as e-Tax and data-driven audit selection.

For tax professionals, researchers, policymakers, and international readers seeking to understand how Japan enforces and administers its tax laws in practice, this document offers an unusually transparent look—directly from the tax authority itself.

● This document was prepared for use as a reference document under technical cooperation by the National Tax Agency of Japan.

● Use of this document other than for its purpose, and copying this document are both strictly prohibited. Also, even copying this document for its purpose is prohibited without obtaining permission of the National Tax College.

Index INTRODUCTION

About the National Tax Agency (NTA)

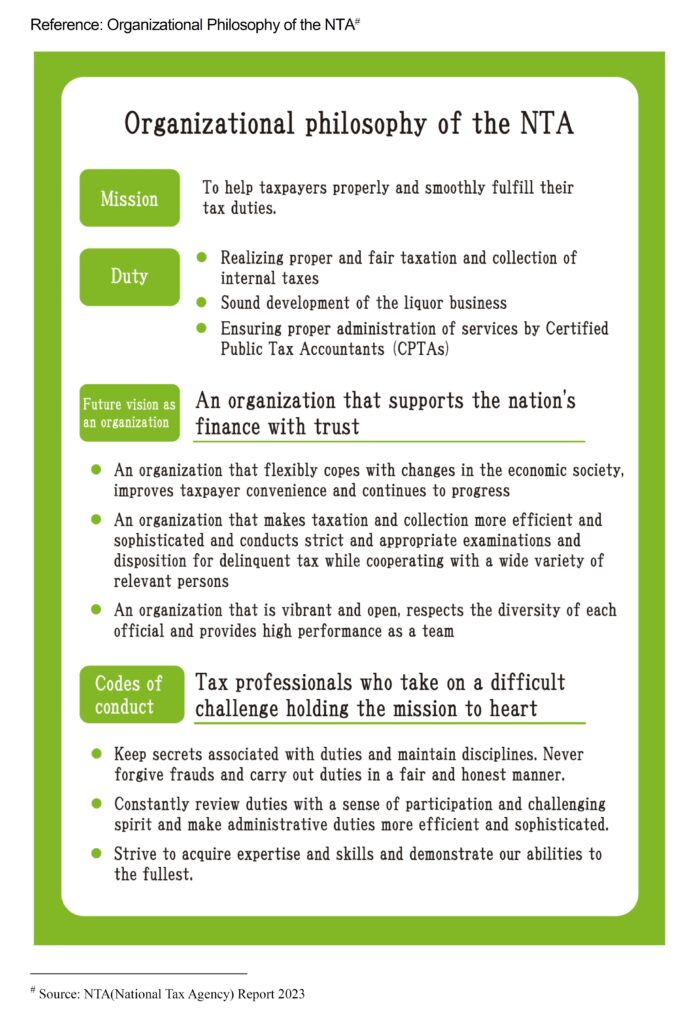

1 Organizational Philosophy of the NTA 1

Reference:Organizational Philosophy of the NTA 2

2 Overview of the National Tax Organization 3

Part 1 Outline of Operations

Chapter 1 Income Tax

Section 1 Overview

1 Self-Assessment System 9

Reference: Hisrory of tax administraion after the introduction of the self-assessment system 10

2 Taxpayers of Income Tax 16

3 Relationship Between Types of Income Earners and Divisions in Charge 16

Section 2 Overview of Administration of Self-Assessed Income Tax

1 Basic Administrative Policy 18

2 State of Self-Assessed Income Tax 19

3 Detail of Each Activity 20

Chapter 2 Withholding Income Tax Administration

1 Basic Administrative Policy 28

2 Outline of Management of Administrative Work 29

Chapter 3 Property Tax Administration

Section 1 Outline of Property Tax Administration

1 Inheritance Tax and Gift Tax 36

2 Income Tax (on Capital Gains and Timber Income) 36

3 Registration and License Tax 36

4 Land Value Tax 37

Reference: History of Property Tax 37

Section 2 Outline of Property Tax Administration

1 Property Tax Administration: Overview 38

2 Organizations for Property Tax Administration 40

Section 3 Main Administrative Procedures for Property Tax

1 Administrative Procedures for Inheritance Tax 41

2 Administrative Procedures for Gift Tax 43

3 Property Valuation Procedures 44

Reference: Property Valuation Structure 50

4 Administration of Capital Gains 52

5 Administration of Timber Income 54

Chapter 4 Corporation Tax Administration Section 1 Outline

1 Introduction 55

2 Anchor of the Self-Assessment System 55

3 Organization in Charge of Corporation Tax Administration 56

Section 2 Management and Examination of Small and Medium-Sized Enterprises (SMEs) (Tax Office Operations)

1 History and Organization 57

2 Outline of Operations of Corporation Tax 62

3 Examinations 70

Section 3 Management and Examination of Large Corporations (Operations at Regional Taxation Bureaus)

1 Administrative Organization 77

2 Administration of the Large Enterprise Departments of the Regional Taxation Bureaus 82

Chapter 5 Consumption Tax Administration

Section 1 Measures Taken for the Introduction of the Consumption Tax

1 Smooth and Effective Shifting of the Burden of Consumption Tax 88

2 Prevention of “Opportunistic” Price Hikes 88

Section 2 Administrative Organization and State of Execution of Consumption Tax

1 Administrative Organization of Consumption Tax Administration 89

2 Administrative Situation to the Present Day 91

3 Current State of Administration 94

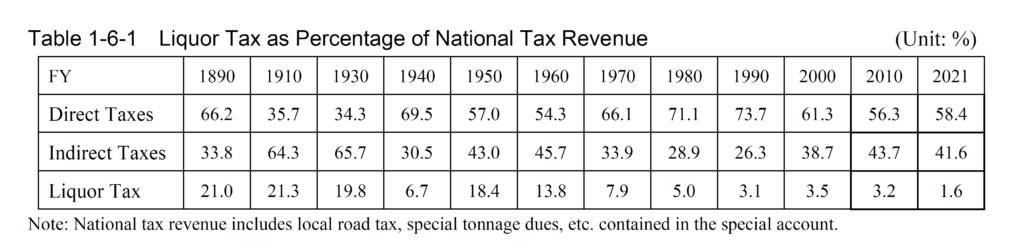

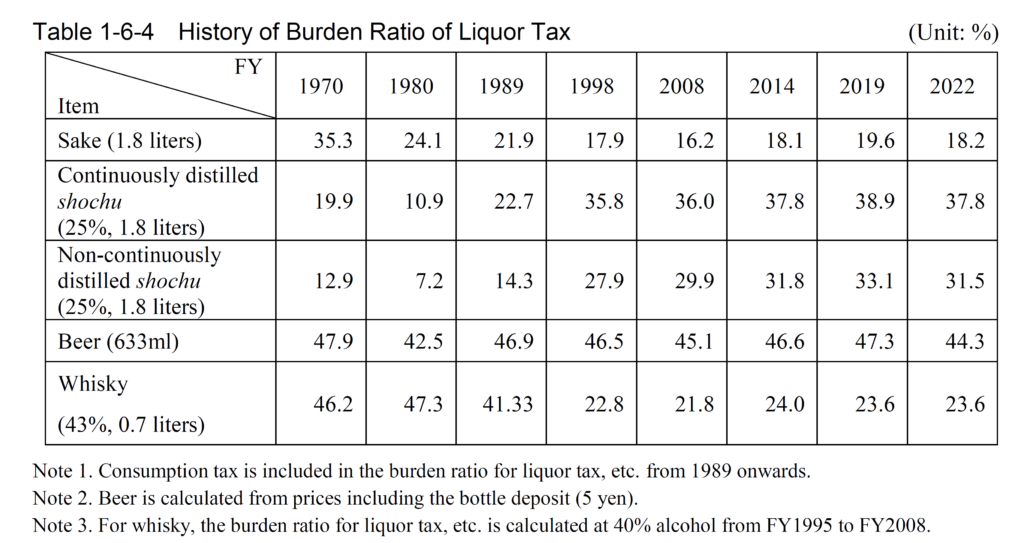

Chapter 6 Indirect Taxes Other Than Consumption Taxes Section 1 Liquor Tax Administration

1 Liquor Tax Revenue 102

2 Unique Aspects of Liquor Tax 103

3 Outline of the Liquor Tax Act 104

4 Overview of Liquor Tax Administration 108

Reference: Affairs related to Liquor Business Associations 114

Reference: National Research Institute of Brewing (NRIB) 116

Section 2 Indirect Taxes Administration

1 Revenue from Indirect Taxes 116

2 Outline of Indirect Taxes 117

3 Outline of Indirect Taxes Administration 120

Chapter 7 Information

1 Definition of Information 124

2 Functions of Information 124

3 Overview of Operations 125

Chapter 8 Examination of Complicated and Difficult Cases

1 Changes in the Environment of Tax Administration 134

2 Reinforcement of Section Specializing in Examinations 134

3 Responding Digitalization 136

4 Response to fraudulent refund of consumption tax 138

5 Improvements in International Taxation 139

Reference: International Cooperation and Coordination with Foreign Tax Authorities 147

Chapter 9 Examination Procedures

1 Outline 154

2 Concrete Examination Procedures 154

Part 2 Criminal Investigation System

1 Introduction 157

2 Characteristics 157

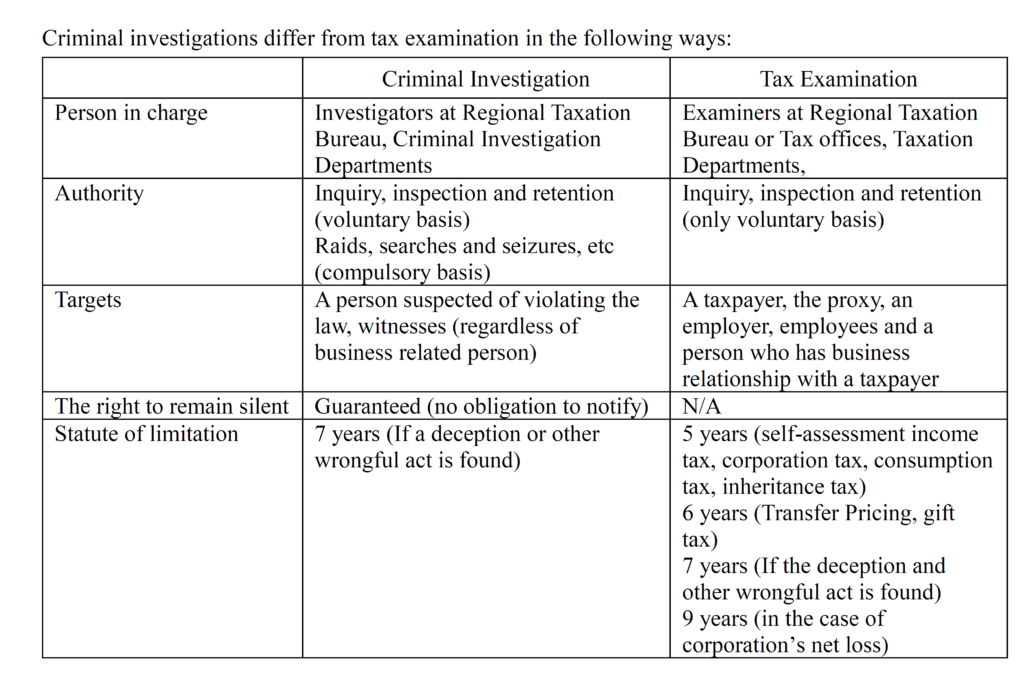

3 Outline 158

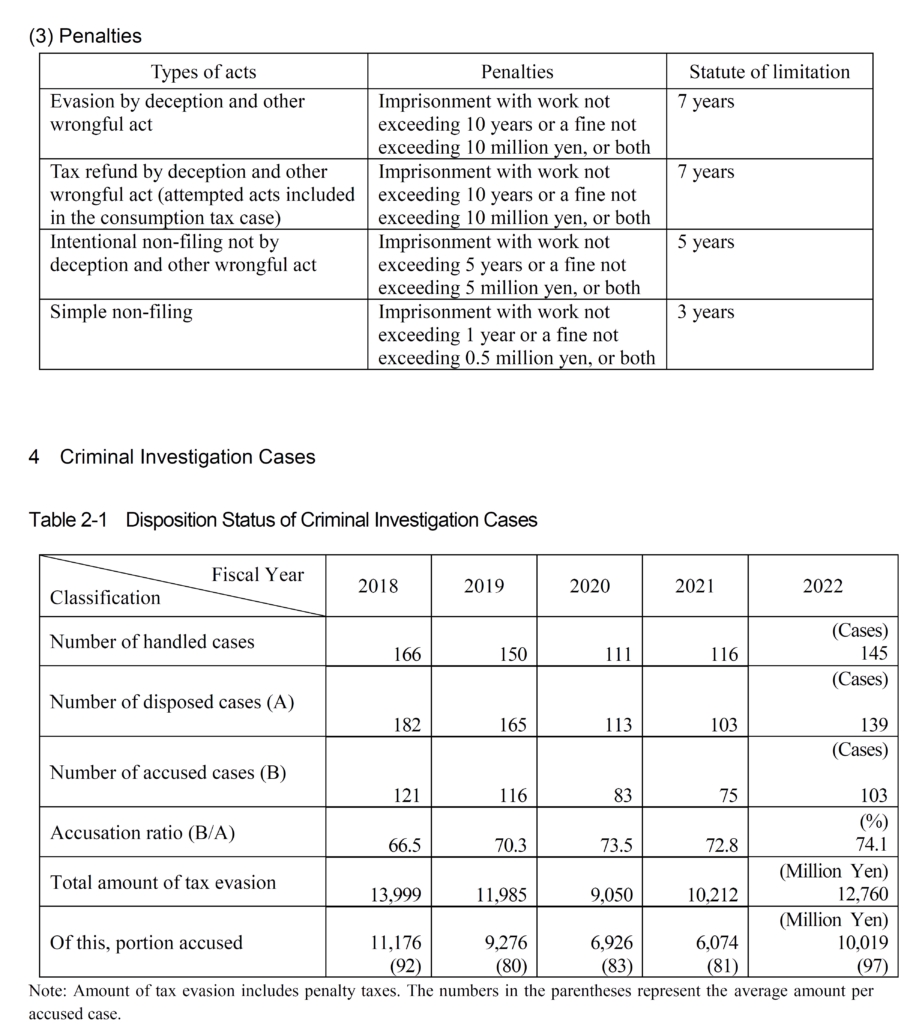

4 Criminal Investigation Cases 159

Part 3 Management and Collection of National Taxes

Chapter 1 Payment of National Taxes

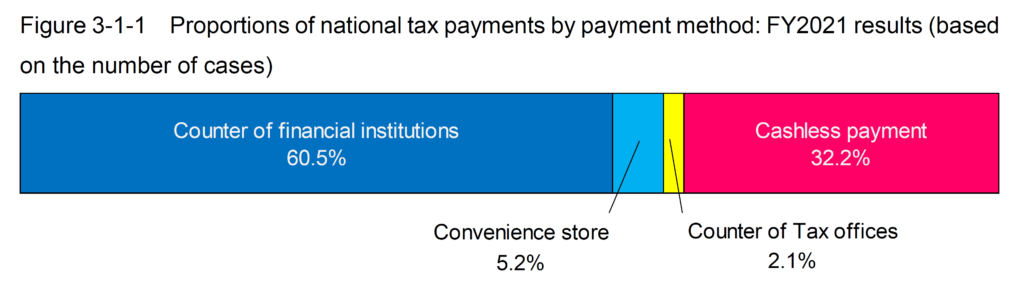

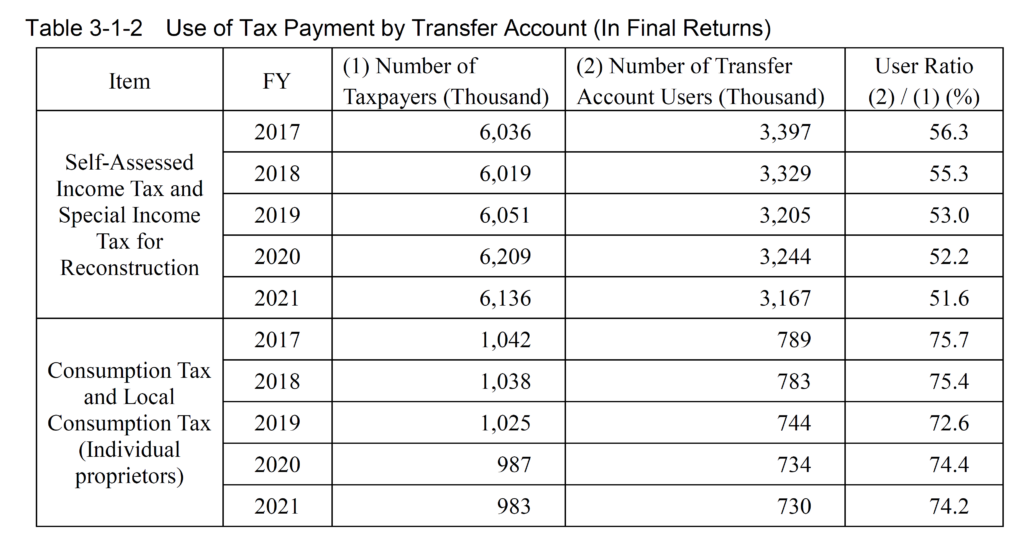

1 Payment of National Taxes 161

2 Methods of Cash Tax Payment 162

3 Delinquent Tax and Interest Tax 165

4 Current State of National Tax Claims 165

Chapter 2 Revenue Management and Processing

1 Outline 166

2 Contact Point Related Work 167

3 Taxpayer Basic Information Processing 169

4 Processing Tax Return Data 170

5 Collection Determination and Receipt 170

6 Refund 172

Chapter 3 Collection

1 Outline 184

2 Status of Tax Delinquency 185

3 Outline of Collection Operations 190

Part 4 Remedy for Taxpayer Rights

Chapter 1 Remedy System for Taxpayer Rights

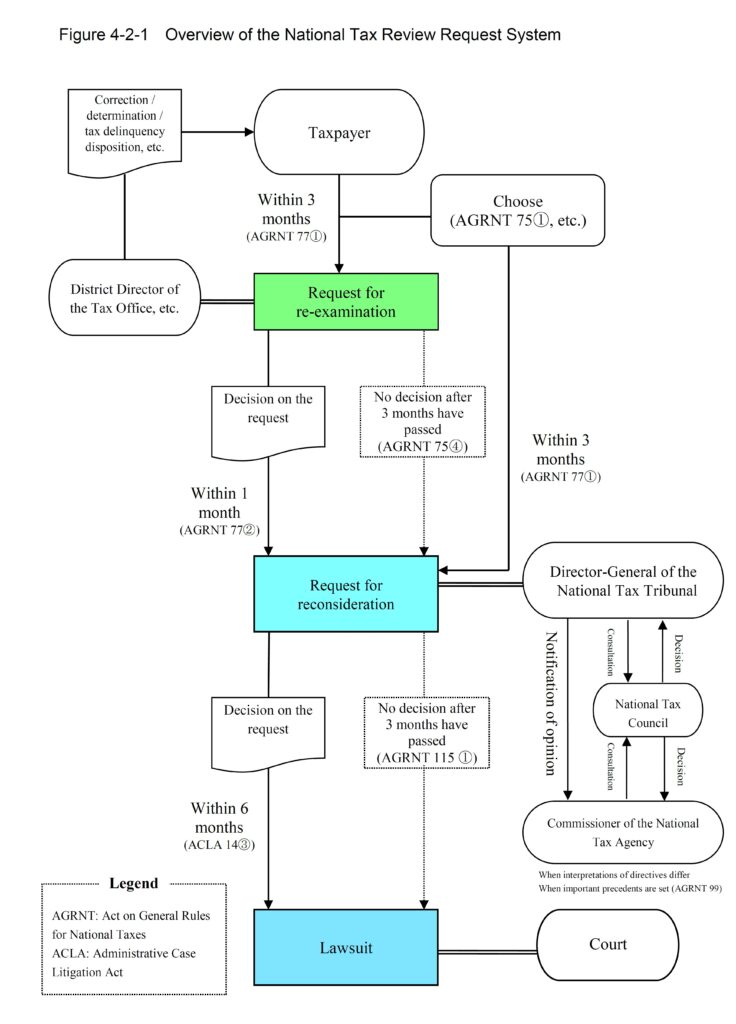

1 Outline 193

2 Meaning of Administrative Remedy and Judicial Remedy 193

Chapter 2 Requests for Review

Section 1 Outline of the Review Request System

1 Forms of Review Requests 195

2 Items Subject to Review Request 195

3 Who Can Request Review 195

4 “Appeal First” Principle 195

5 Standard Period for a Proceeding 196

6 Relationship between the review request and the collection of national taxes 197

Section 2 Requests for Re-examination

1 Procedures 199

2 Proceedings 200

3 Decision 201

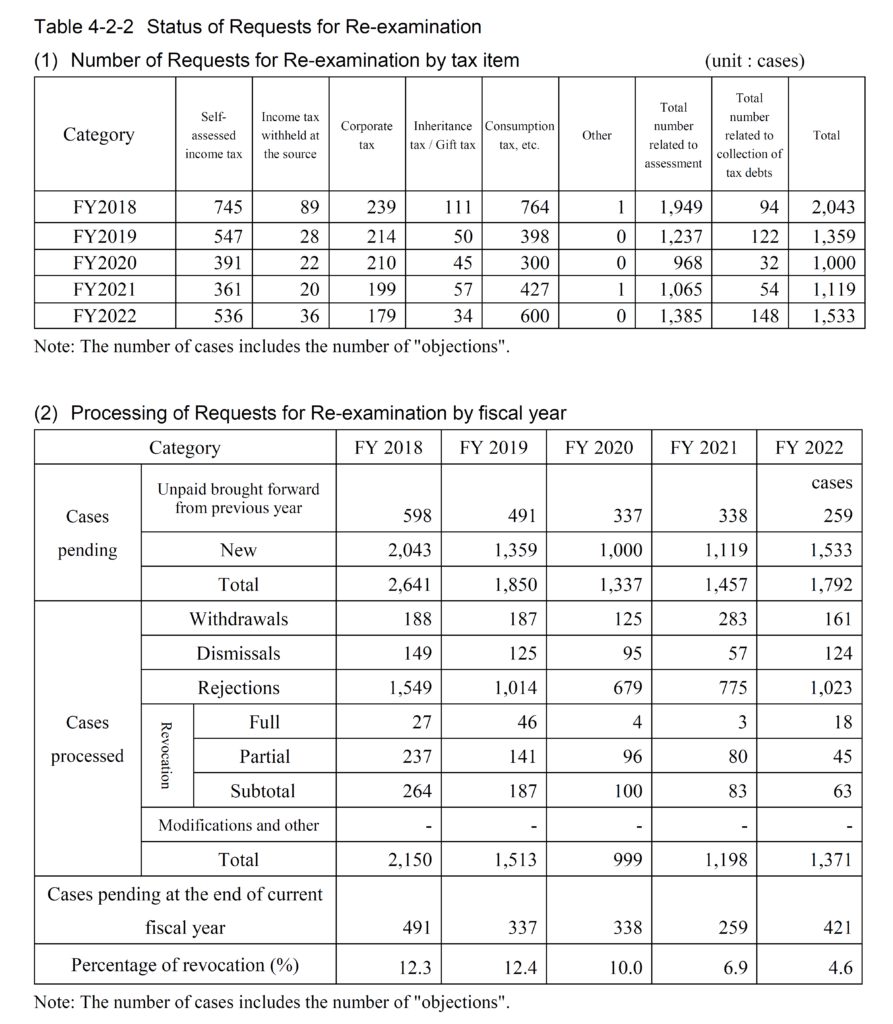

4 Statistics 203

Section 3 National Tax Tribunal

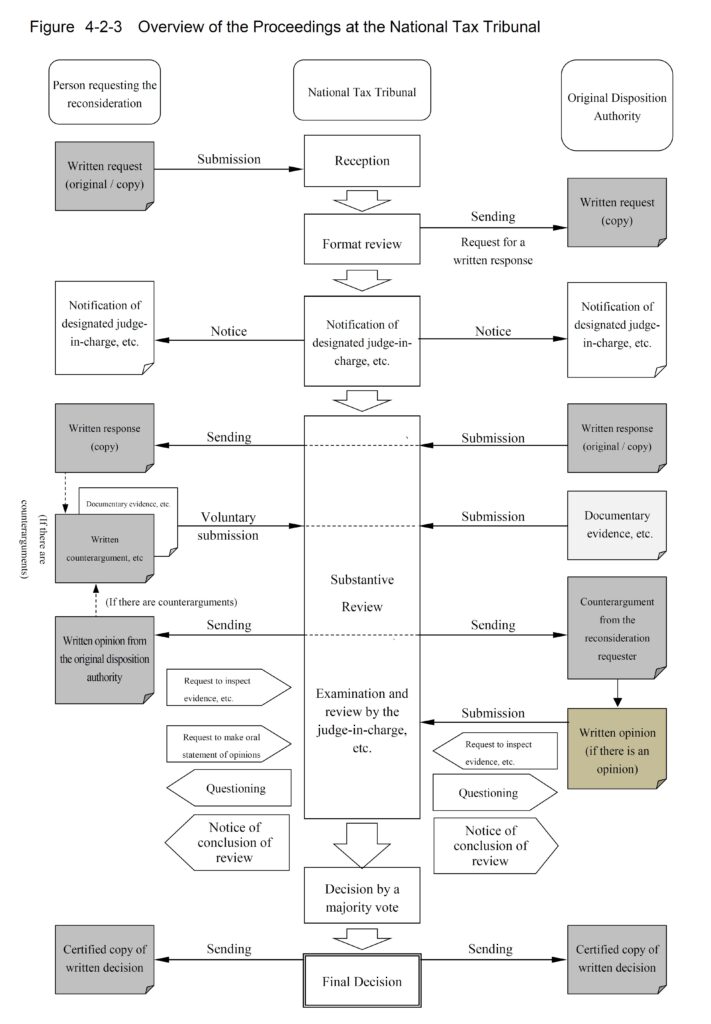

1 Outline 204

2 Organization and Membership 204

3 Characteristics 205

Section 4 Requests for Reconsideration

1 Where to File 206

2 Proceedings 207

3 Decision 209

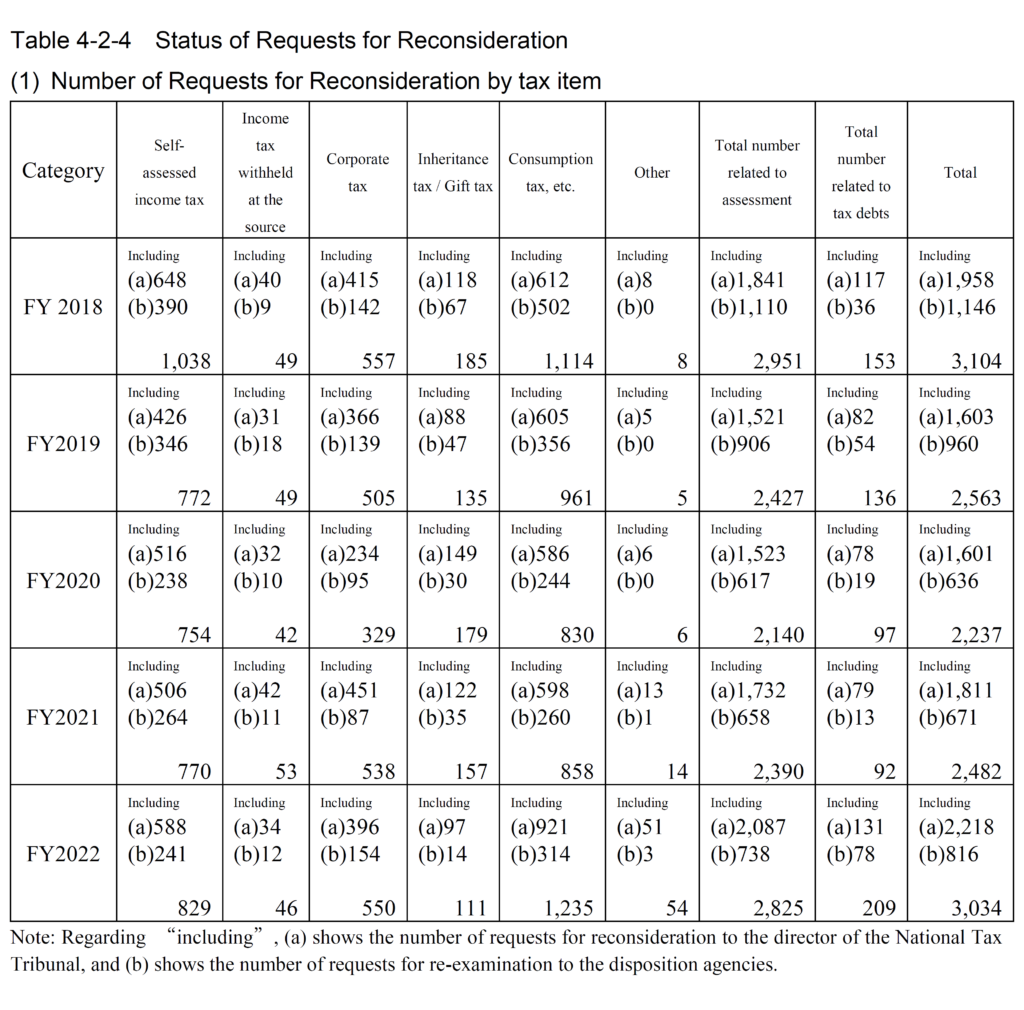

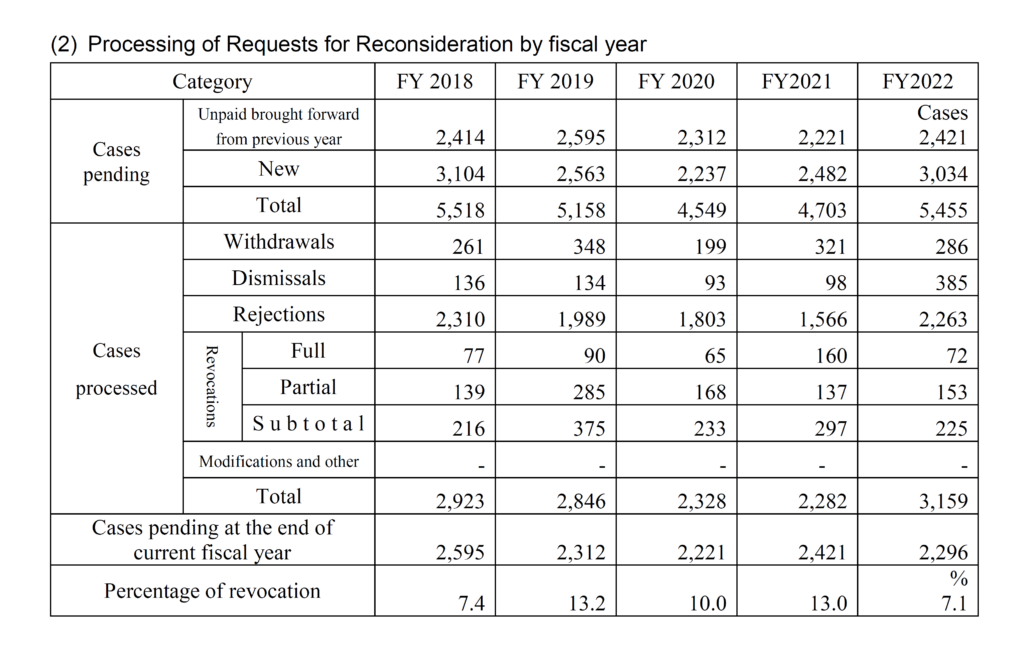

4 Statistics 213

Section 5 Revision of the Review Request System

1 Background 214

2 Overview of the Revision 215

Chapter 3 Tax Lawsuits

1 Forms of Tax Lawsuits 216

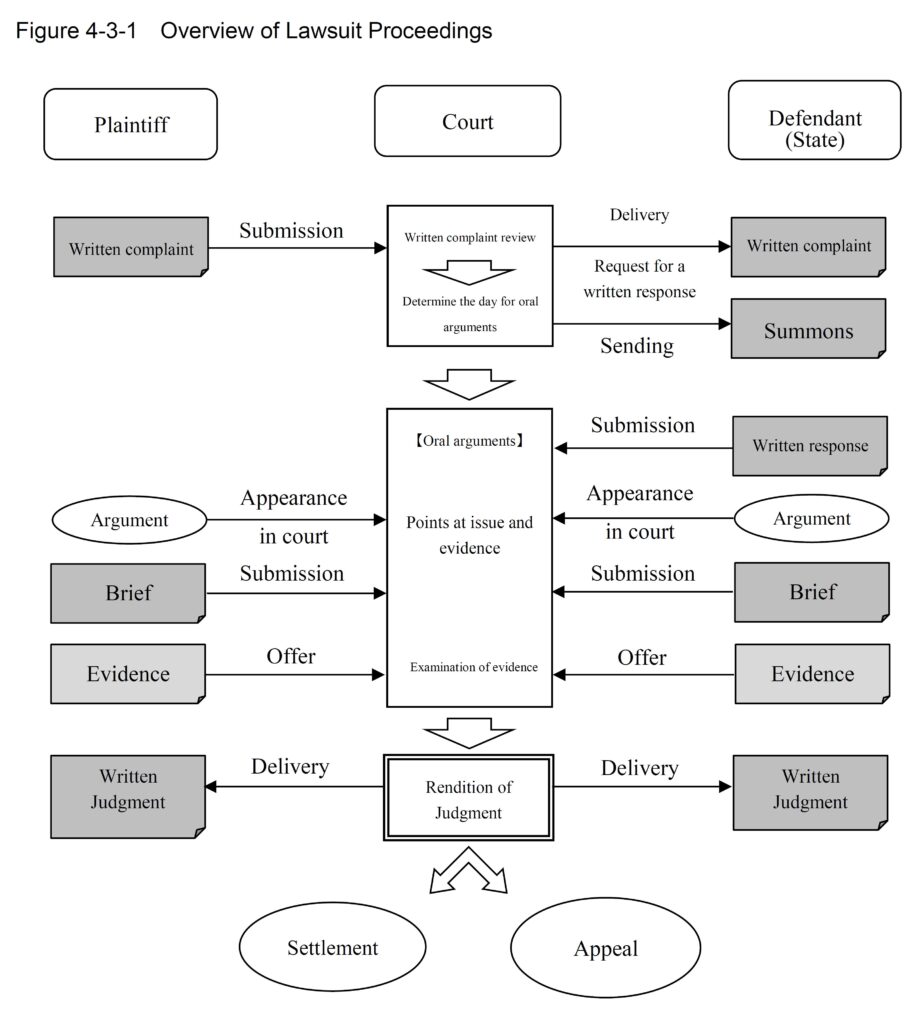

2 Procedures 216

3 Proceedings 218

4 Judgment 219

5 Appeal 220

6 Stay of Execution 221

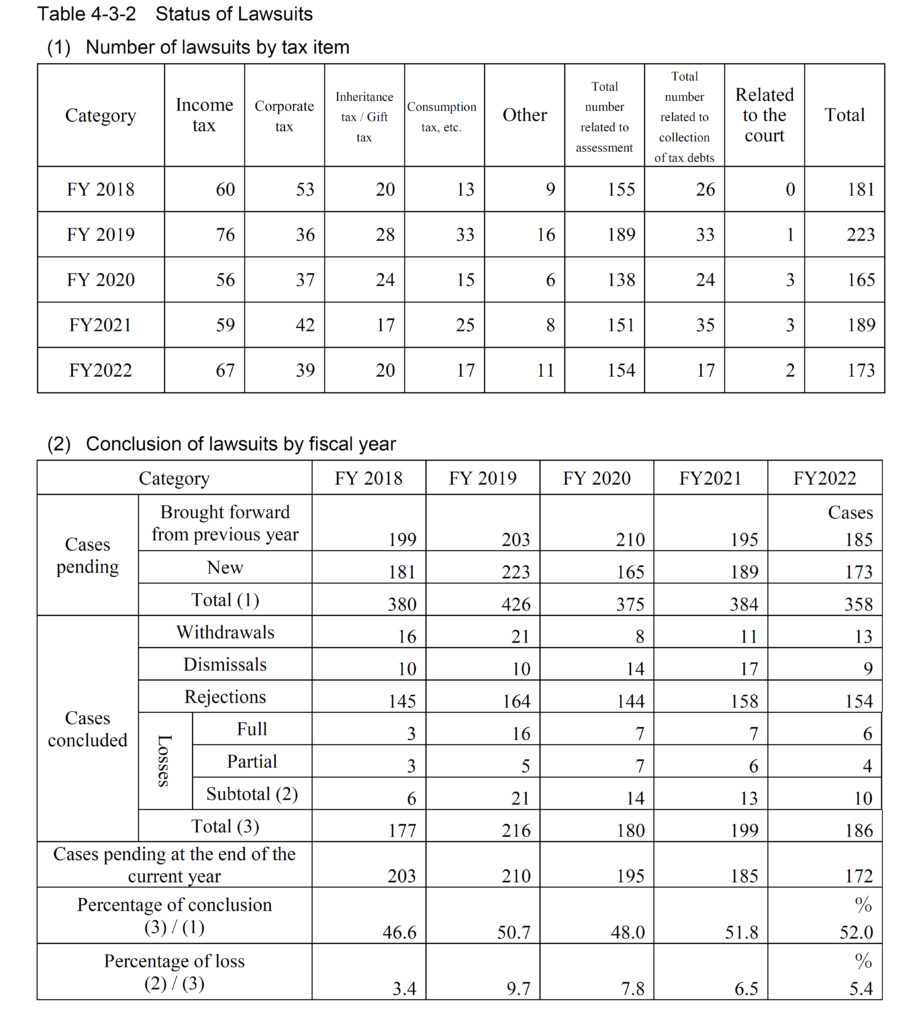

7 Statistics 223

Part 5 Certified Public Tax Accountant System

1 Certified Public Tax Accountant (CPTA) System 224

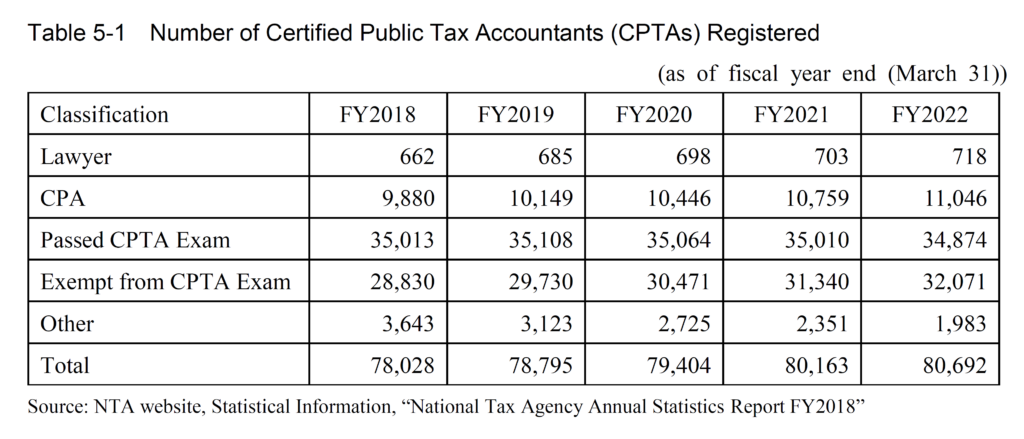

2 Present Circumstances of the CPTA Organizations and CPTA 230

3 Coordination and Cooperation with CPTAs Associations,etc 231

4 Guidance and Supervision of CPTAs 232

5 Other 233

Part 6 Cooperation with Relevant Private Organizations

Chapter 1 Relevant Private Organizations

1 Role of Relevant Private Organizations 234

2 Blue-Return Taxpayers’ Associations 234

3 Corporations Associations 234

4 Indirect Tax Associations 235

5 Savings-for-Tax Associations 235

6 Tax Payment Associations 235

Chapter 2 Local Governments 237

Chapter 3 Commendations

1 Decorations and Medals 239

2 Taxpayer Commendations 240

3 Presentation of Certificates of Appreciation 240

Part 7 Taxpayer Service

Chapter 1 Improvement of Public Hearing and Public Relations Activities

1 Improvement of Public Relations Activities for a Wide Spectrum of the Population and Taxpayers 241

2 Building a Tax Culture 243

3 Partnership with Relevant Private Organizations 247

4 Alliance with Local Governments 248

5 Appropriate Response to A Wide Spectrum of the Population and Taxpayers’Feedback 248

Chapter 2 Taxpayers’ inquiries and complaints

1 Taxpayers’ Inquiries 250

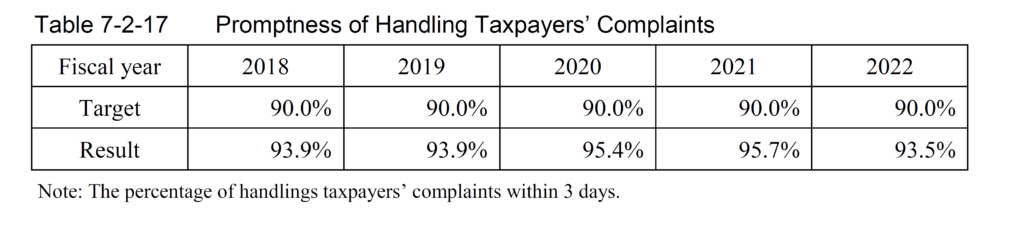

2 Taxpayers’ Complaints 256

Chapter 3 The Use of ICT in Taxpayer Services

1 Outline of Filing Tax Returns and Tax Payments in Japan 259

2 Recent Environment 264

3 Promoting Online Services 266

Chapter 4 Future Vision of Tax administration

1 Improvement in convenience for taxpayers 269

2 Efficiency and Sophistication of Taxation and Collection 272

3 Promotion of digitalization at business operators 273

4 Sophistication of Information Systems (Efforts for the Sophistication of Information Systems for the Realization of Future Vision) 273

Part 8 Computerization of Tax Administration

Chapter 1 Outline of National Tax Related Systems

1 KSK System (NTA Comprehensive Information Management System) 275

2 e-Tax (Online Tax Return Filing and Tax Payment System) 276

Chapter 2 Development of Information System for Clerical Work

1 Outline of the KSK System 277

2 Use of ICT 280

3 Ensuring Information Security 280

Chapter 3 Online National Tax Return Filing and Tax Payment System (e-Tax)

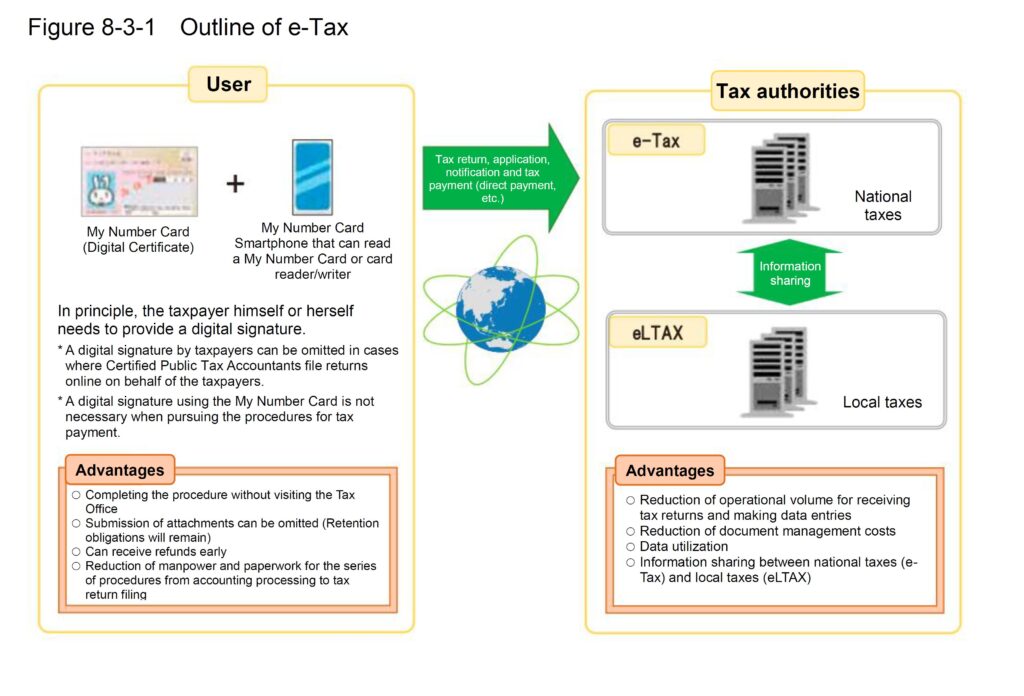

1 Outline of e-Tax 282

2 Measures to expand the use of e-Tax (ICYMI) 283

3 e-Tax Security Measures 284

Part 9 Human Resources Management and Training

Chapter 1 Personnel Management

1 Recruitment 286

2 Composition of Staff Members 287

3 Staff Appointments 287

4 Retirement 288

5 Staff Salaries 289

6 Discipline for Civil Service 289

7 Rewards 290

8 Working Hours and Paid Holidays, etc 290

9 National Tax Agency Action Plan for Specific Business Owners 291

Chapter 2 Internal Inspector System

1 Internal Inspector System 294

2 Duties of Internal Inspectors 294

3 Administration of Internal Inspectors 295

Chapter 3 Staff Training

1 Staff Training Policy 296

2 Training System 296

3 Effective and Efficient Training 297

4 Training at the National Tax College (NTC) 298

Part 10 Other Matters

Chapter 1 Inspections of Administrative Office Work

1 Outline 312

2 Type of Inspections 312

3 Inspection Methods 312

Chapter 2 Evaluation of Performance

1 Outline 314

2 2022 Business Year NTA Performance Evaluation Implementation Plan 314

3 2022 Business Year NTA Performance Evaluation Report 315

Chapter 3 Disclosure of Official Information and Personal Information Protection

1 Outline of the Information Disclosure Act 316

2 Outline of Act on Protection of Personal Information 318

3 NTA’s Response to Information Disclosure and Personal Information Protection

Requirements 321

Chapter 4 Proposals for Improvement

1 Purpose of Proposals for Improvement 323

2 Content and Scope of Proposals for Improvement 323

3 Required Qualifications for the Proposer and Application Period 323

4 Administrative Procedure 323

5 Use of Proposals 324

Index of Figures and Tables

Introduction

About the National Tax Agency (NTA)

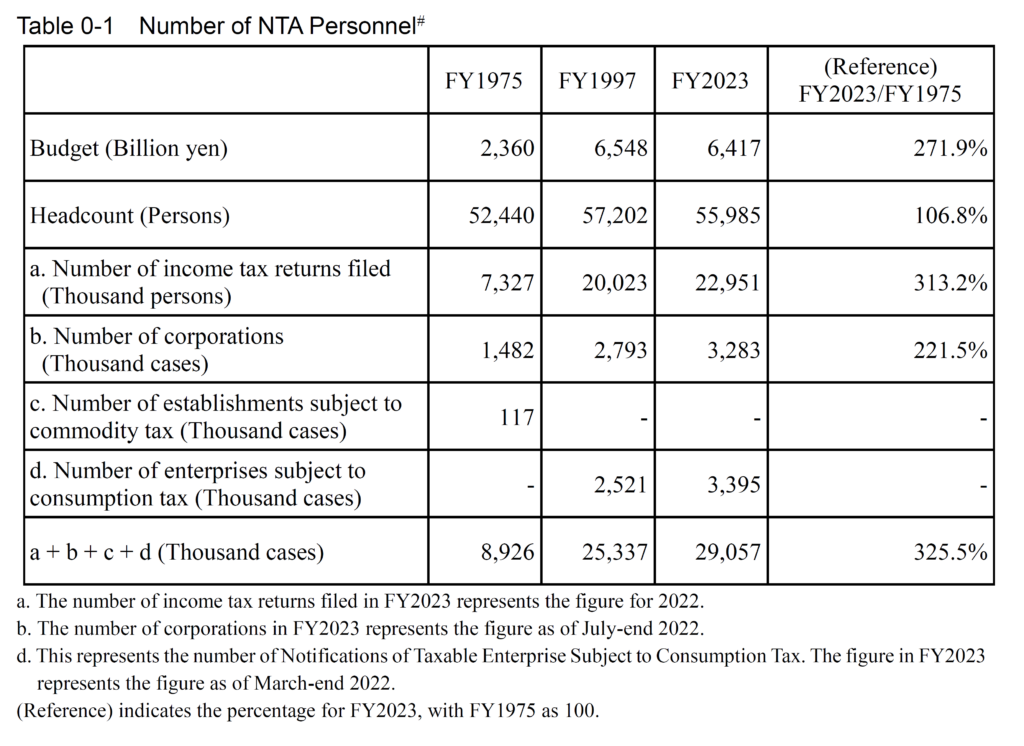

0-1 Number of NTA Personnel 3

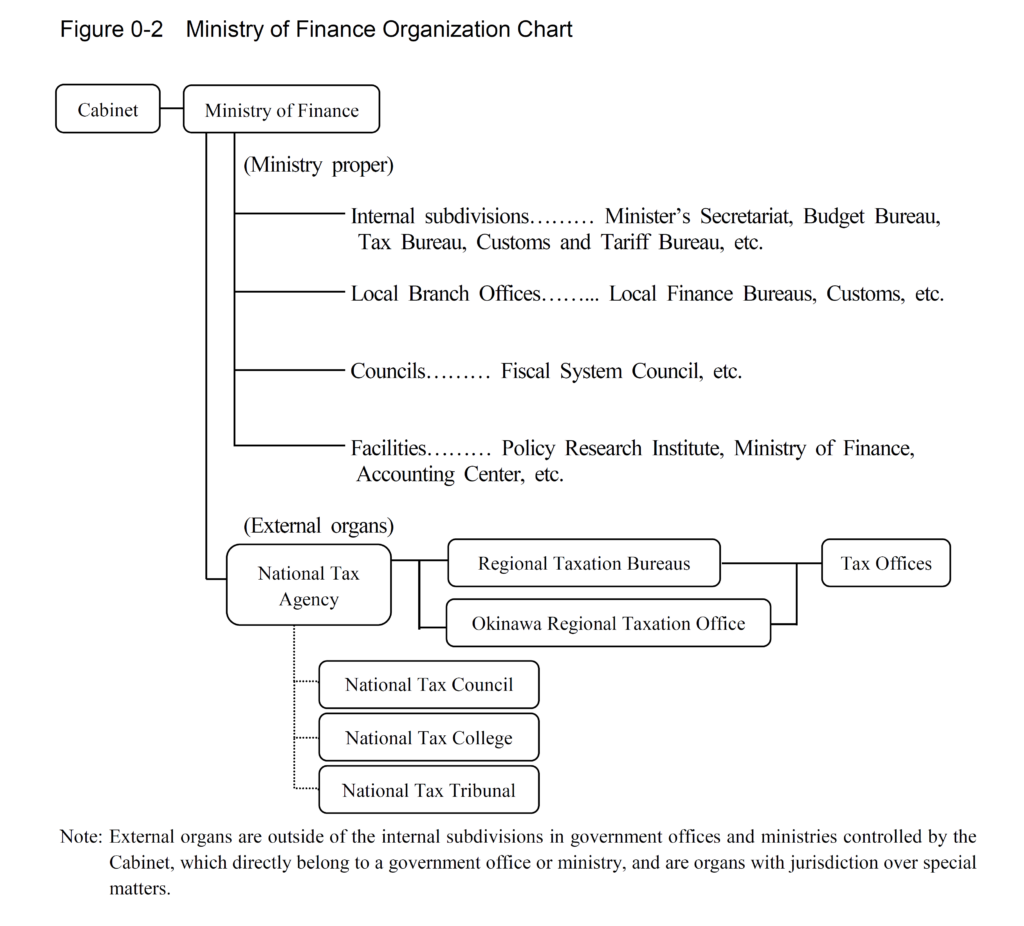

0-2 Ministry of Finance Organization Chart 4

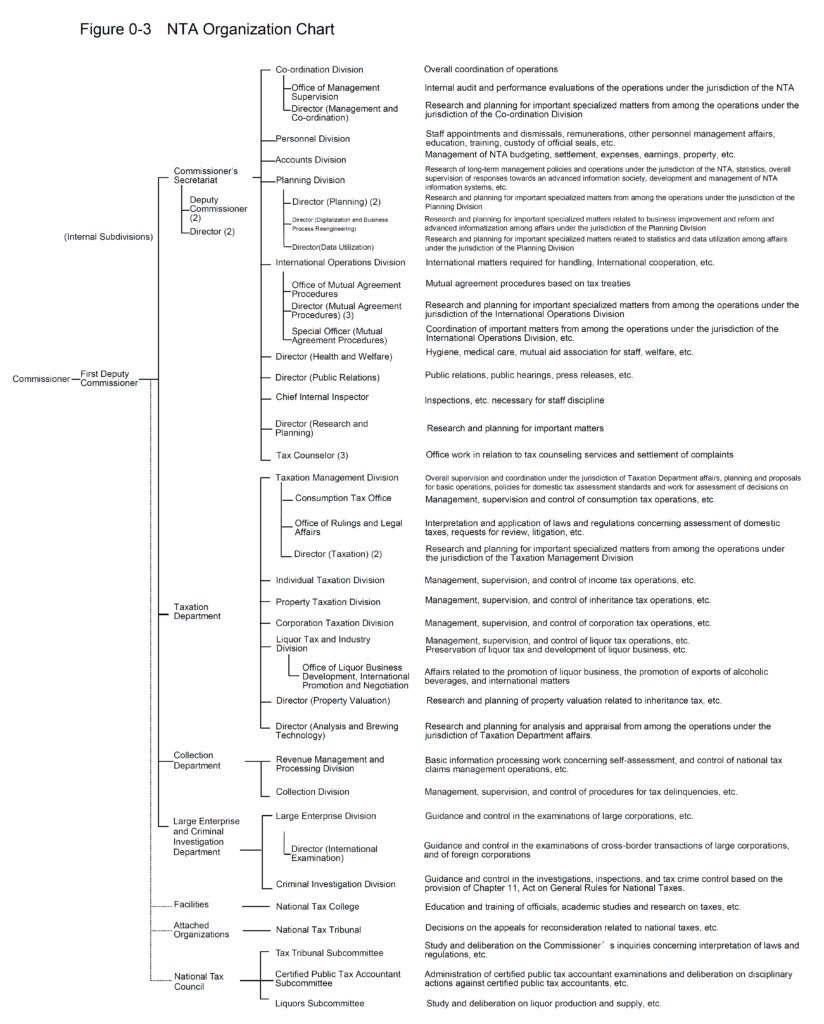

0-3 NTA Organization Chart 5

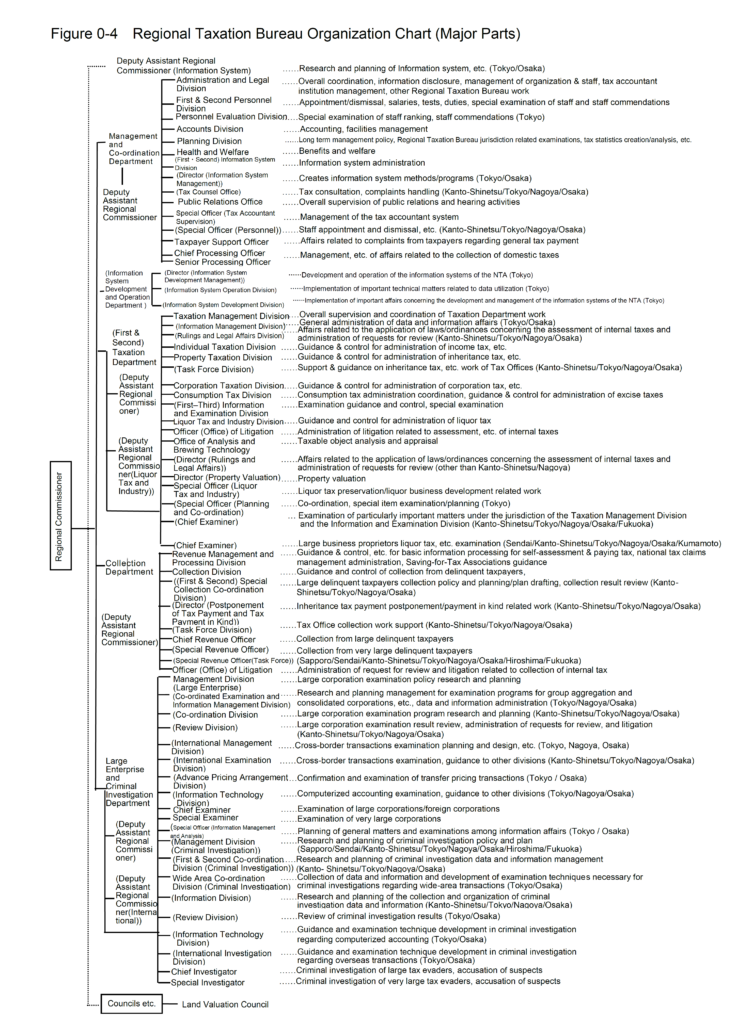

0-4 Regional Taxation Bureau Organization Chart (Major Parts) 6

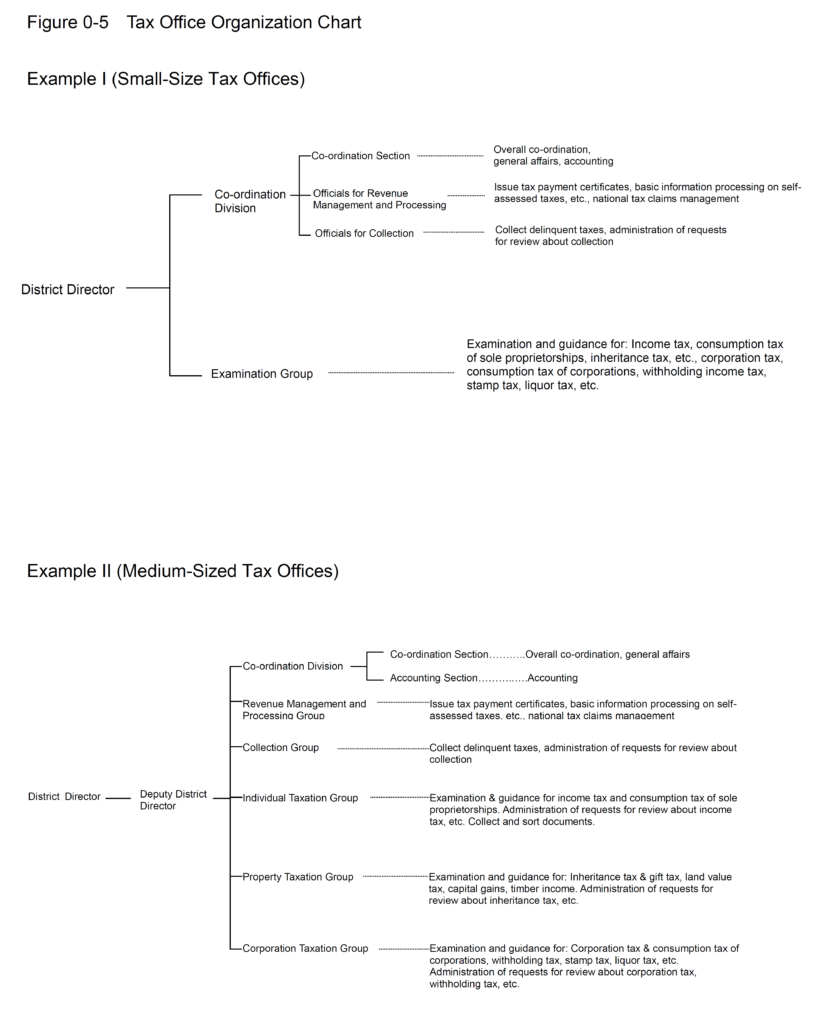

0-5 Tax Office Organization Chart 7

Part 1 Outline of Operations Chapter 1 Income Tax

1-1-1 Category of Income Tax Returned by Type of Income(2021) 18

1-1-2 Trends in Final Returns Filed for Income Tax 20

1-1-3 Number of Field Examinations on Taxpayers of Self-Assessed Income Tax Conducted 23

1-1-4 Increase in Blue Return Taxpayers (Self-employed and Other Business Income Earners among Taxpayers of Self-assessed Income Tax) 24

Chapter 2 Withholding Income Tax Administration

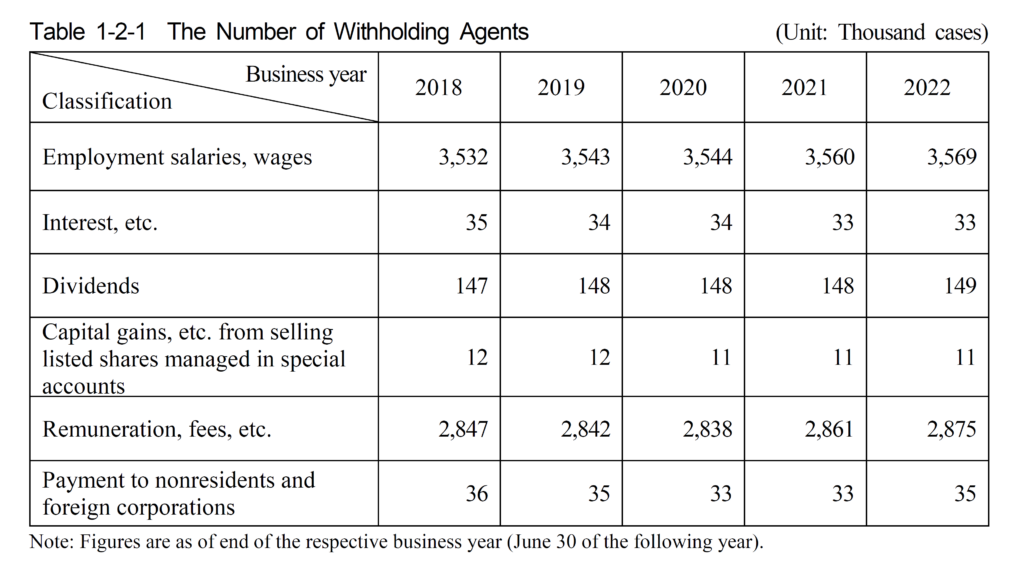

1-2-1 The Number of Withholding Agents 34

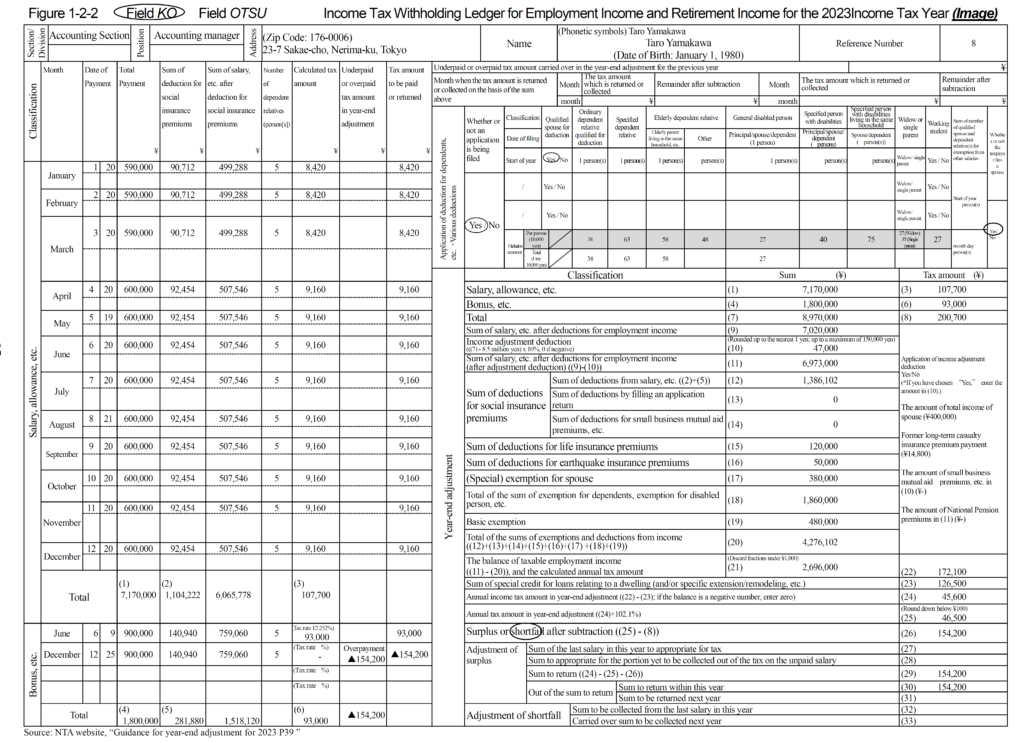

1-2-2 Income Tax Withholding Ledger for Employment Income and Retirement Income for the 2023 Income Tax Year 35

Chapter 3 Property Tax Administration

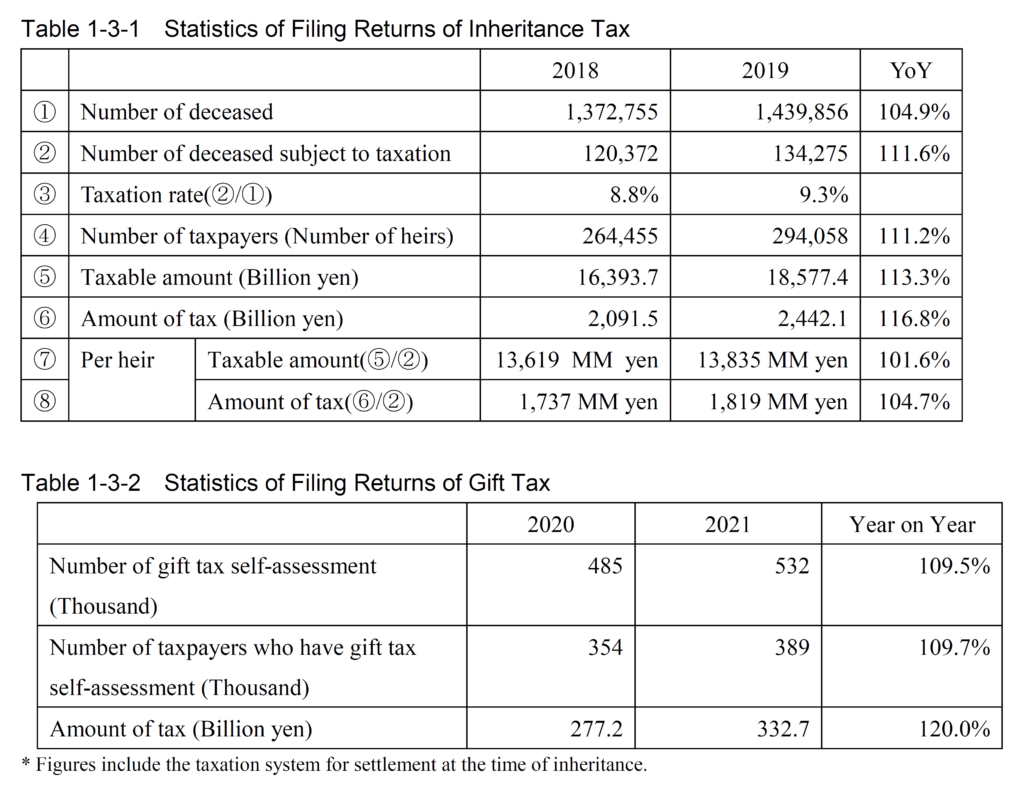

1-3-1 Statistics of Filing Returns of Inheritance Tax 37

1-3-2 Statistics of Filing Returns of Gift Tax 37

1-3-3 Results of Field Examinations for Inheritance Tax 42

Chapter 4 Corporation Tax Administration

1-4-1 Group Functions at Standard Tax Offices 61

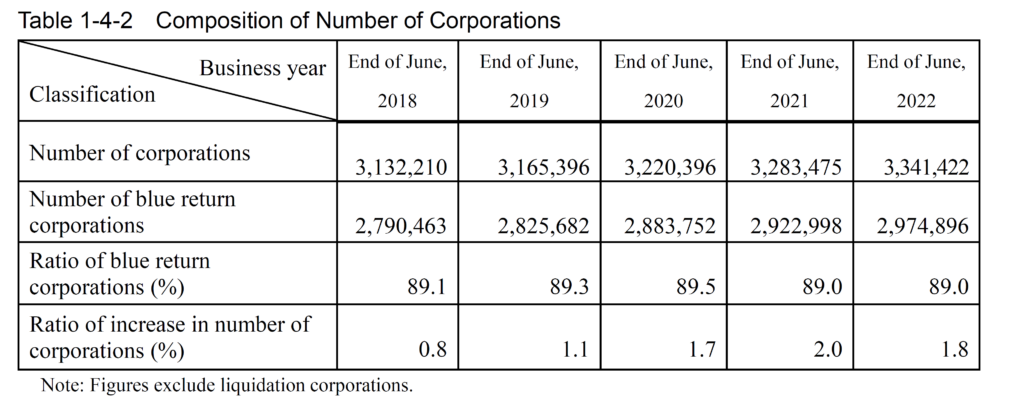

1-4-2 Composition of Number of Corporations 64

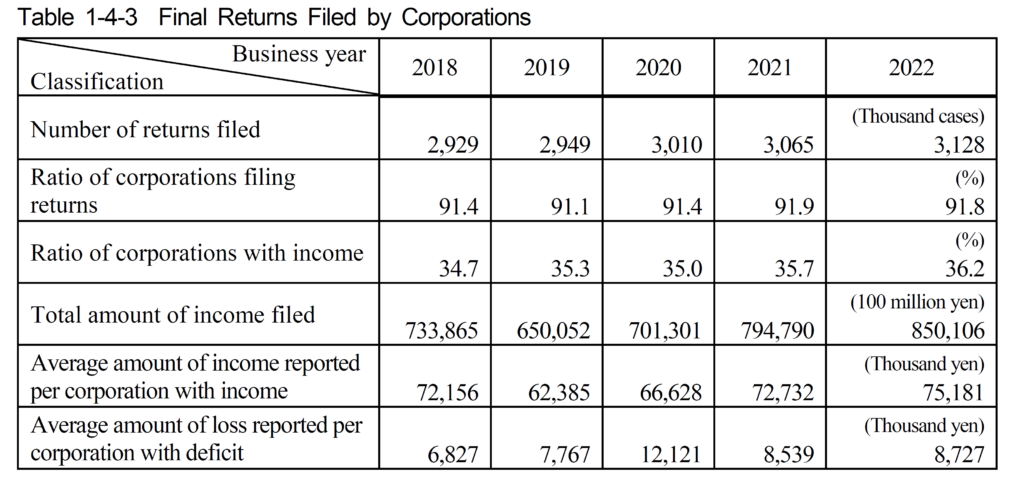

1-4-3 Final Returns Filed by Corporations 64

1-4-4 Field Examinations of Corporations 65

1-4-5 The 10 Lines of Business in Which Fraud Cases Were Discovered Most Frequently (Corporation Tax) 65

1-4-6 The 10 Lines of Business in Which Fraud Income Amount Per Examined Corporation Was Largest (Corporation Tax) 66

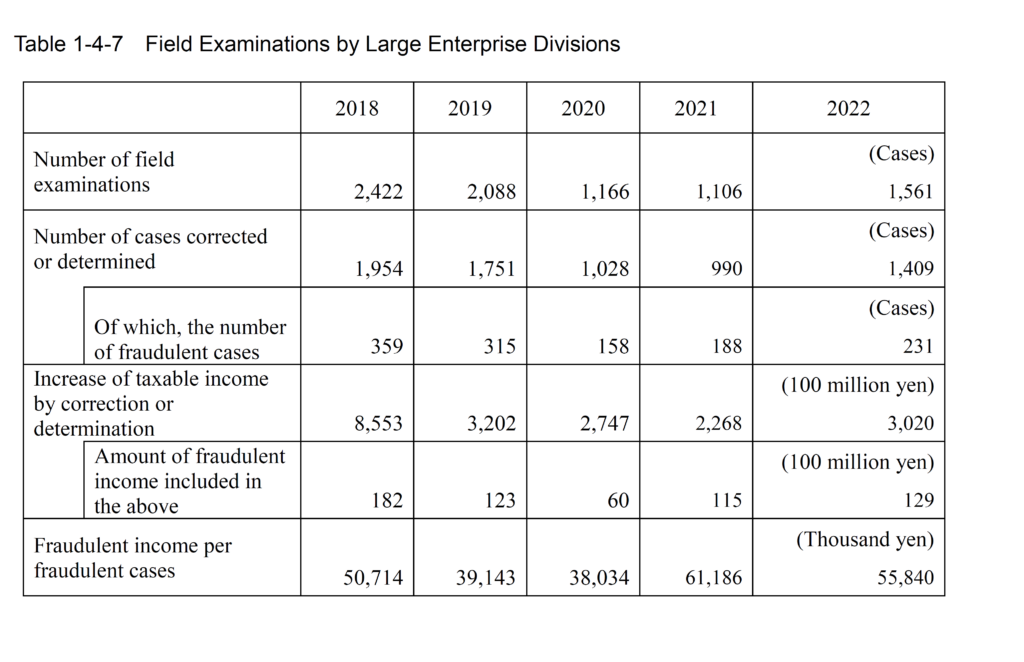

1-4-7 Field Examinations by Large Enterprise Divisions 86

Chapter 5 Consumption Tax Administration

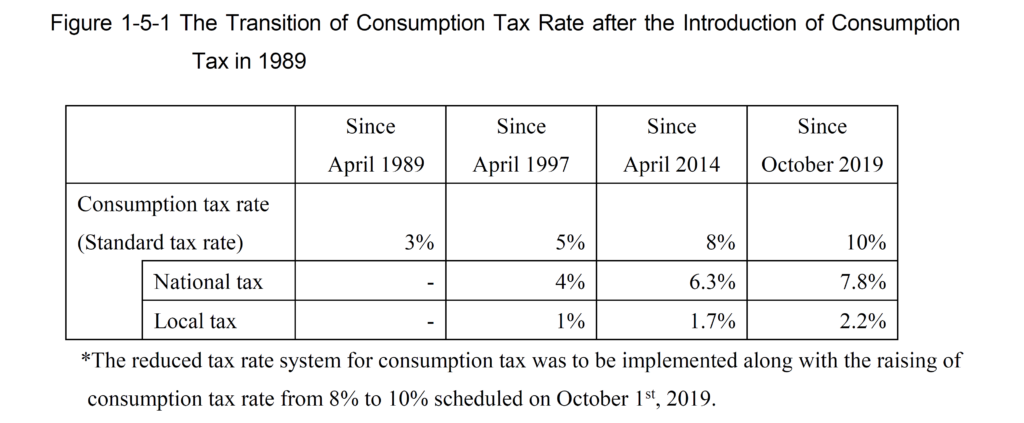

1-5-1 The Transition of Consumption Tax Rate after the Introduction of Consumption Tax in 1989 87

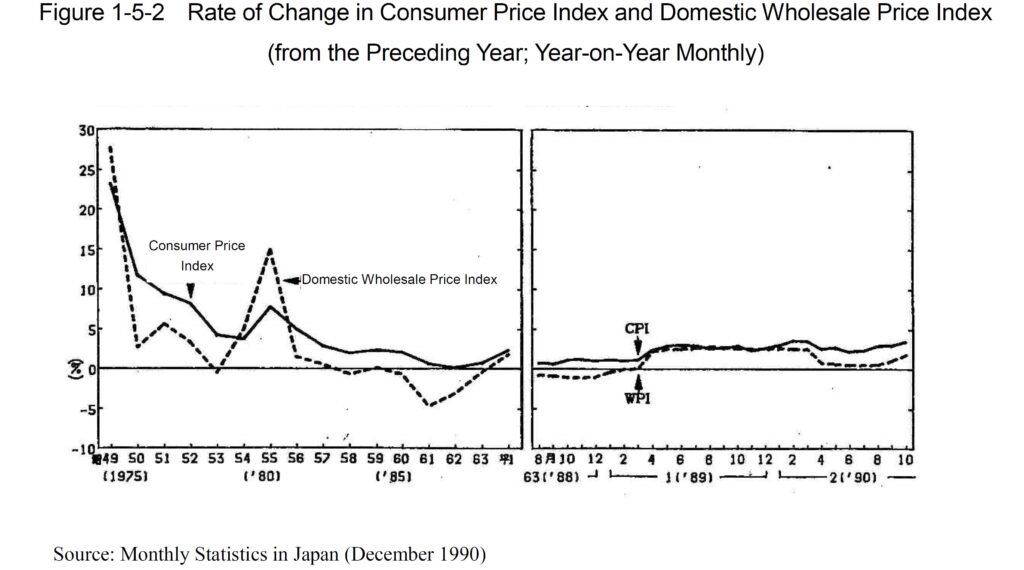

1-5-2 Rate of Change in Consumer Price Index and Domestic Wholesale Price Index (from the Preceding Year; Year-on-Year Monthly) 89

1-5-3 Rise of Consumption Tax Rate 98

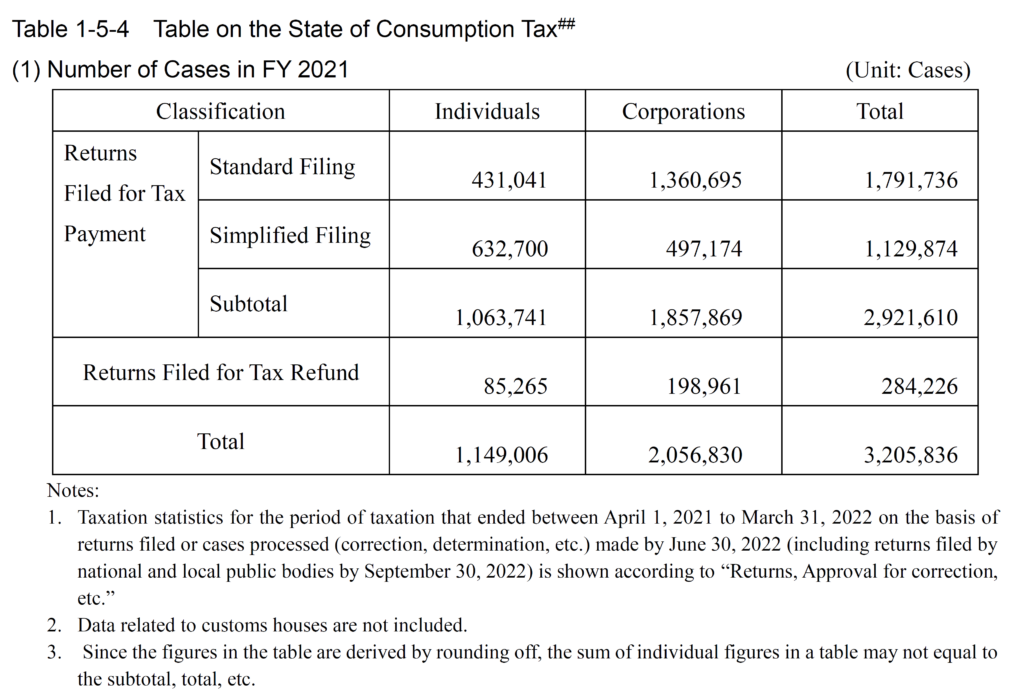

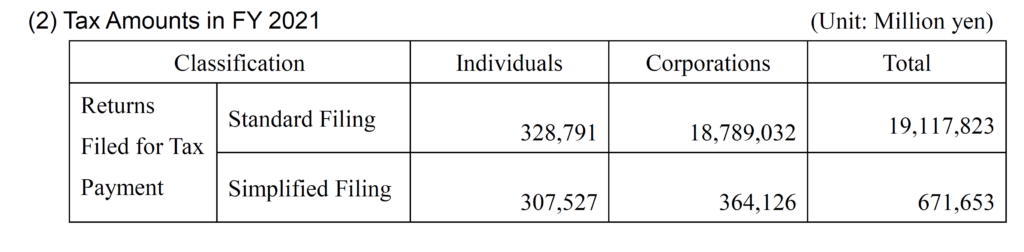

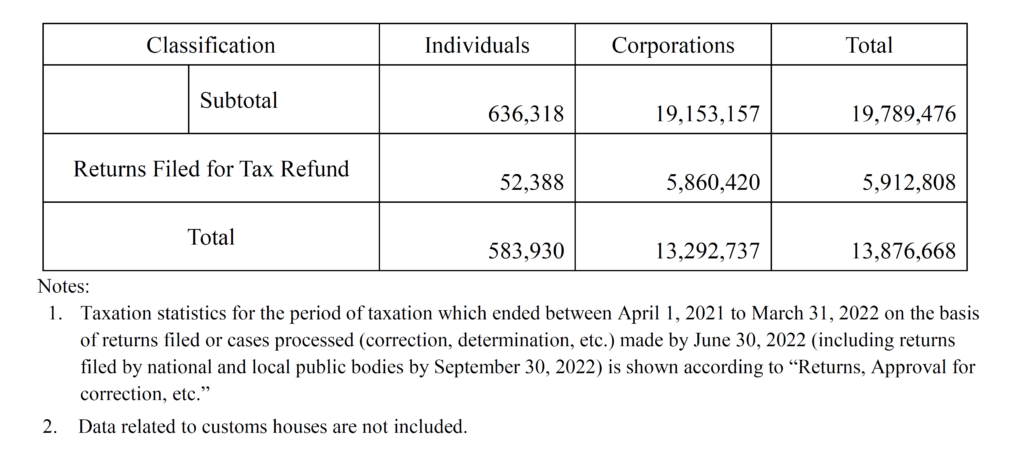

1-5-4 Table on the State of Consumption Tax 99

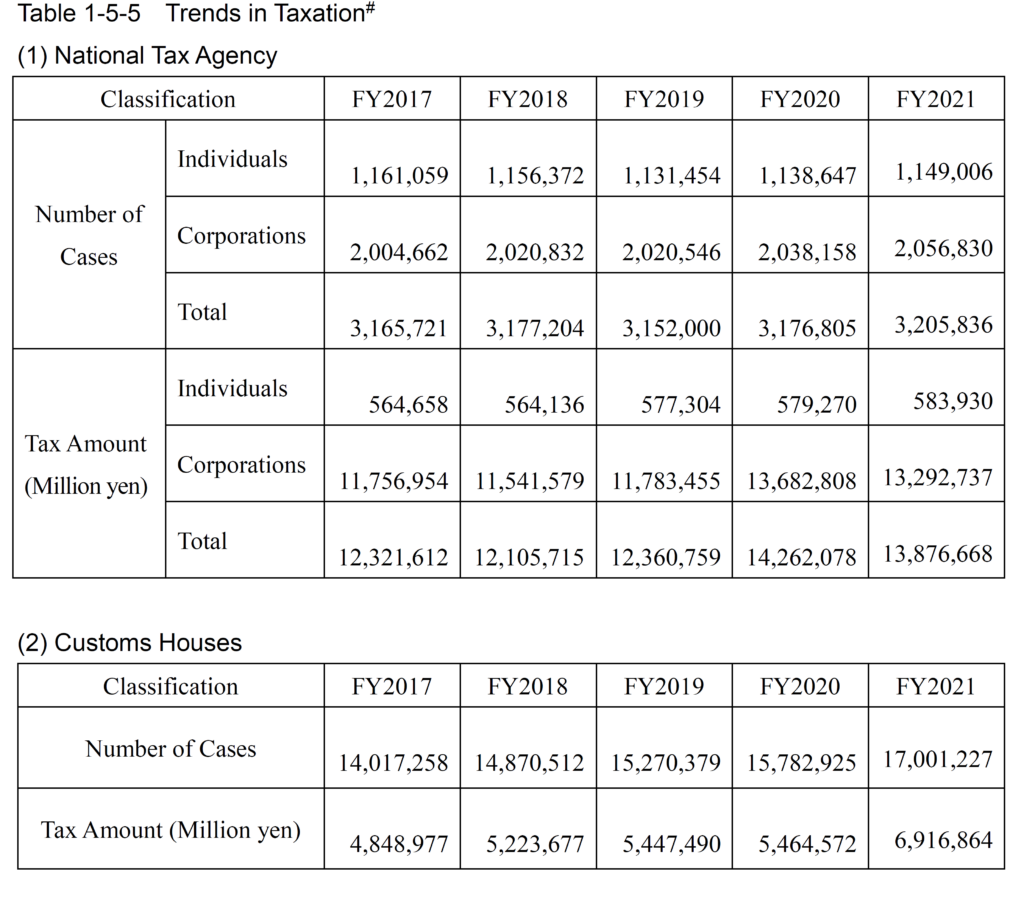

1-5-5 Trends in Taxation 100

1-5-6 Number of Notifications of Taxable Enterprise Status, etc. 100

1-5-7 Trends in Field Examinations for Consumption Tax (Individual Proprietors) 101 1-5-8 Trends in Field Examinations for Consumption Tax (Corporations) 101

Chapter 6 Indirect Taxes Other Than Consumption Taxes

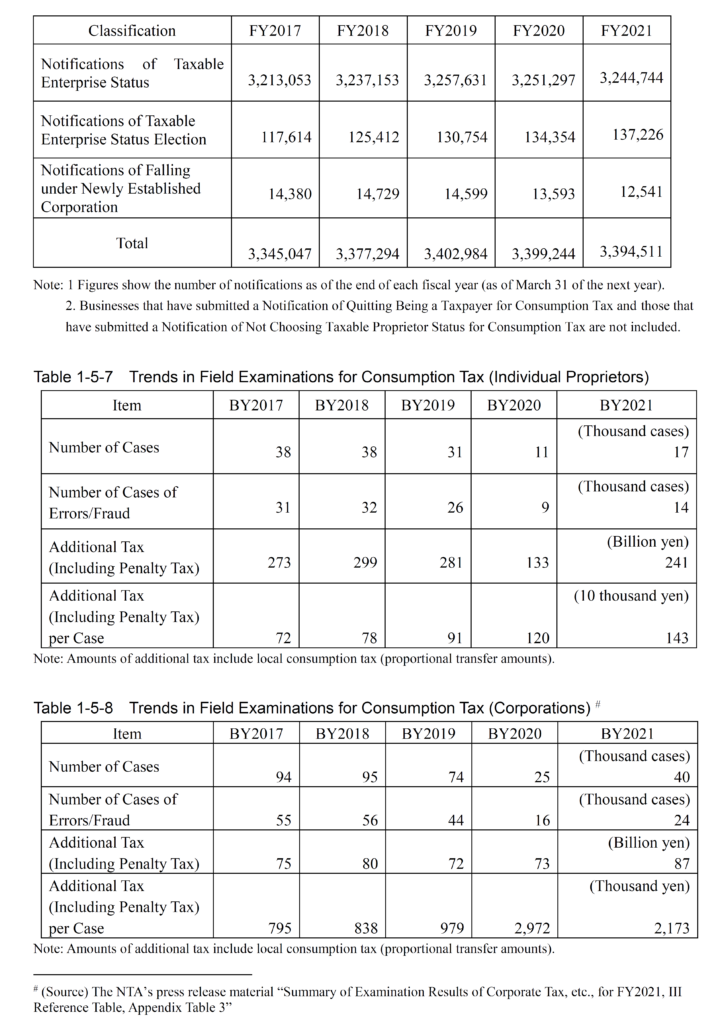

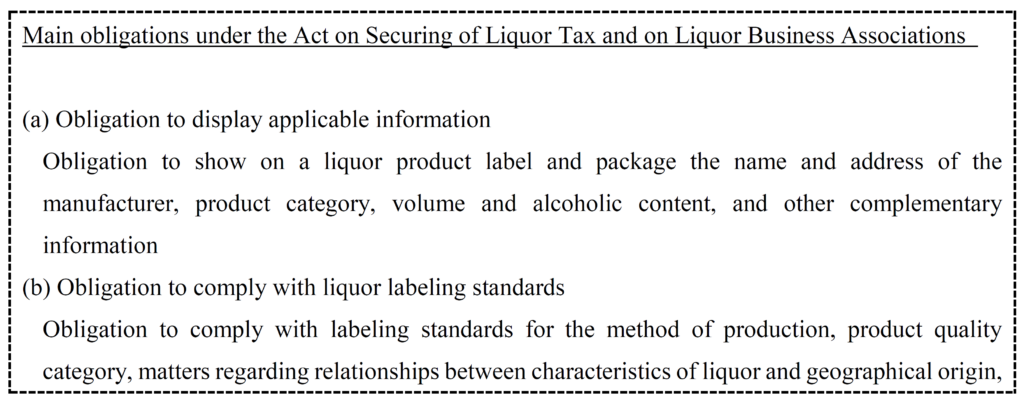

1-6-1 Liquor Tax as Percentage of National Tax Revenue 102

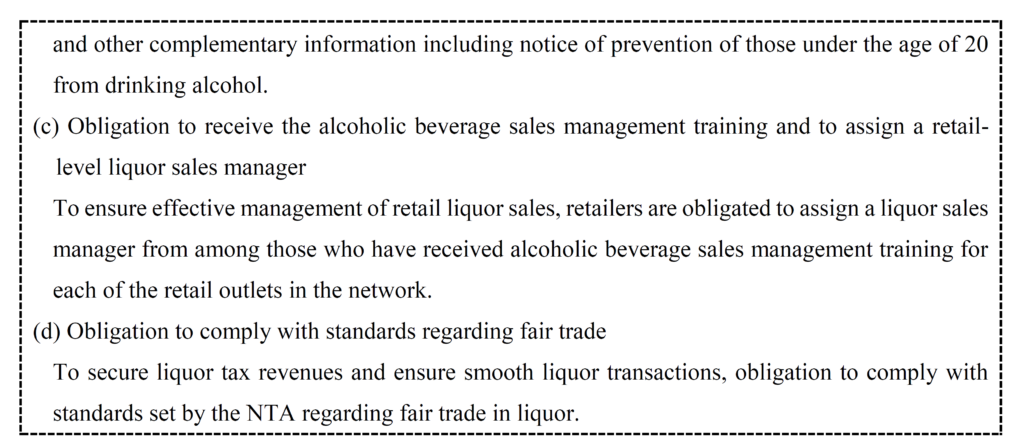

1-6-2 Rates of Liquor Tax (October 1,2023-September 30,2026) 105

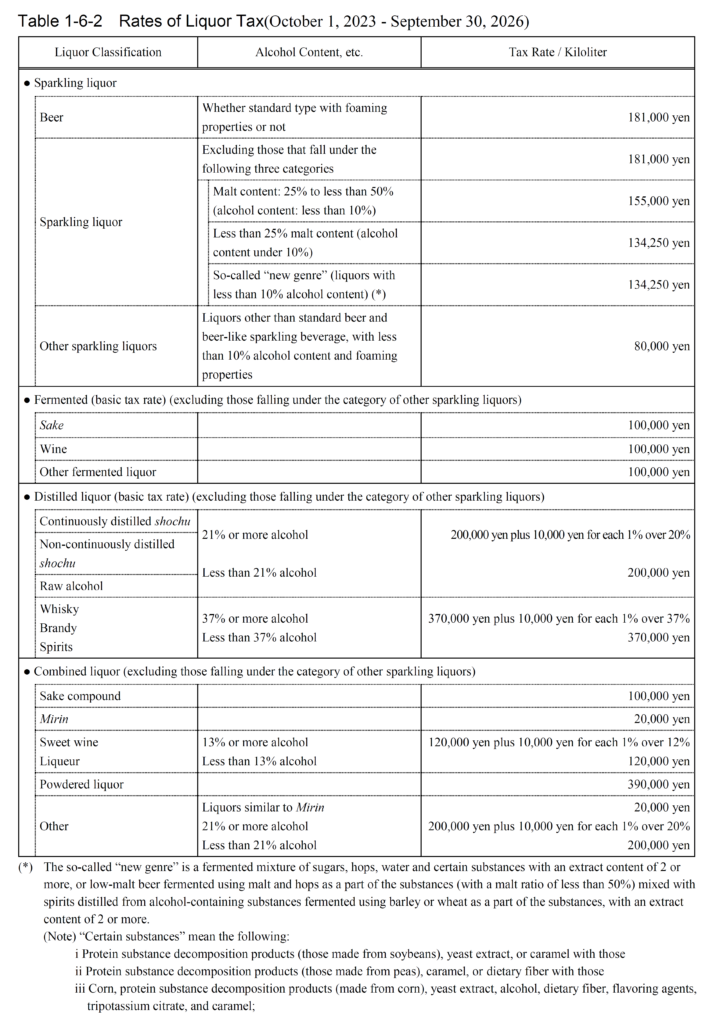

1-6-3 Ratio of Burden of Liquor Tax of Major Liquors 106

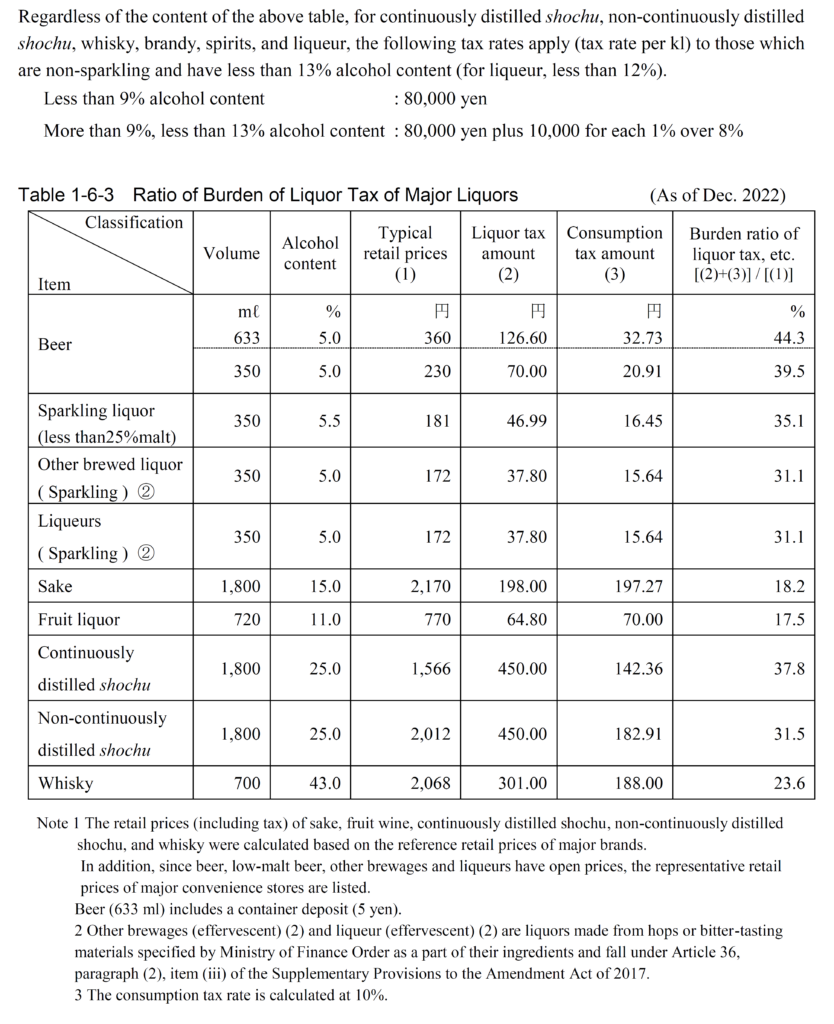

1-6-4 History of Burden Ratio of Liquor Tax 107

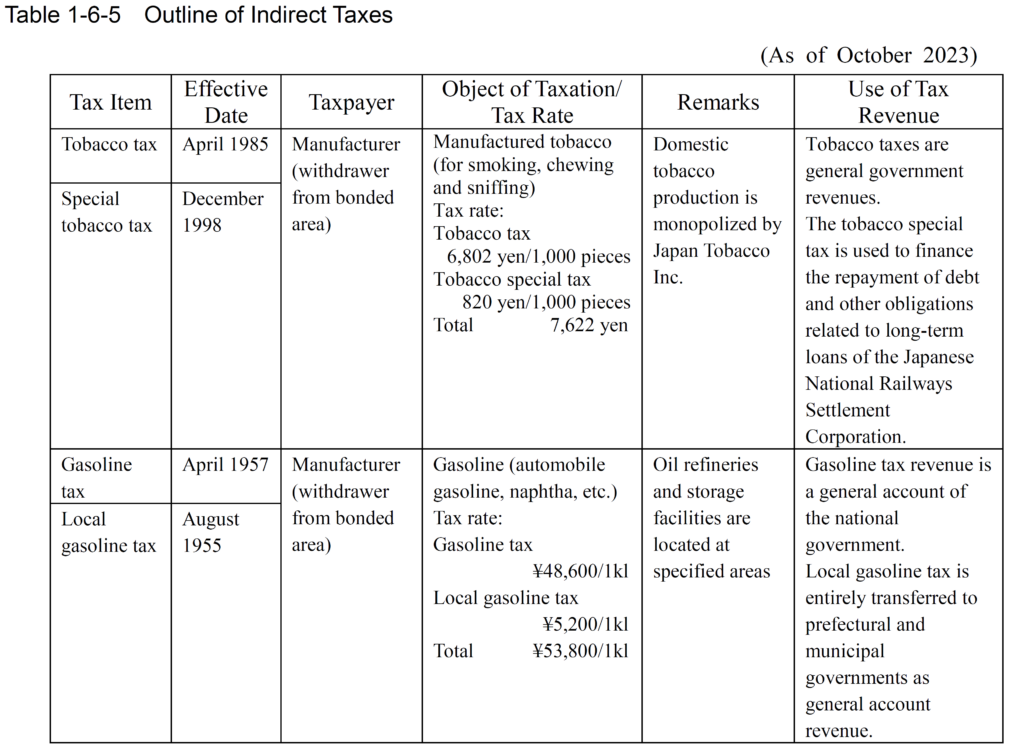

1-6-5 Outline of Indirect Taxes 117

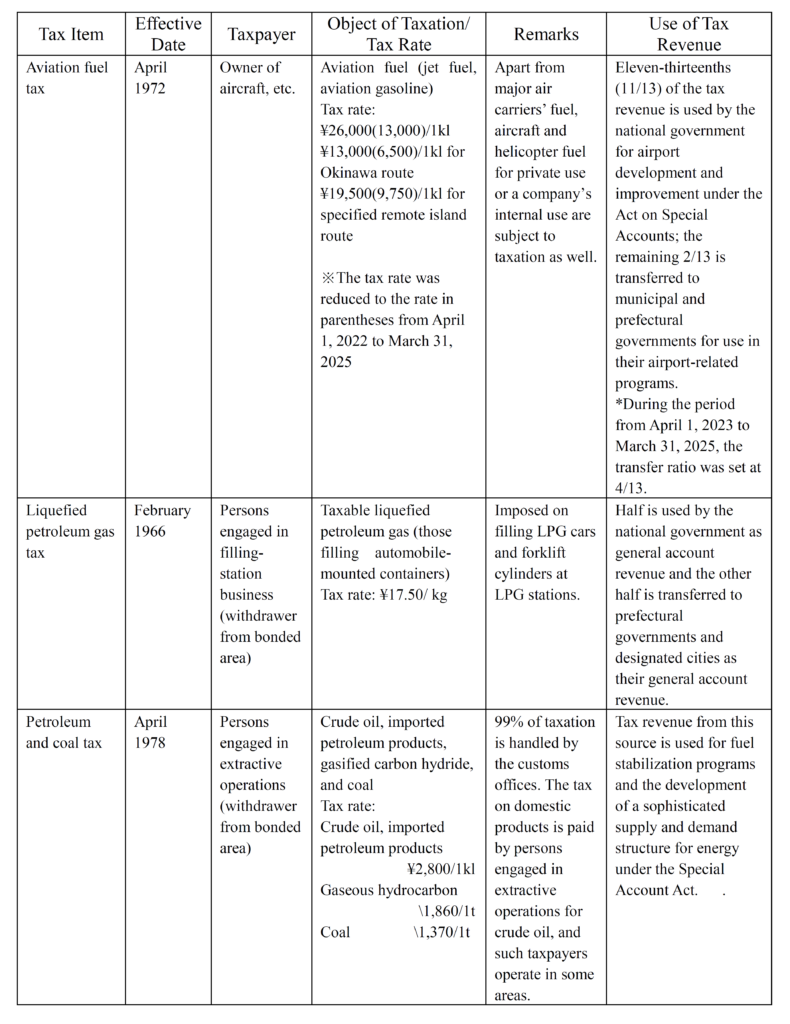

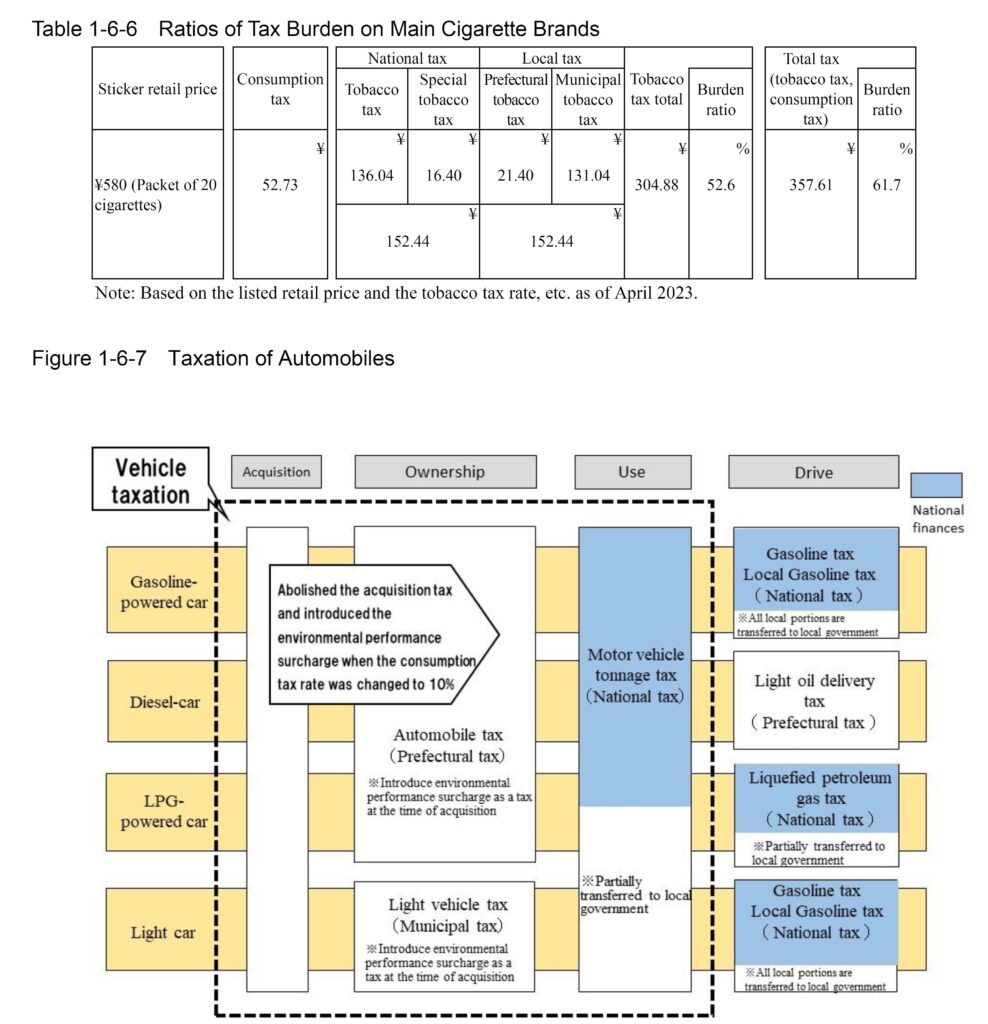

1-6-6 Ratios of Tax Burden on Main Cigarette Brands 120

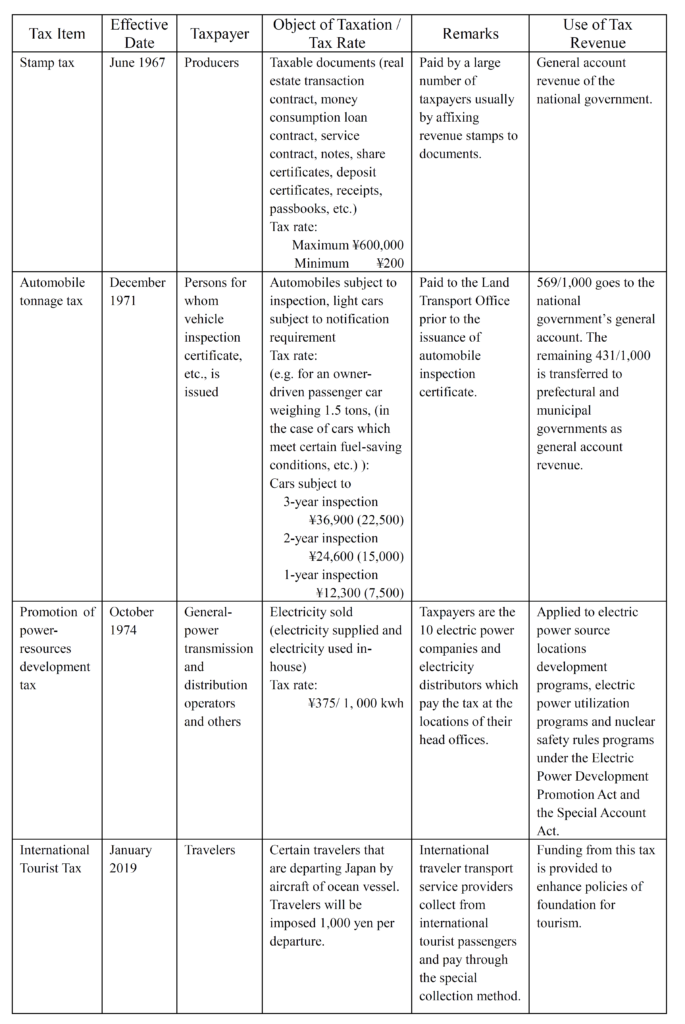

1-6-7 Taxation of Automobiles 120

Chapter 7 Information

1-7-1 Types of Statutory Information 131

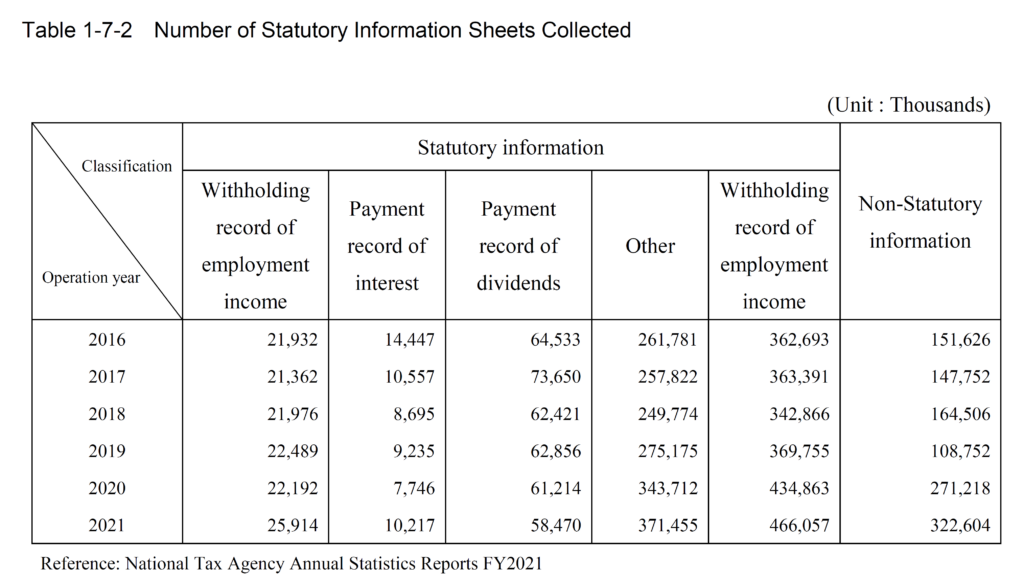

1-7-2 Number of Statutory Information Sheets Collected 133

Chapter 8 Examination of Complicated and Difficult Cases

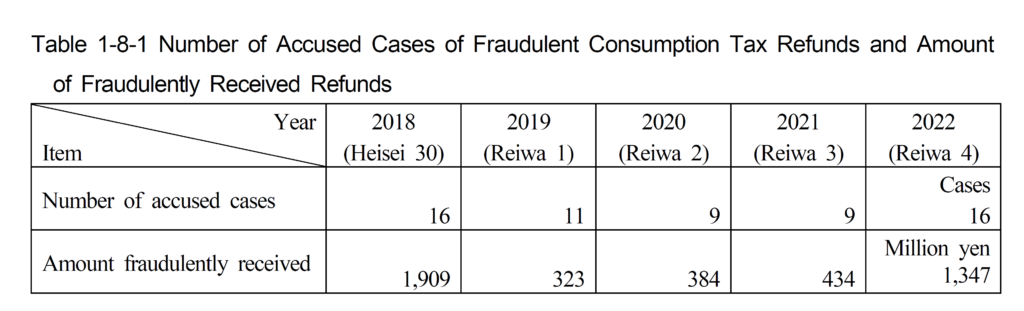

1-8-1 Number of Accused Cases of Fraudulent Consumption Tax Refunds and Amount of Fraudulently Received Refunds 138

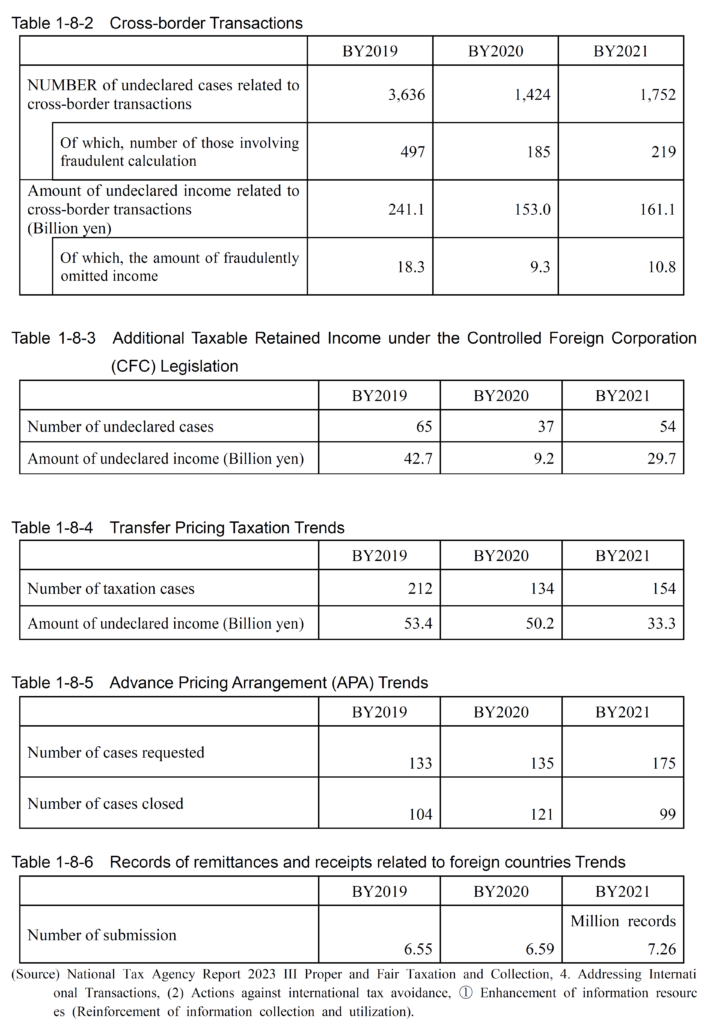

1-8-2 Cross-border Transactions 146

1-8-3 Additional Taxable Retained Income under the Controlled Foreign Corporation (CFC) Legislation 146

1-8-4 Transfer Pricing Taxation Trends 146

1-8-5 Advance Pricing Arrangement (APA) Trends 146

1-8-6 Records of remittances and receipts related to foreign countries Trends 146

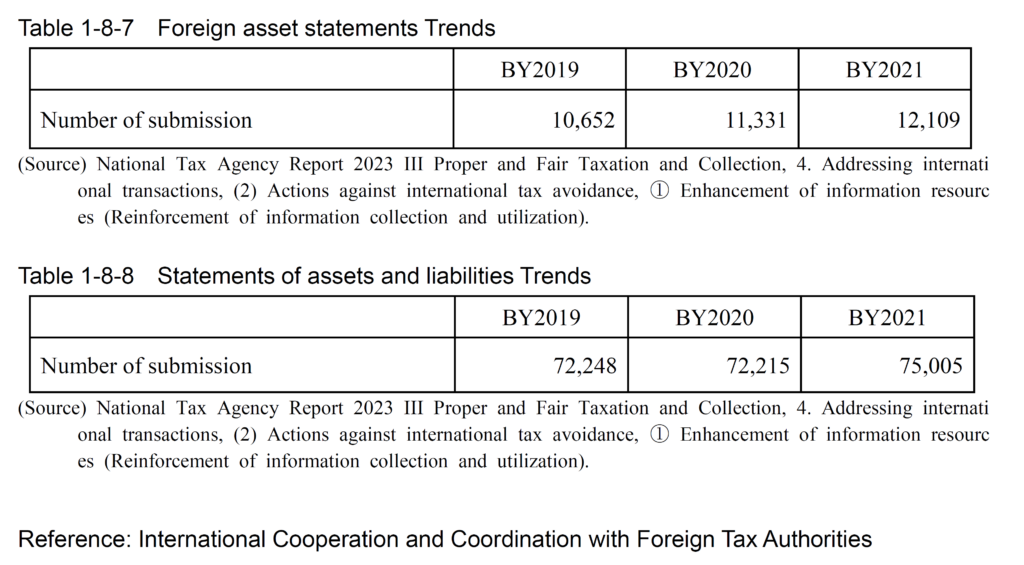

1-8-7 Foreign asset statements Trends 147

1-8-8 Statements of assets and liabilities Trends 147

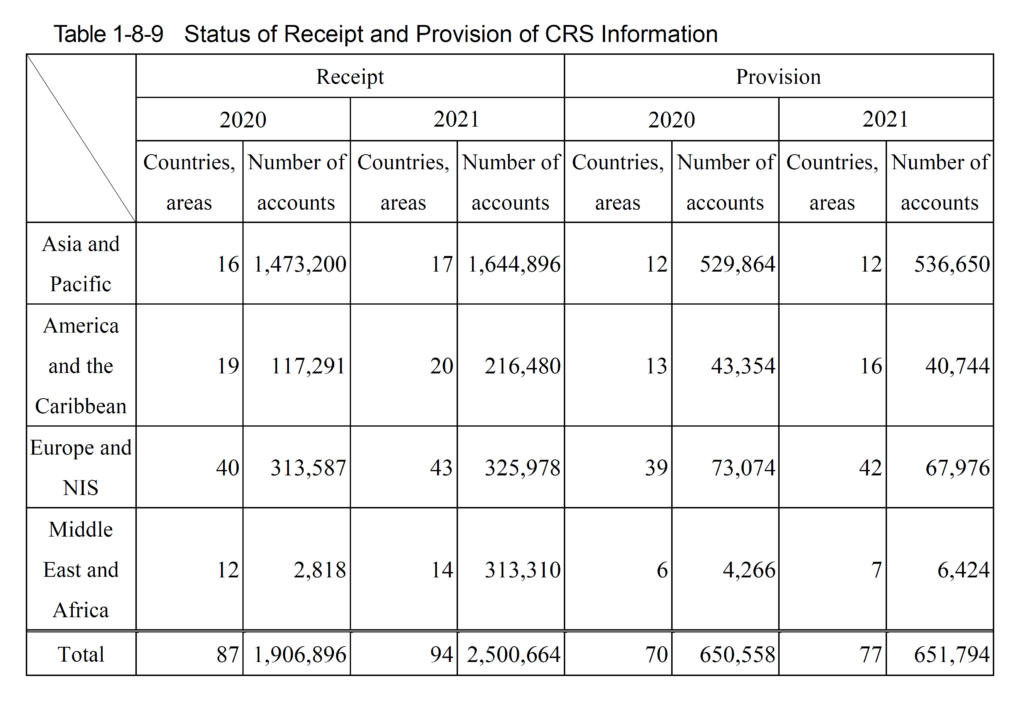

1-8-9 Status of Receipt and Provision of CRS Information 149

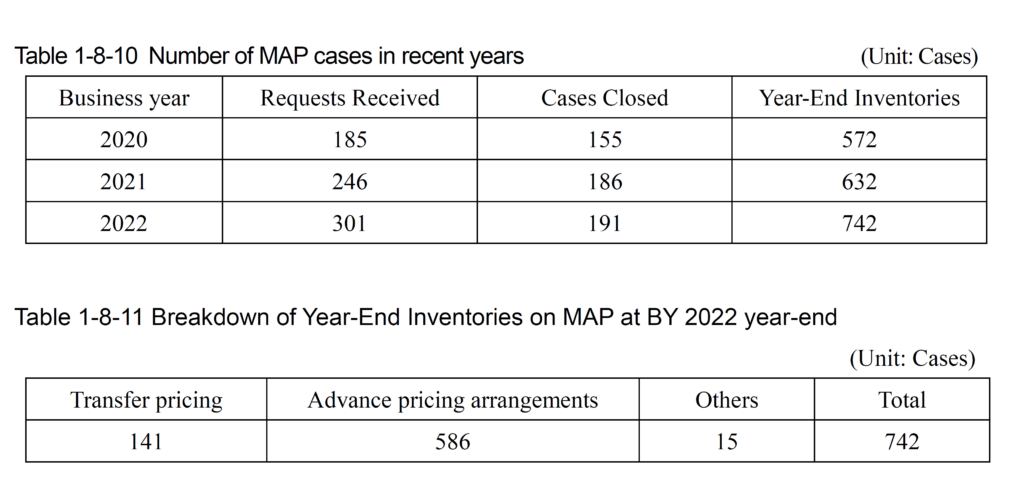

1-8-10 Number of MAP cases in recent years 150

1-8-11 Breakdown of Year-End Inventories on MAP at BY 2022 year-end 150

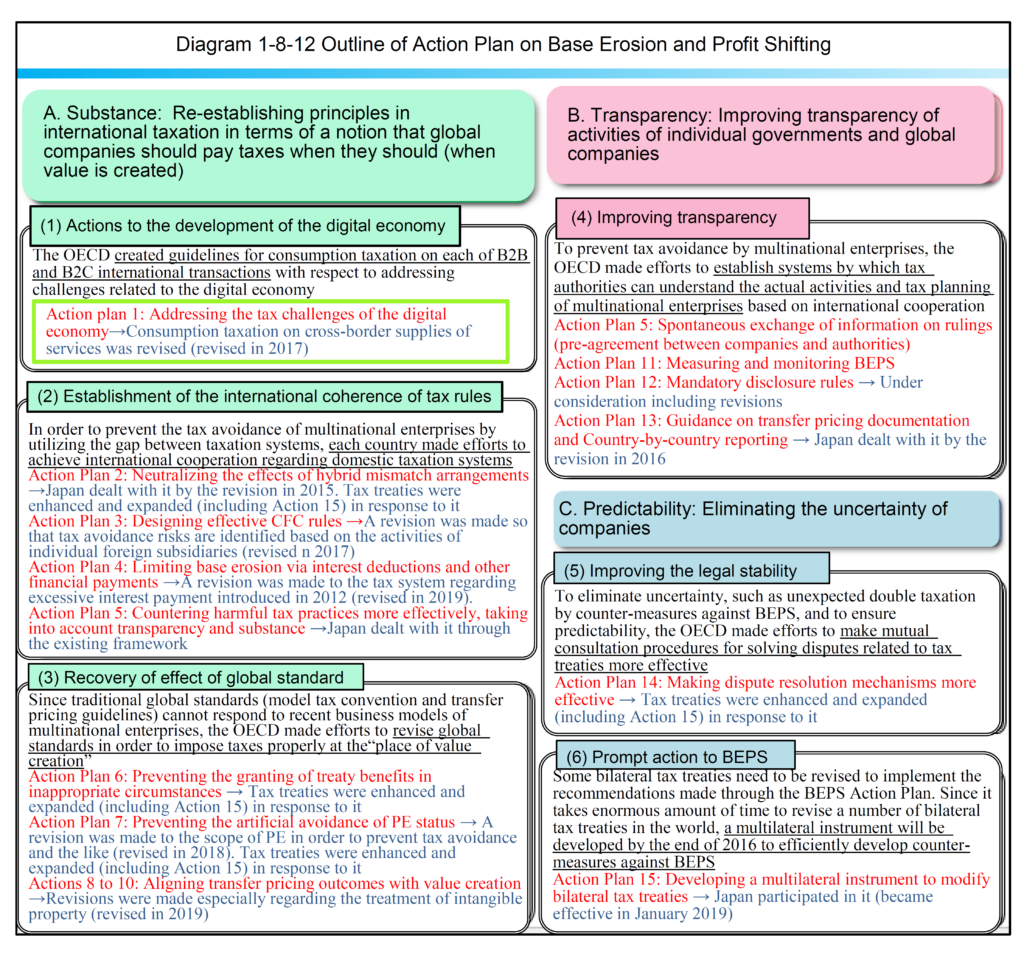

1-8-12 Outline of Action Plan on Base Erosion and Profit Shifting 152

Chapter 9 Examination Procedures

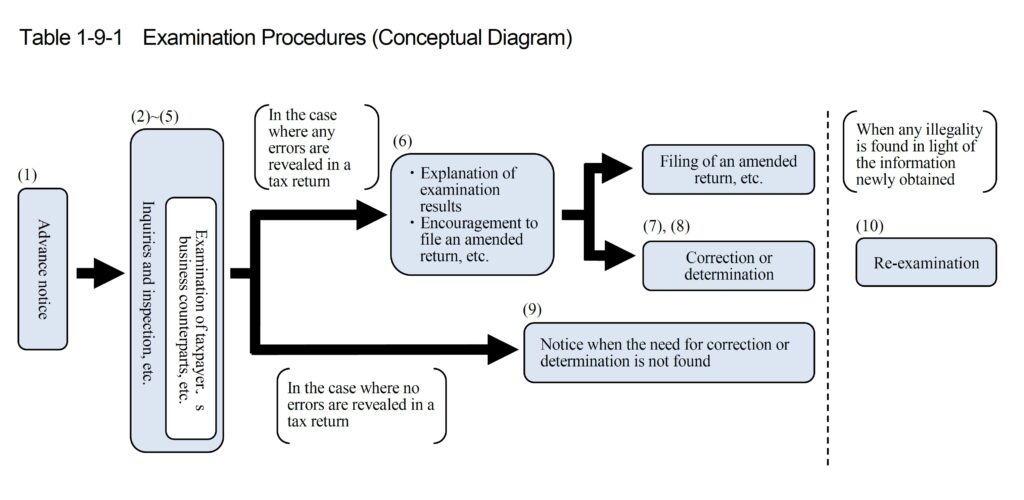

1-9-1 Examination Procedures (Conceptual Diagram) 154

Part 2 Criminal Investigation System

2-1 Disposition Status of Criminal Investigation Cases 159

2-2 Industries or Transactions with Frequent Cases of Accusation 160

2-3 State of Judgment at the First Trial 160

Part 3 Management and Collection of National Taxes Chapter 1 Payment of National Taxes

3-1-1 Proportions of national tax payments by payment method:FY2021 results (based on the number of cases) 162

3-1-2 Use of Tax Payment by Transfer Account (In Final Returns) 163

Chapter 2 Revenue Management and Processing

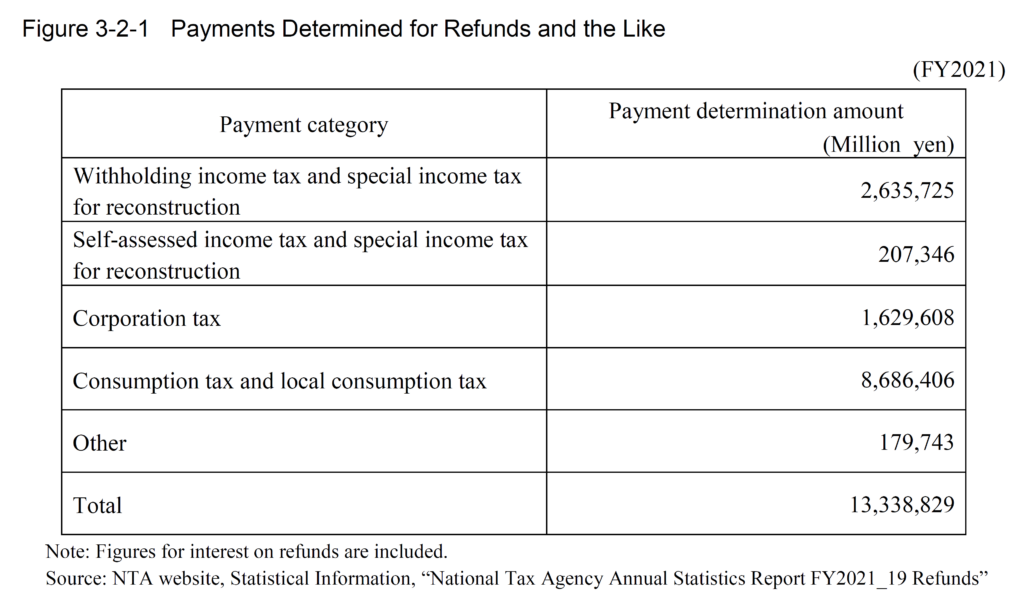

3-2-1 Payments Determined for Refunds and the Like 174

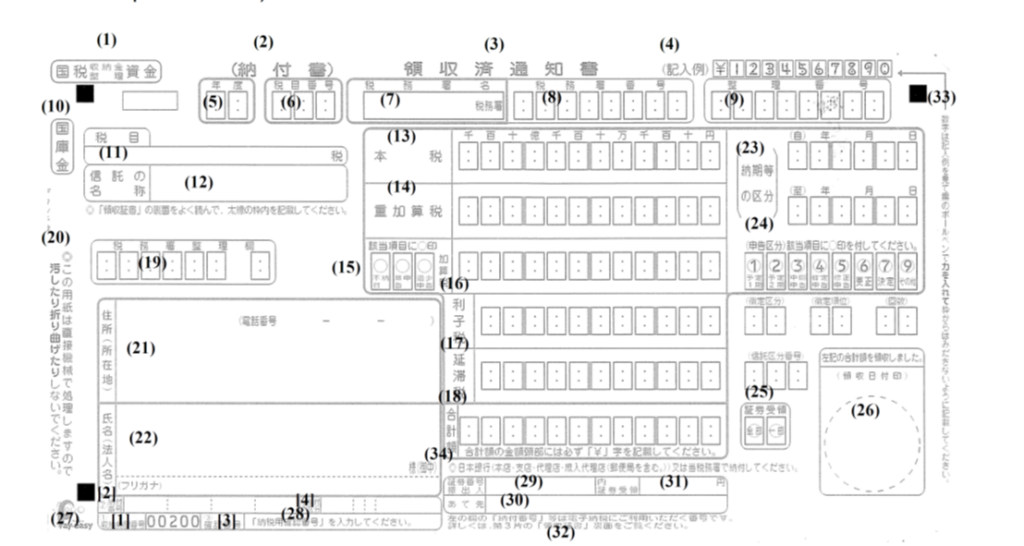

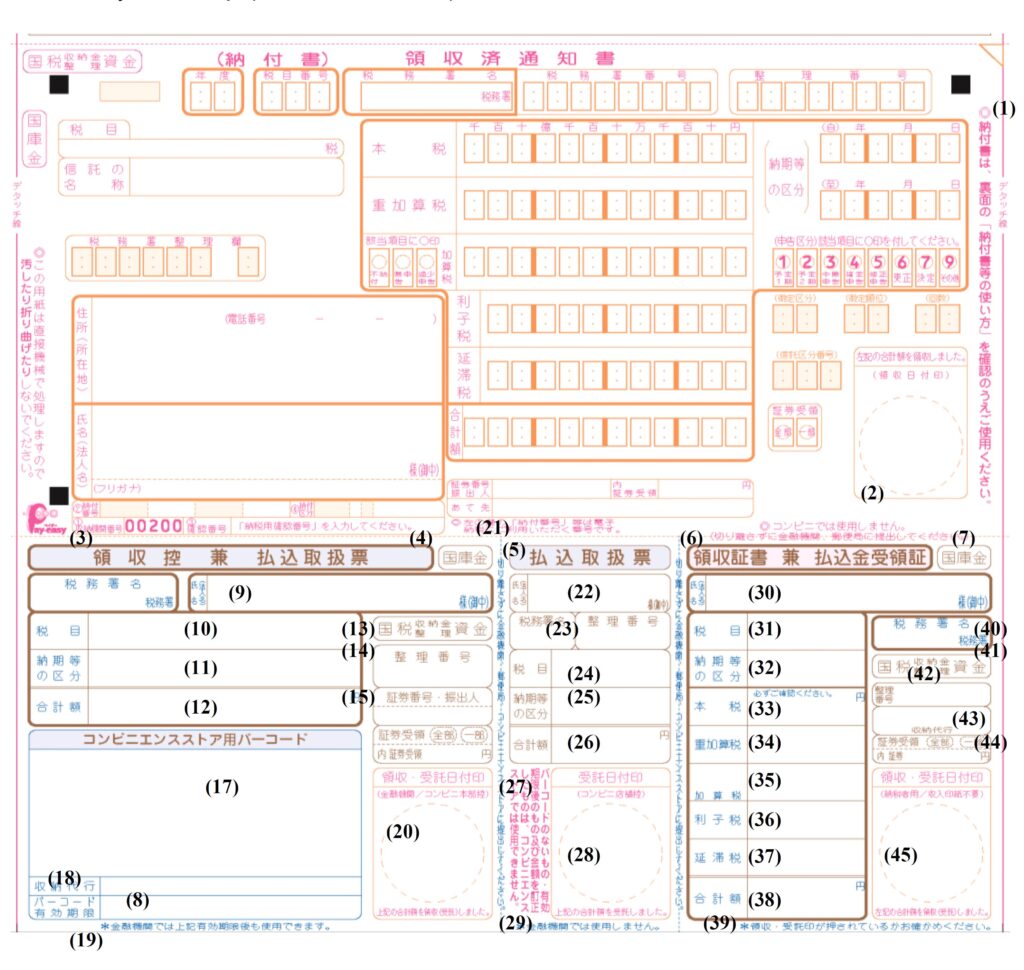

3-2-2 Tax Payment Slip 175

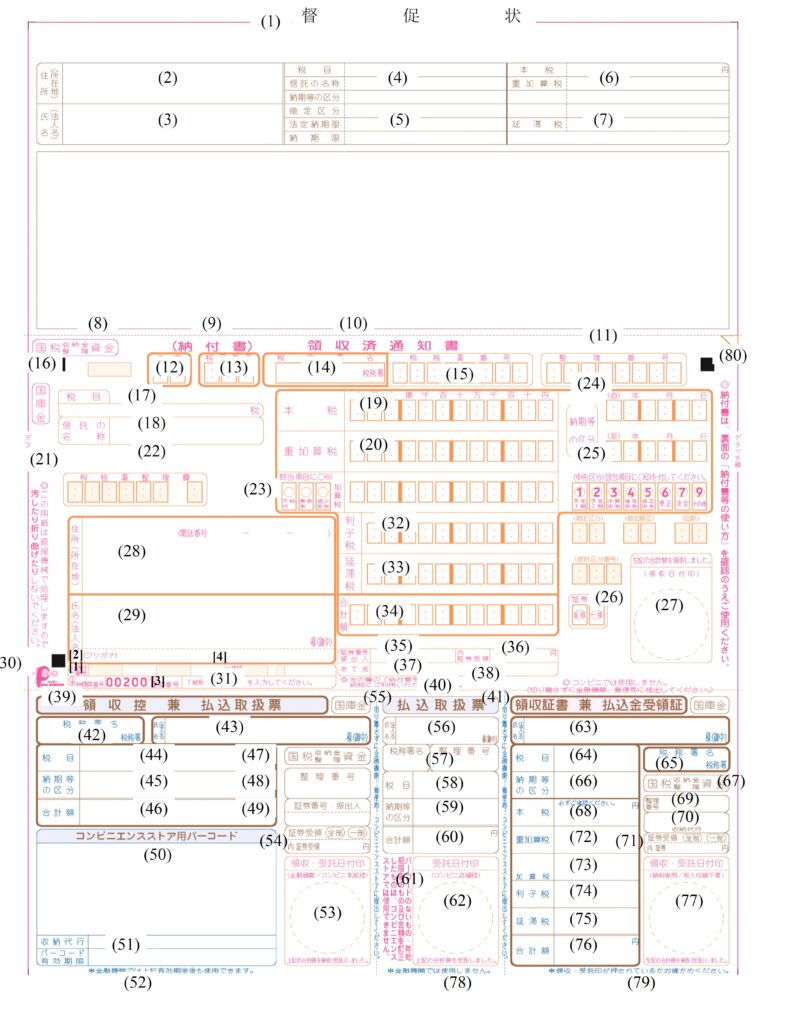

3-2-3 Letter of Demand 179

3-2-4 Certificate of Tax Payment (No. 1; for Certificate of Amount of Tax Paid, etc.)

. 183

Chapter 3 Collection

3-3-1 Status of Occurrence and Disposition of Tax Delinquency 187

3-3-2 Trends in Newly Occurring Delinquencies, Delinquencies Collected, and Outstanding Delinquencies 188

Part 4 Remedy for Taxpayer Rights

Chapter 1 Remedy System for Taxpayer Rights Chapter 2 Requests for Review

4-2-1 Overview of the National Tax Review Request System 198

4-2-2 Status of Requests for Re-examination 203

4-2-3 Overview of the Proceedings at the National Tax Tribunal 212

4-2-4 Status of Requests for Reconsideration 213

Chapter 3 Tax Lawsuits

4-3-1 Overview of Lawsuit Proceedings 222

4-3-2 Status of Lawsuits 223

Part 5 Certified Public Tax Accountant System

5-1 Number of Certified Public Tax Accountants (CPTAs) Registered 231

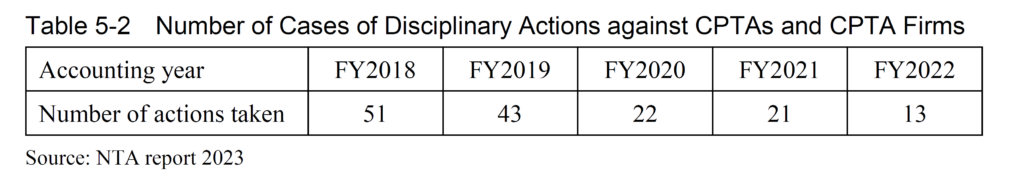

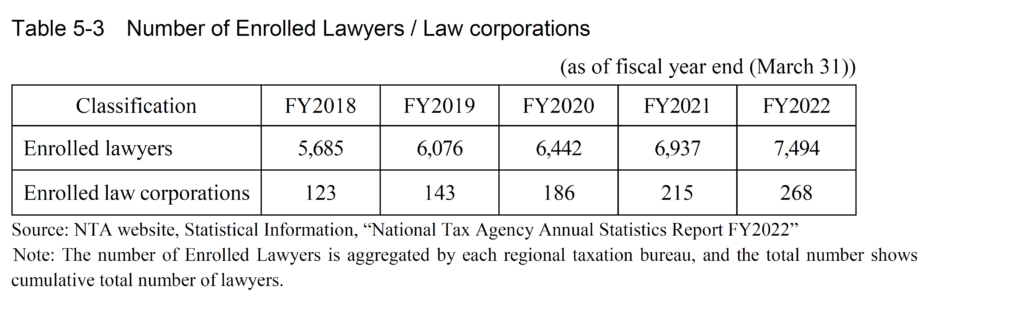

5-2 Number of Cases of Disciplinary Actions against CPTAs and CPTA Firms . 233 5-3 Number of Enrolled Lawyers / Law corporations 233

Part 6 Cooperation with Relevant Private Organizations Chapter 1 Relevant Private Organizations

Chapter 2 Local Governments Chapter 3 Commendations Part 7 Taxpayer Service

Chapter 1 Improvement of Public Hearing and Public Relations Activities

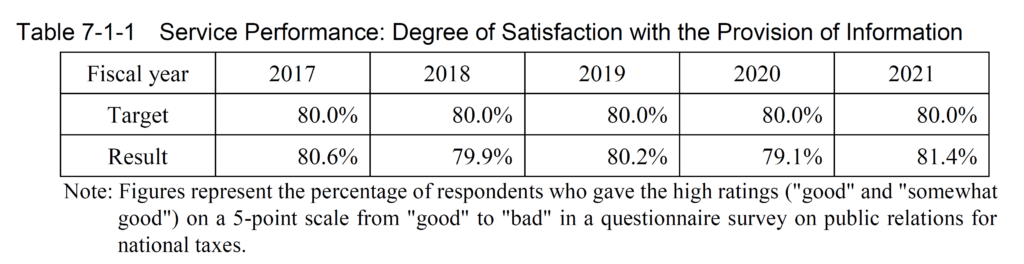

7-1-1 Service Performance: Degree of Satisfaction with the Provision of

Information 242

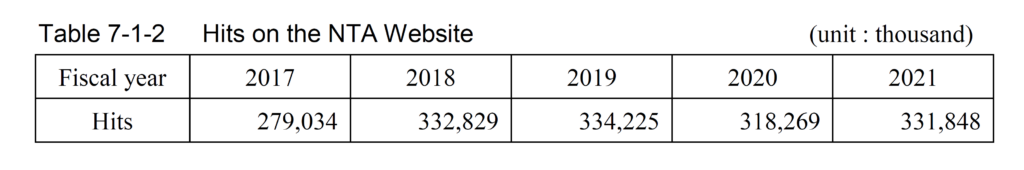

7-1-2 Hits on the NTA Website 242

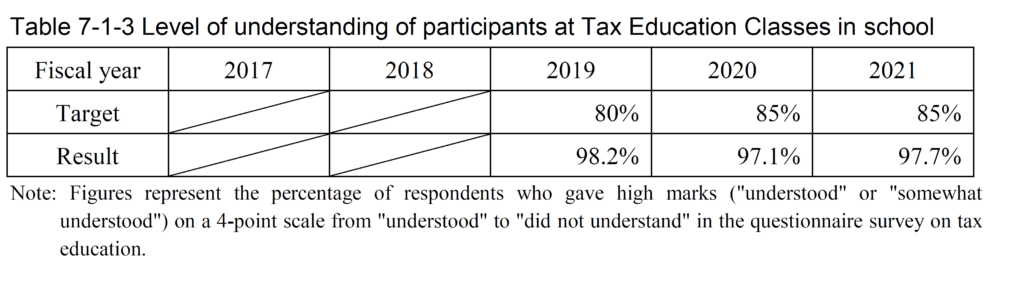

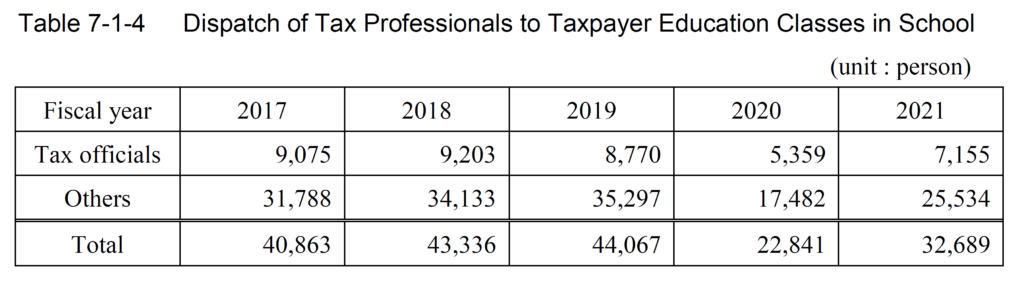

7-1-3 Level of understanding of participants at Tax Education Classes in school . 244 7-1-4 Dispatch of Tax Professionals to Taxpayer Education Classes in School 245

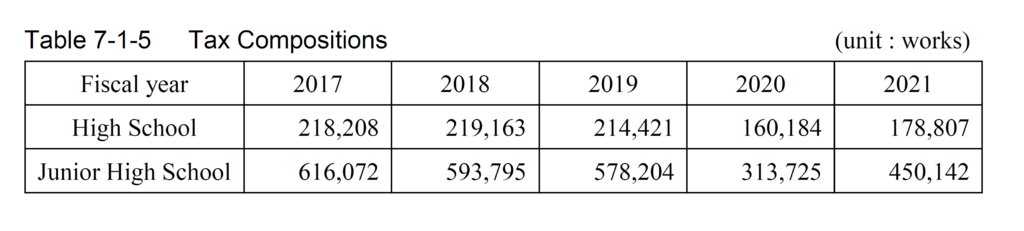

7-1-5 Tax Compositions 246

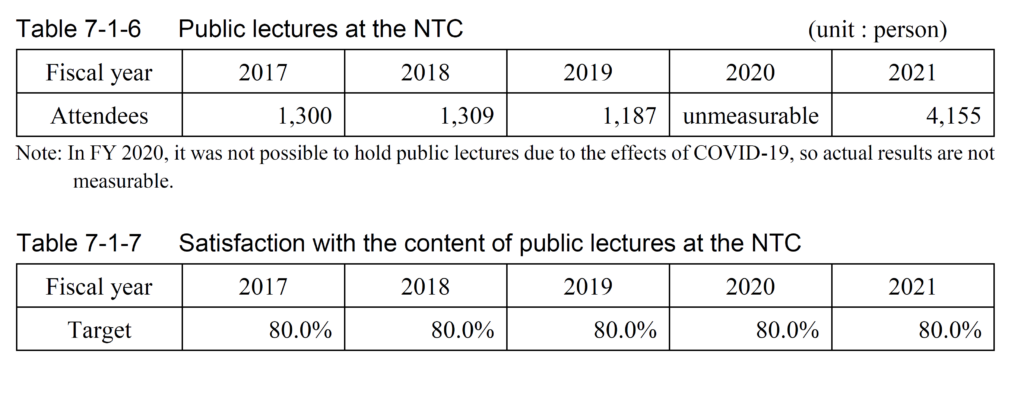

7-1-6 Public Lectures at the NTC 246

7-1-7 Satisfaction with the content of Public lectures at the NTC 246

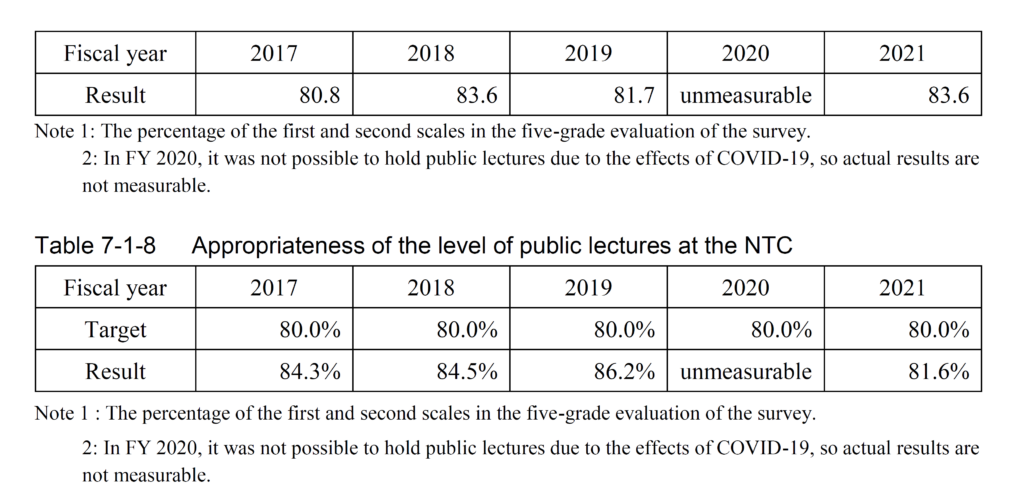

7-1-8 Appropriateness of the level of Public lectures at the NTC 247

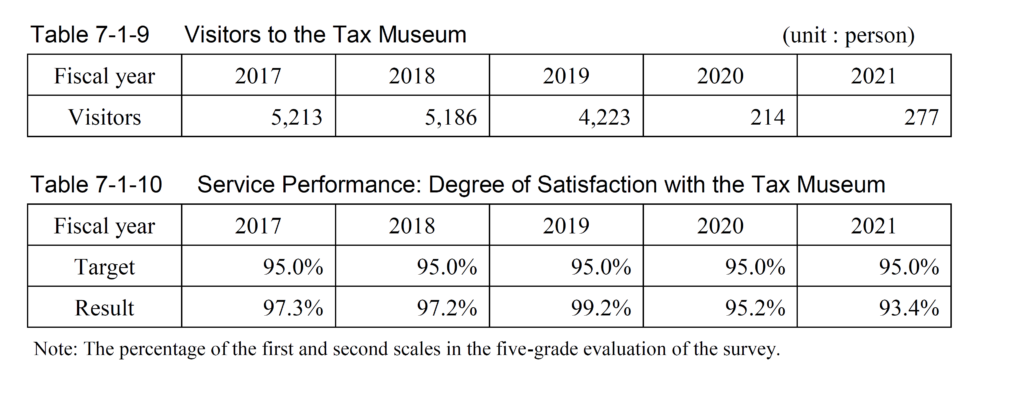

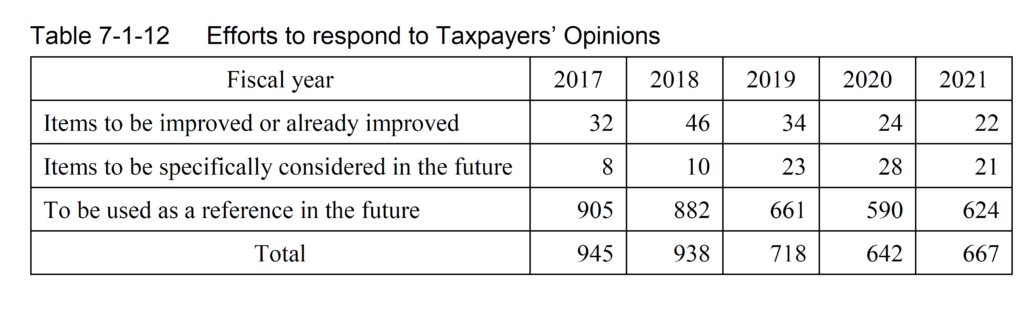

7-1-9 Visitors to the Tax Museum 247

7-1-10 Service Performance: Degree of Satisfaction with the Tax Museum 247

7-1-11 Tax Authorities Conference 248

7-1-12 Efforts to respond to Taxpayers’ Opinions 249

Chapter 2 Taxpayers’ Inquiries and Complaints

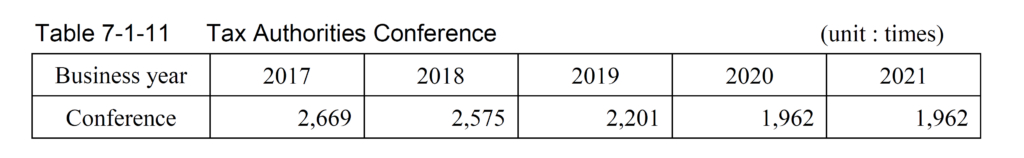

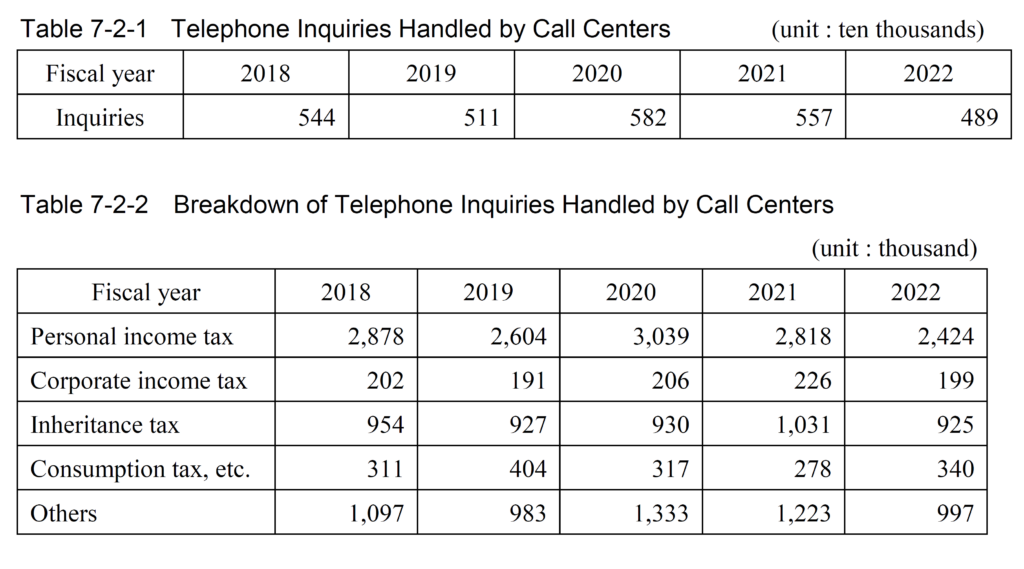

7-2-1 Telephone Inquiries Handled by Call Centers 250

7-2-2 Breakdown of Telephone Inquiries Handled by Call Centers 250

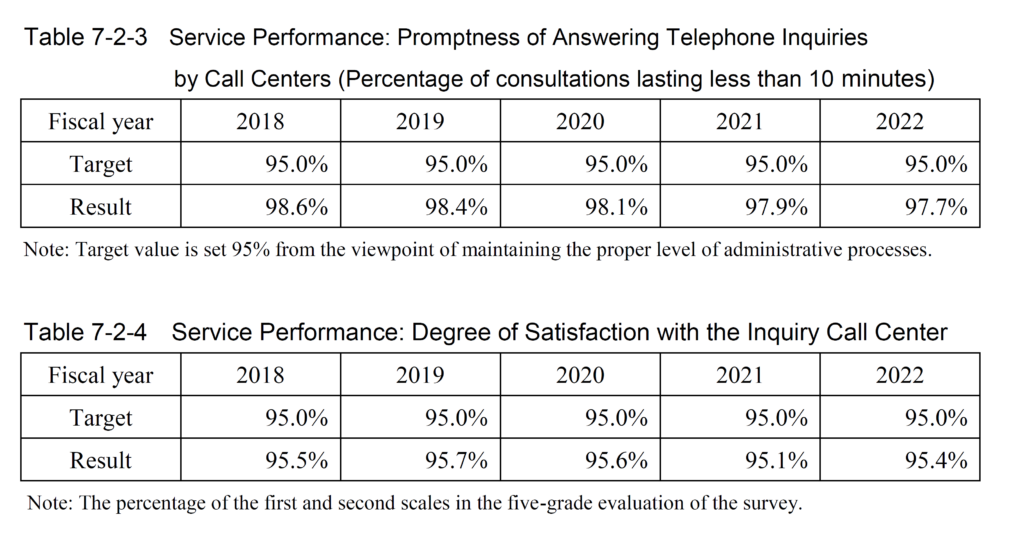

7-2-3 Service Performance: Promptness of Answering Telephone Inquiries by Call Centers 251

7-2-4 Service Performance: Degree of Satisfaction with the Inquiry Call Center 251

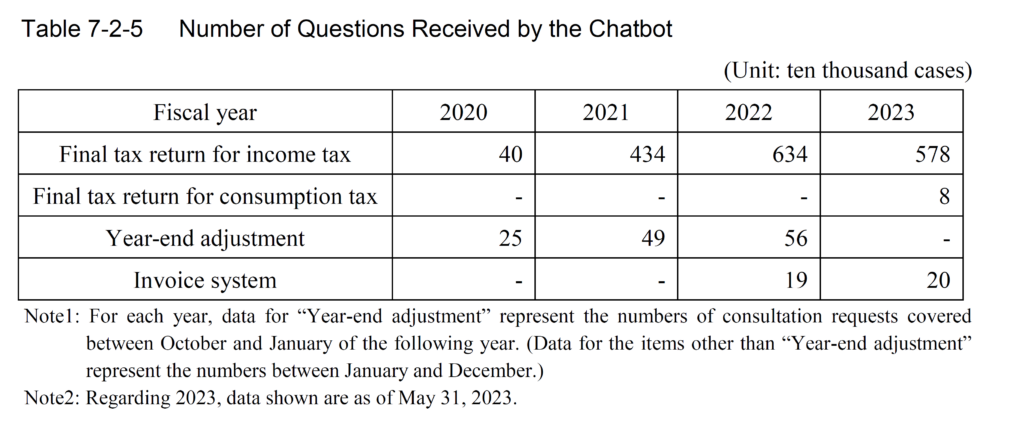

7-2-5 Number of Questions Received by the Chatbot 251

7-2-6 Number of accesses to “Tax Answer” 252

7-2-7 Service Performance: Degree of Satisfaction with In-Person Inquiries at

Tax Offices 252

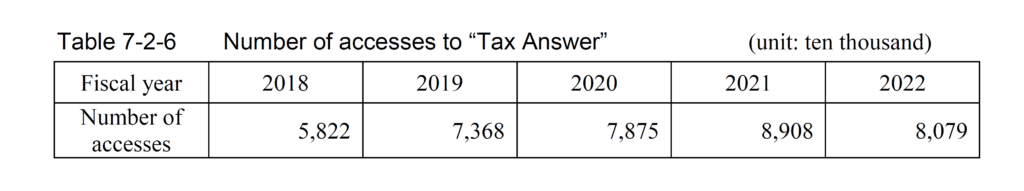

7-2-8 Workshops 253

7-2-9 Service Performance: Bookkeeping Workshops 253

7-2-10 Blue-return Taxpayer on Personal Income Tax 253

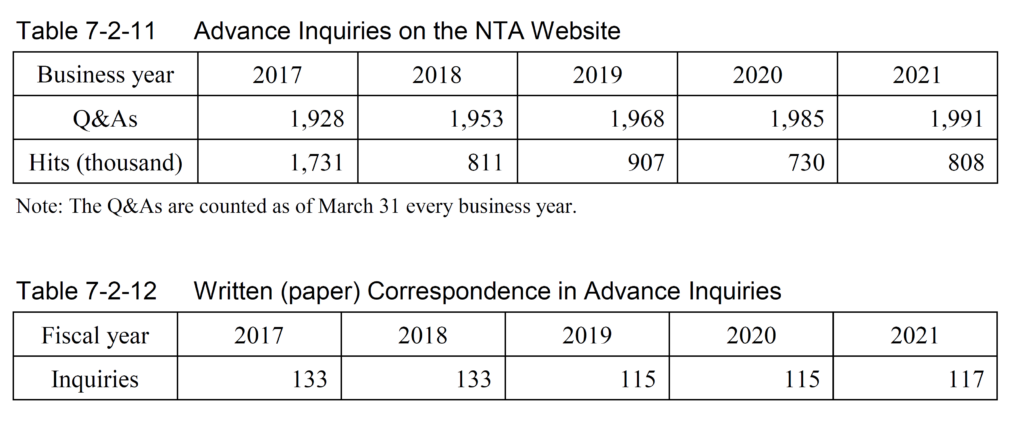

7-2-11 Advance Inquiries on the NTA Website 253

7-2-12 Written (paper) Correspondence in Advance Inquiries 253

7-2-13 Promptness of Answers to Complex Inquiries by Paper 254

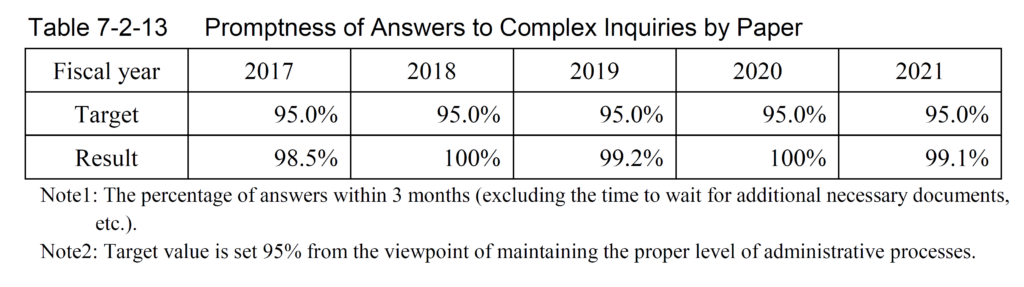

7-2-14 Tax Returns Using ICT 255

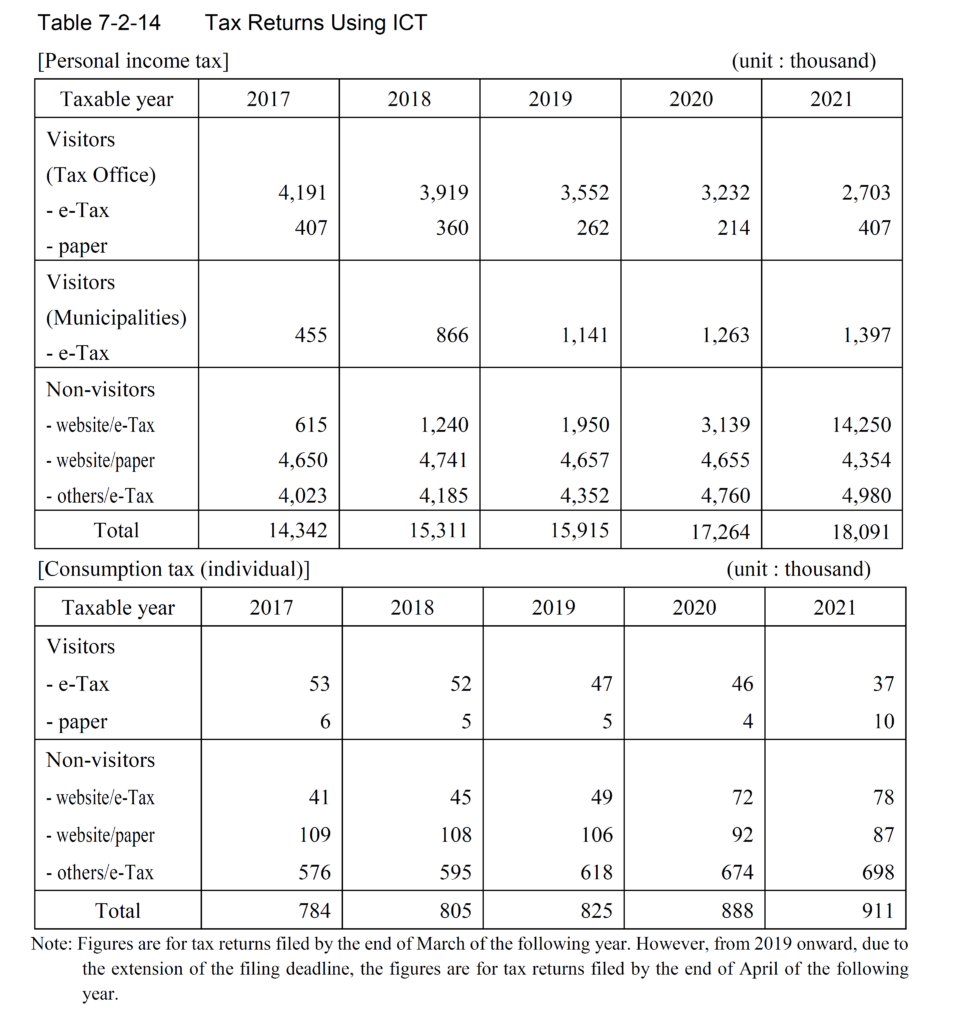

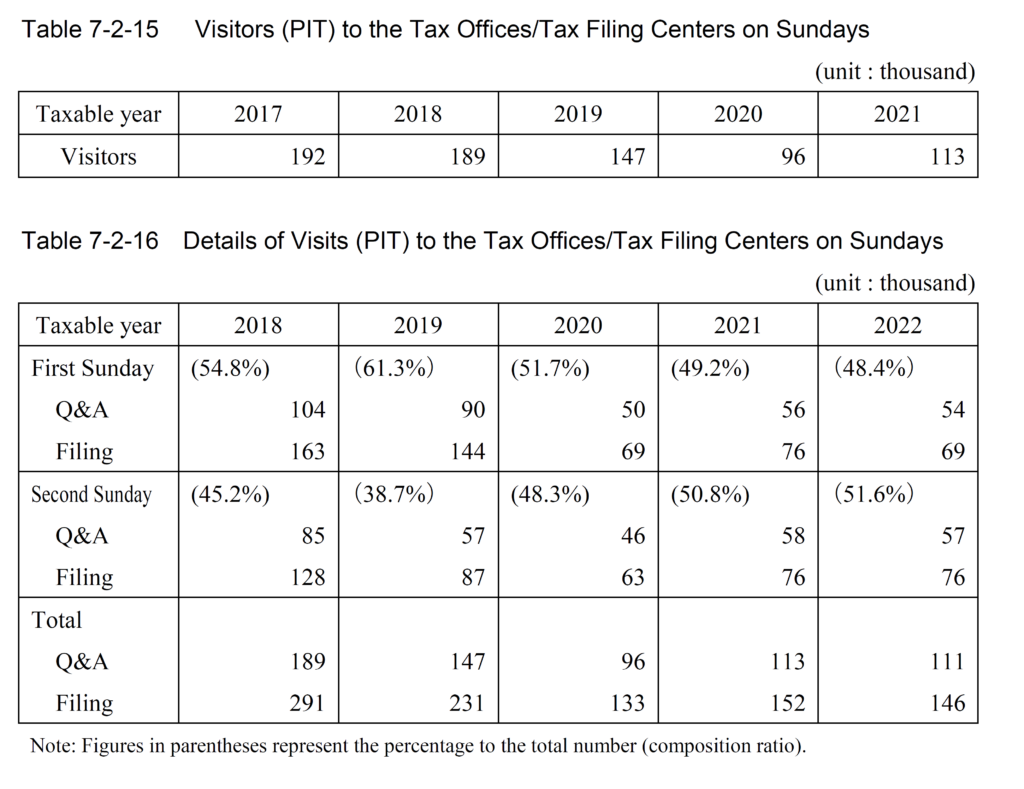

7-2-15 Visitors (PIT) to the Tax Offices / Tax Filing Centers on Sundays 256

7-2-16 Details of Visits (PIT) to the Tax Offices / Tax Filing Centers on Sundays 256

7-2-17 Promptness of Handling Taxpayers’ Complaints 257

Chapter 3 The Use of ICT in Taxpayer Services

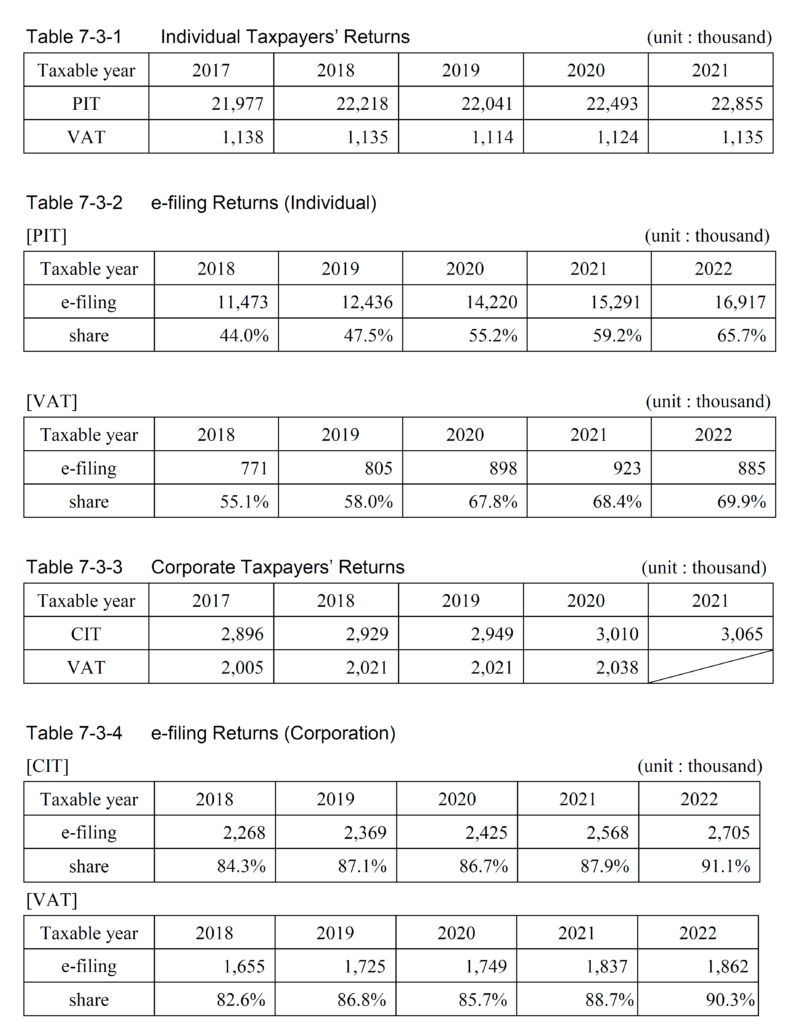

7-3-1 Individual Taxpayers’ Returns 264

7-3-2 e-filing Returns (Individual) 264

7-3-3 Corporate Taxpayers’ Returns 264

7-3-4 e-filing Returns (Corporation) 264

7-3-5 Amount of Taxes Paid 265

7-3-6 Cashless Payment 265

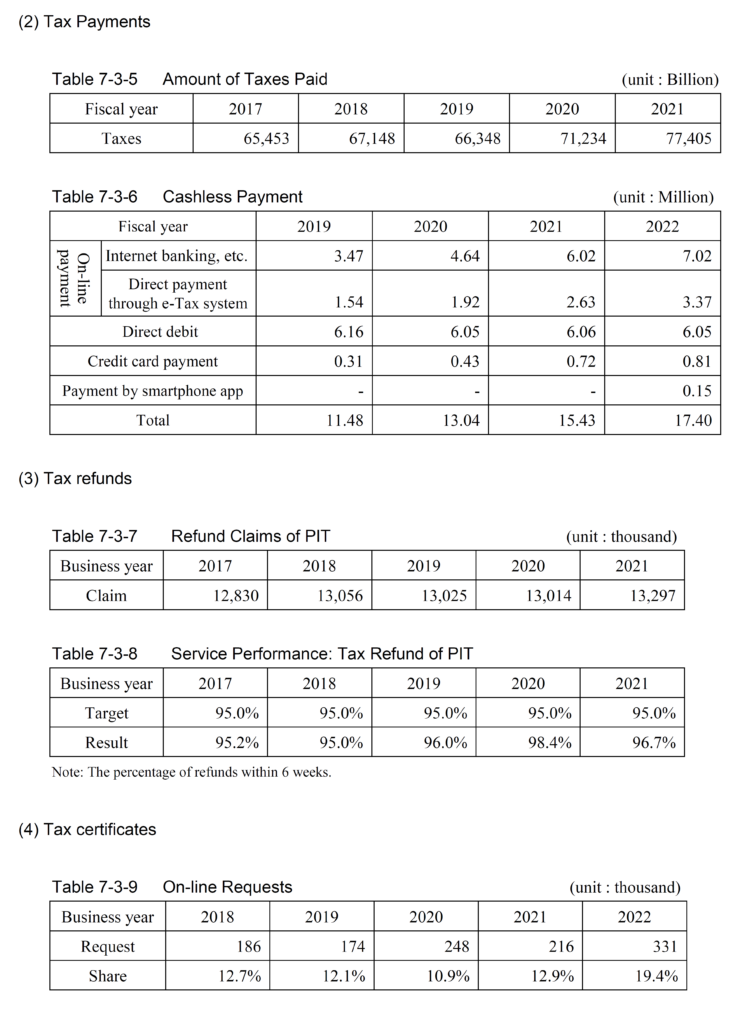

7-3-7 Refund Claims of PIT 265

7-3-8 Service Performance: Tax refund of PIT 265

7-3-9 On-line Requests 265

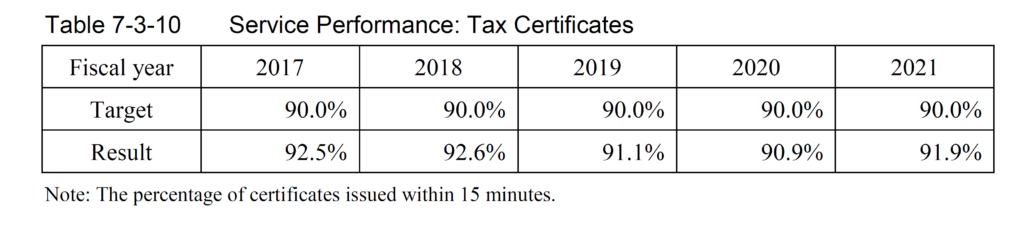

7-3-10 Service Performance: Tax Certificates 266

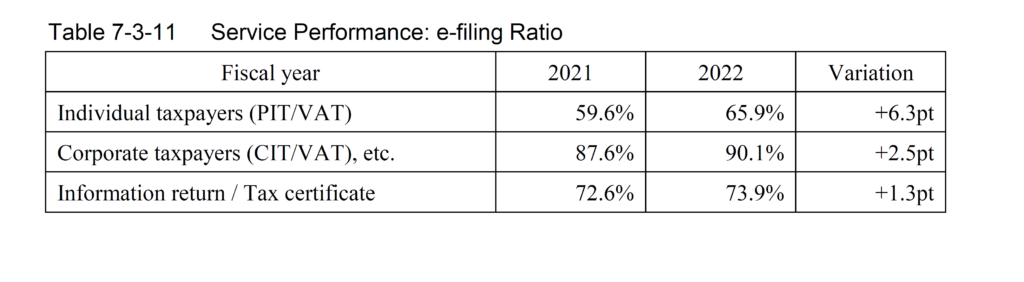

7-3-11 Service Performance: e-filing Ratio 266

Chapter 4 Future Vision of Tax administration

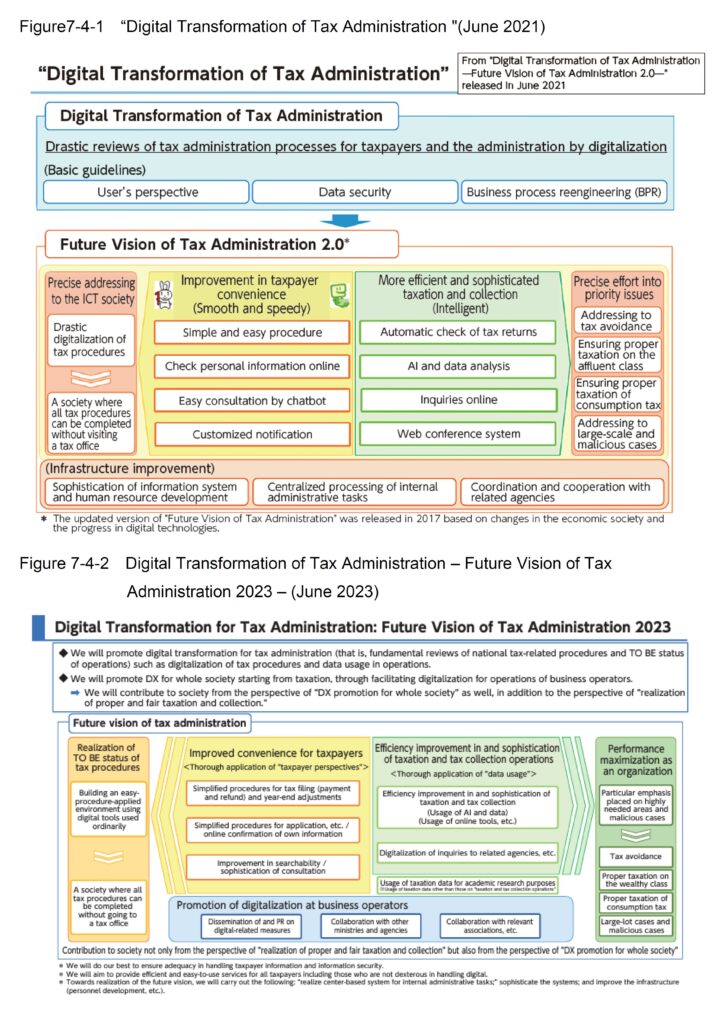

7-4-1 “Digital Transformation of Tax Administration”(June 2021) 268

7-4-2 Digital Transformation of Tax Administration-Future Vision of

Tax Administration 2023-(June 2023) 268

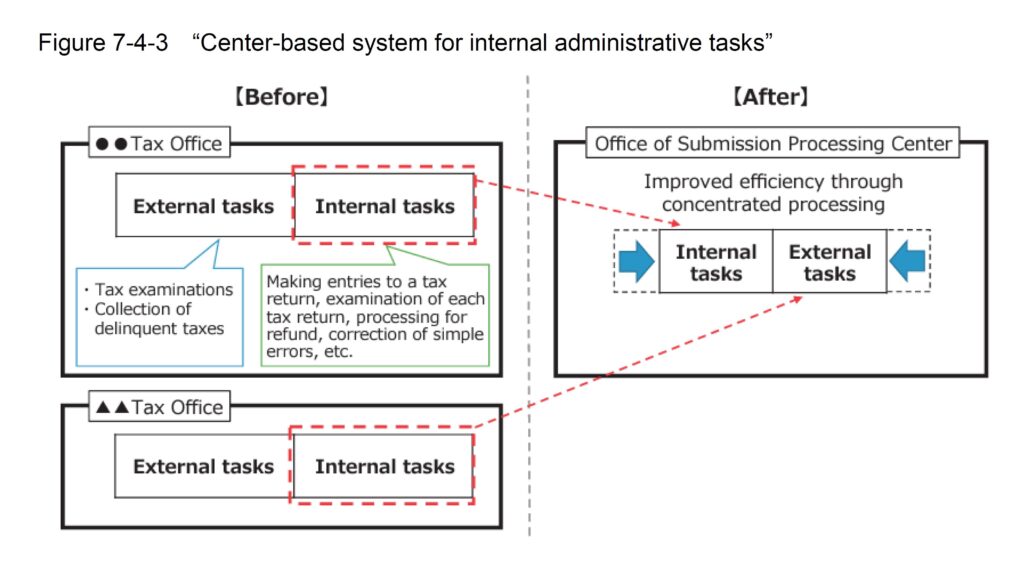

7-4-3 “Center-based system for internal administrative tasks” 269

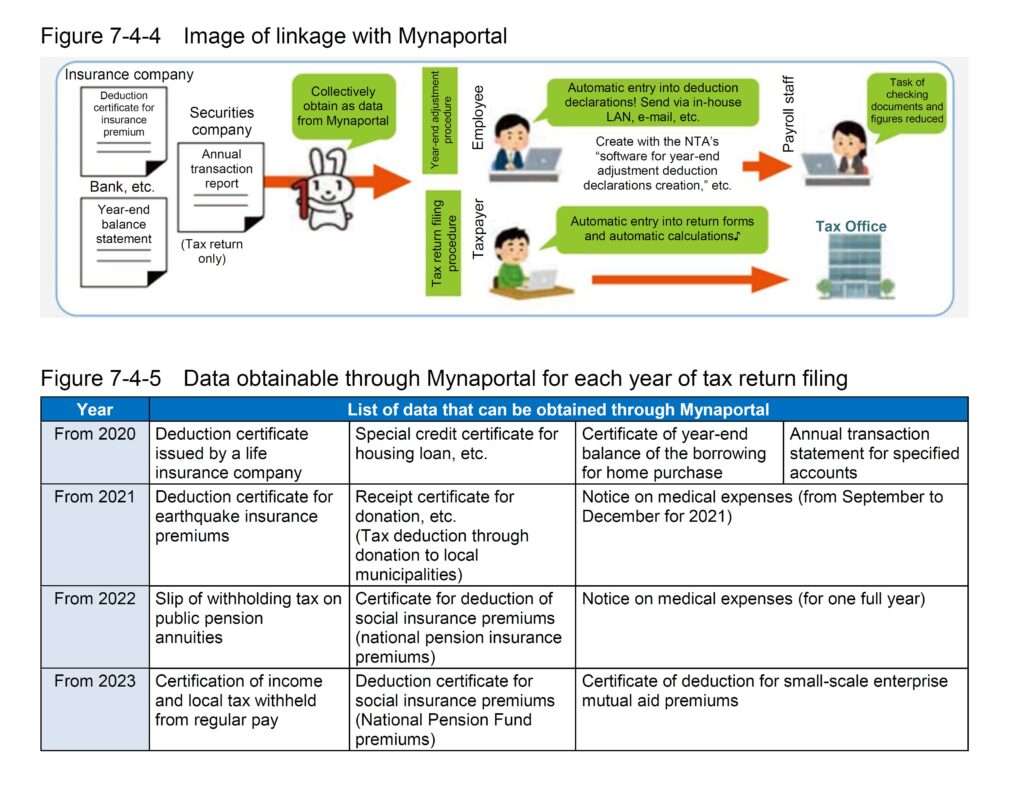

7-4-4 Image of linkage with Mynaportal 270

7-4-5 Data obtainable through Mynaportal for each year of tax return filing 270

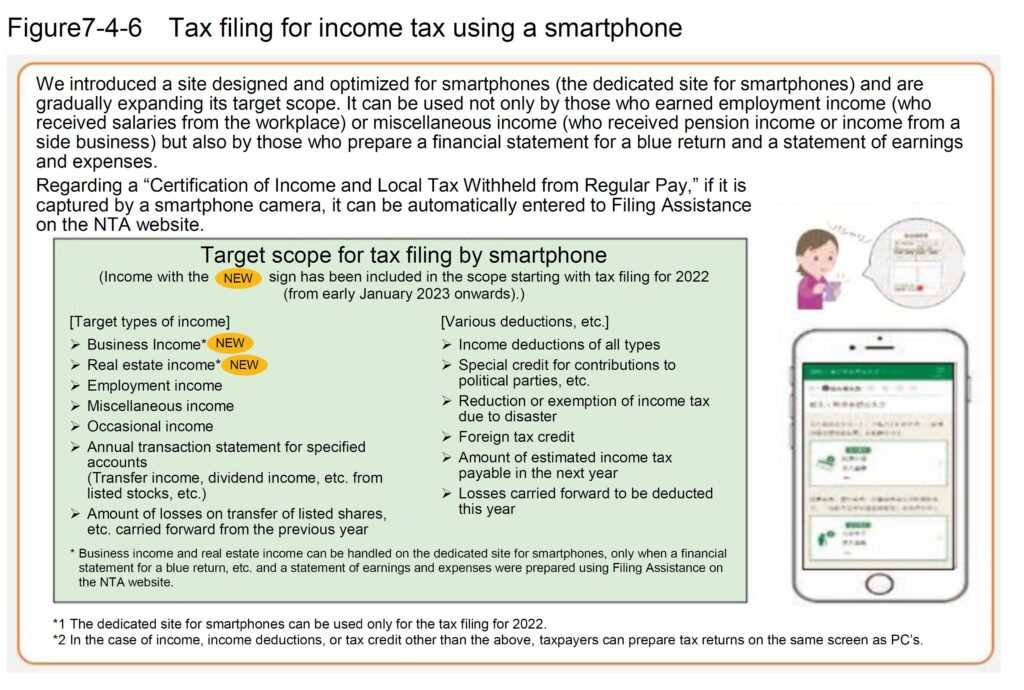

7-4-6 Tax filling for income tax using a smartphone 271

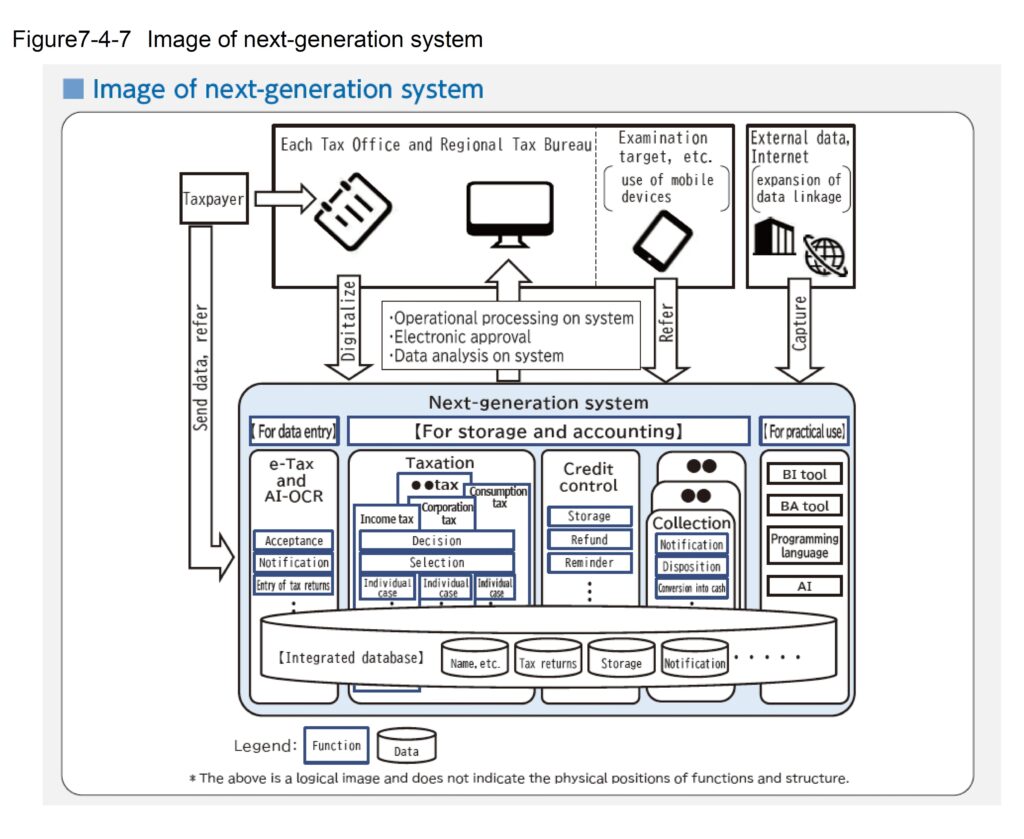

7-4-7 Image of next-generation system 274

Part 8 Computerization of Tax Administration Chapter 1 Outline of National Tax Related Systems

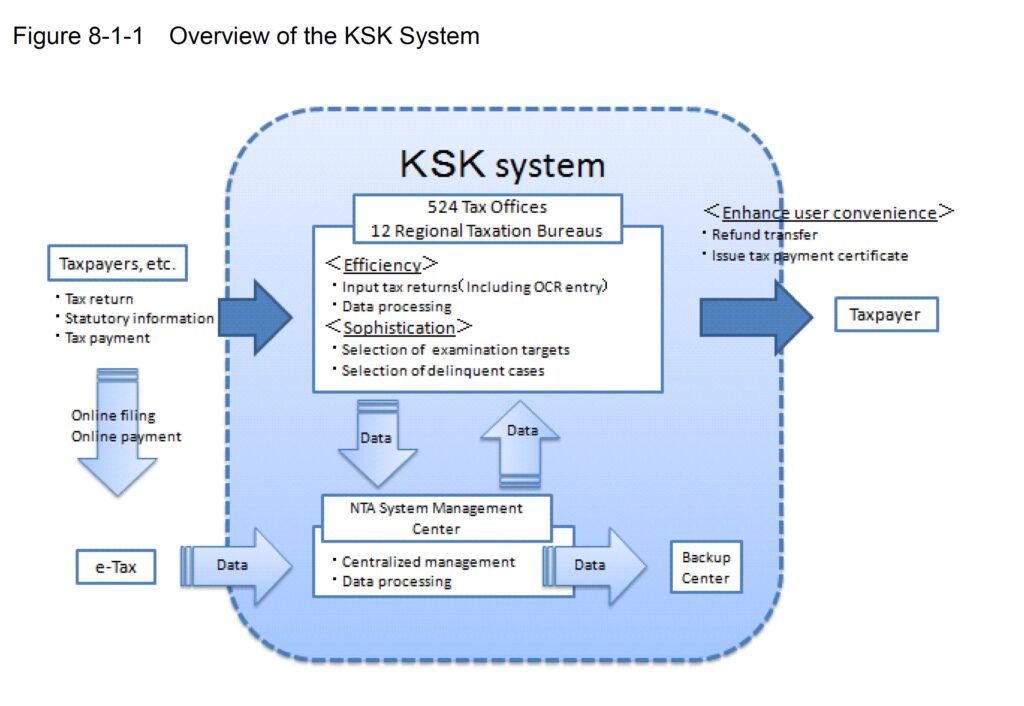

8-1-1 Overview of the KSK System 275

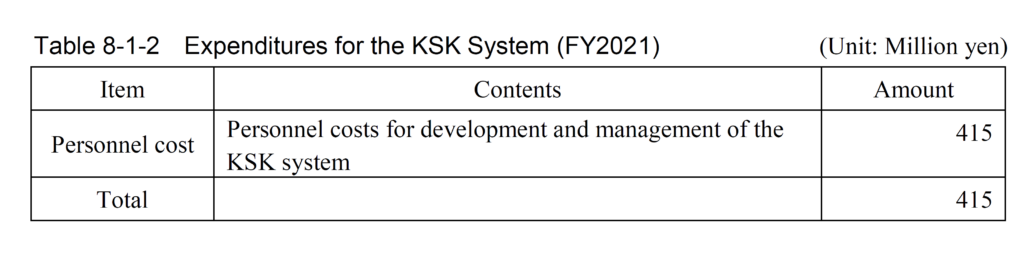

8-1-2 Expenditures for the KSK System (FY2021) 276

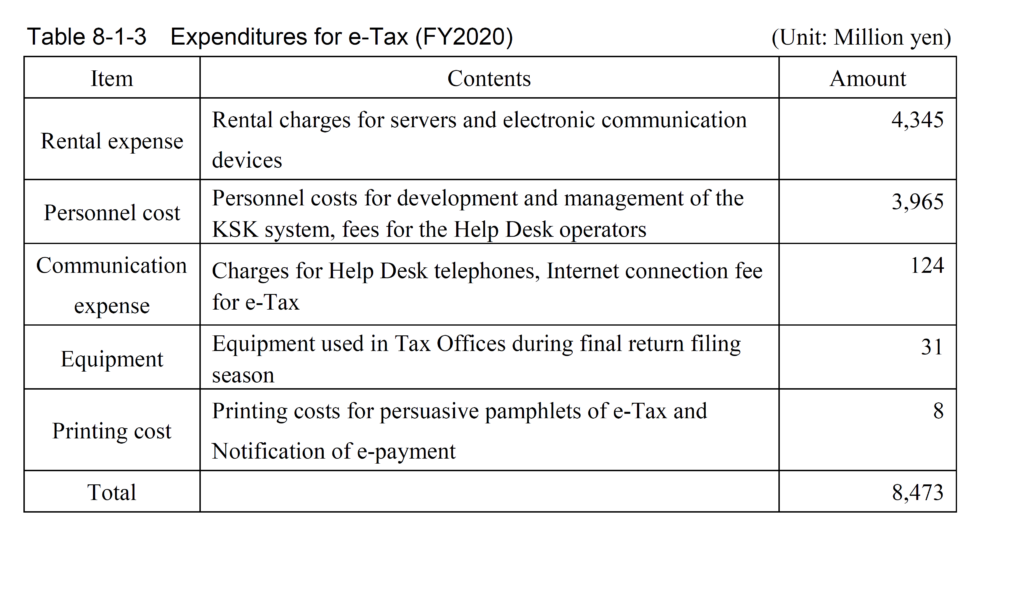

8-1-3 Expenditures for e-Tax (FY2020) 276

Chapter 2 Development of Information System for Clerical Work

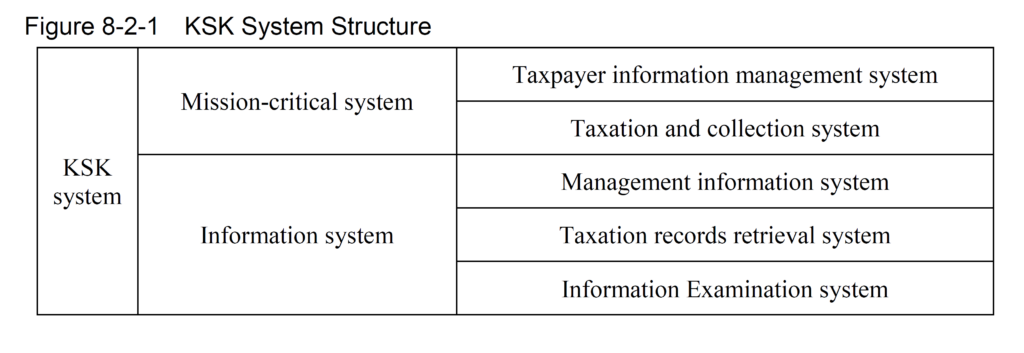

8-2-1 KSK System Structure 277

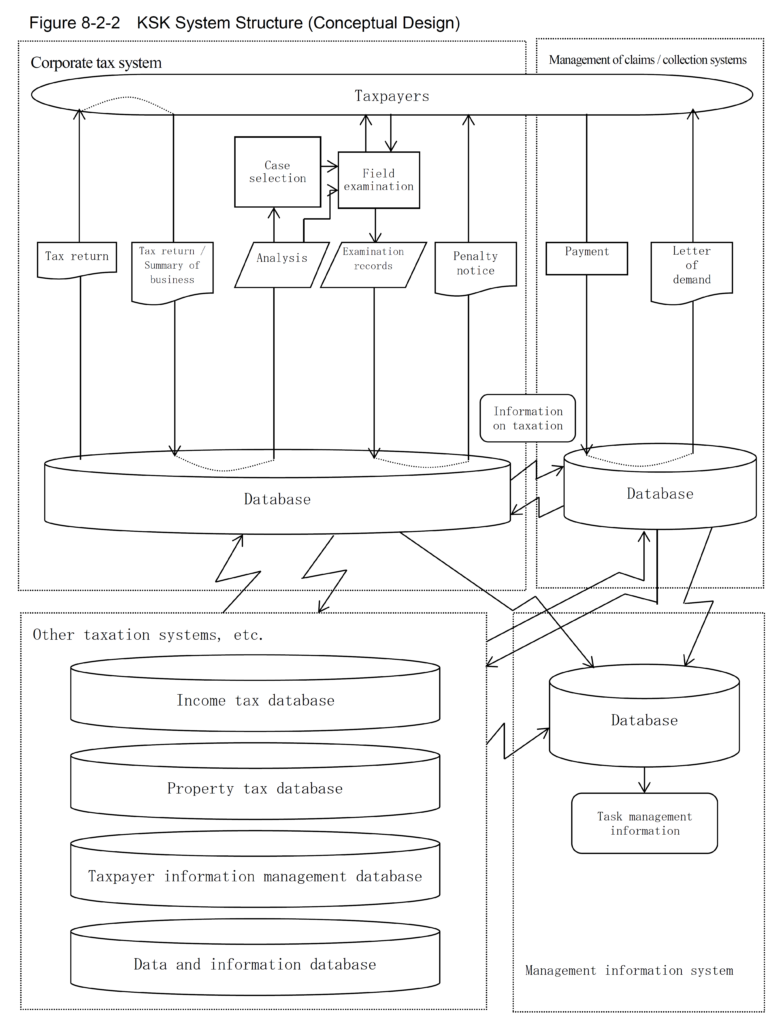

8-2-2 KSK System Structure (Conceptual Design) 278

Chapter 3 Online National Tax Return Filing and Tax Payment System (e-Tax)

8-3-1 Outline of e-Tax 282

8-3-2 Target scope for tax filing by smartphone 284

Part 9 Human Resources Management and Training Chapter 1 Personnel Management

9-1-1 Recruitment Numbers (by Examination) 293

Chapter 2 Internal Inspector System Chapter 3 Staff Training

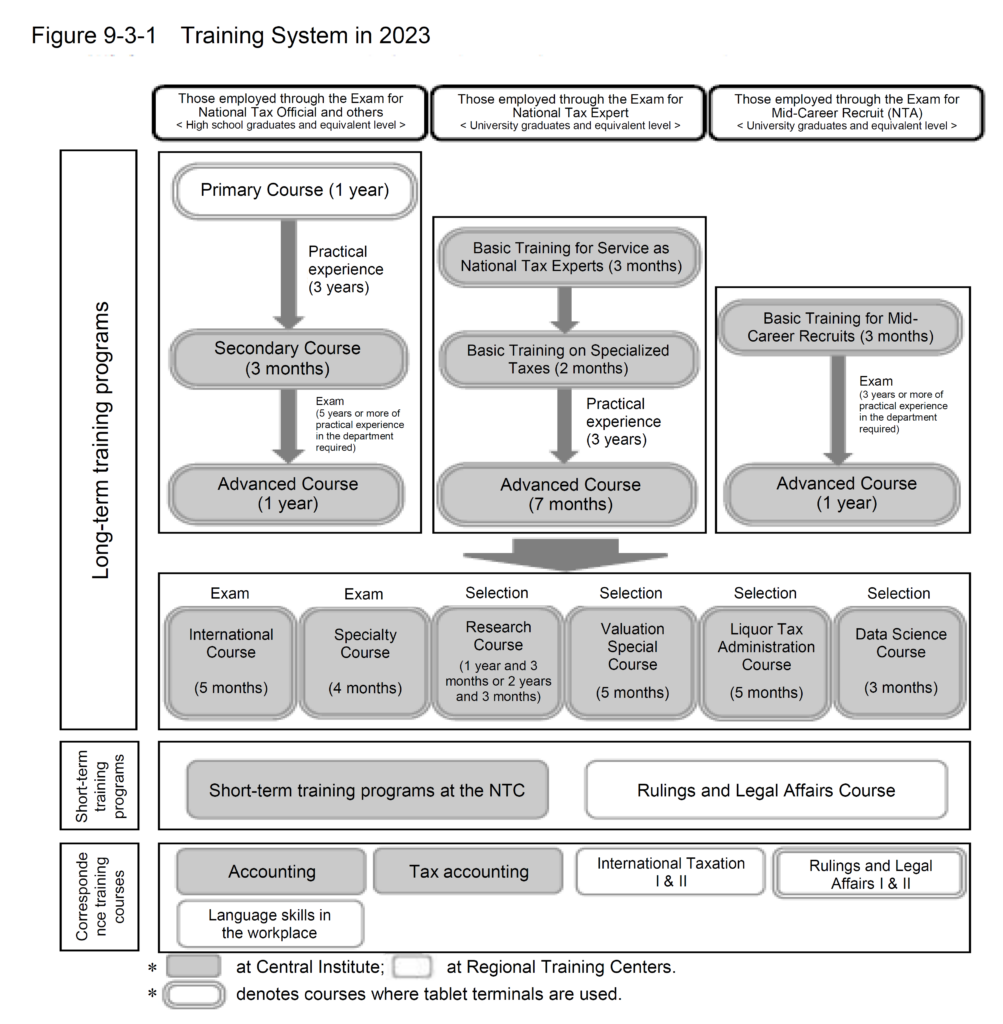

9-3-1 Training System in 2023 300

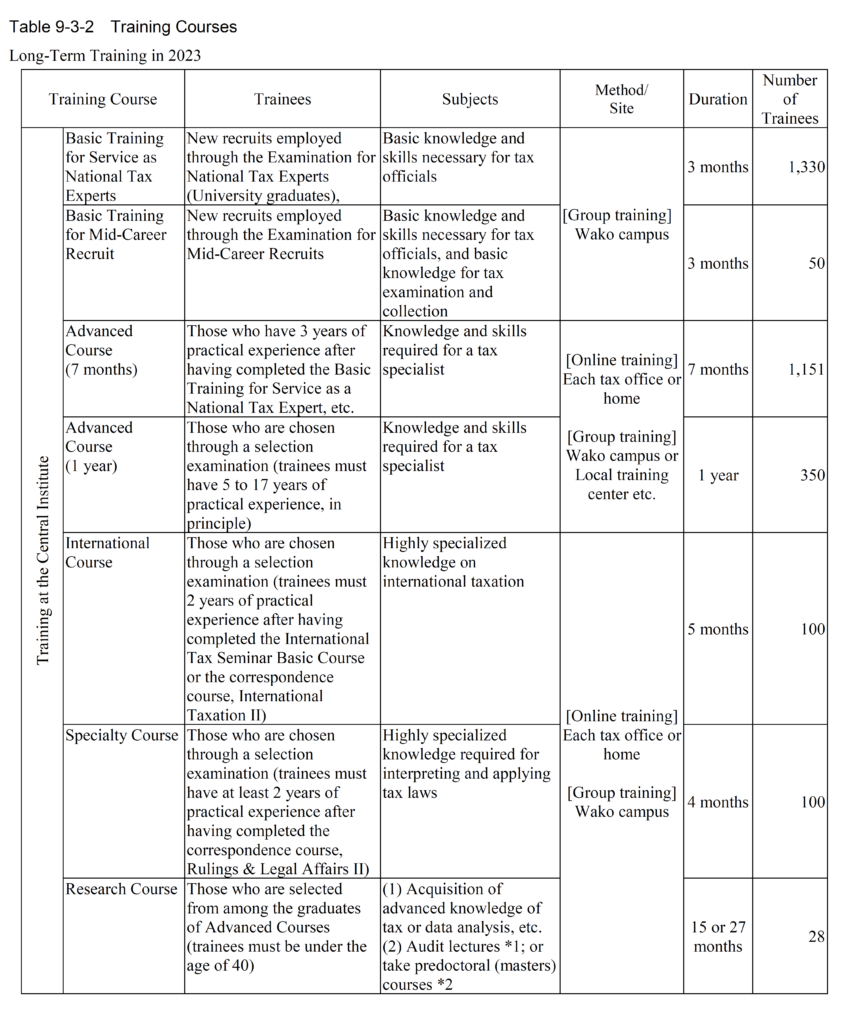

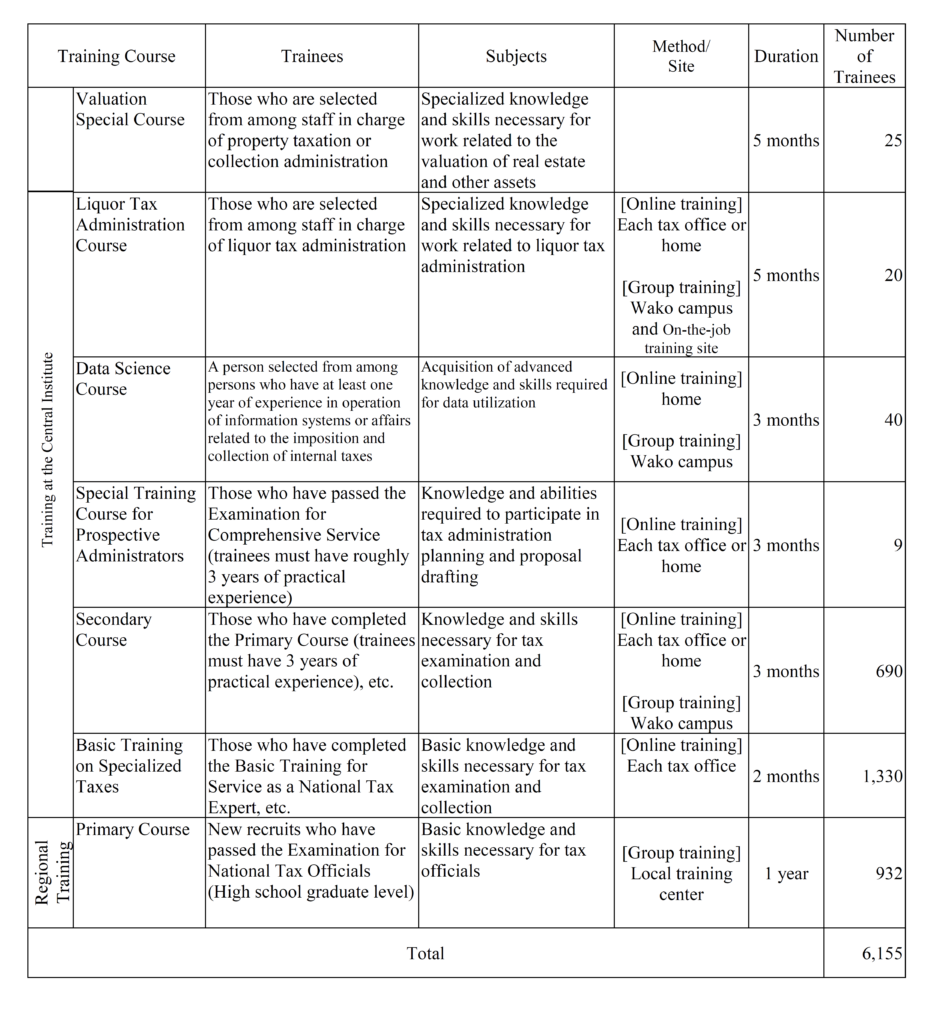

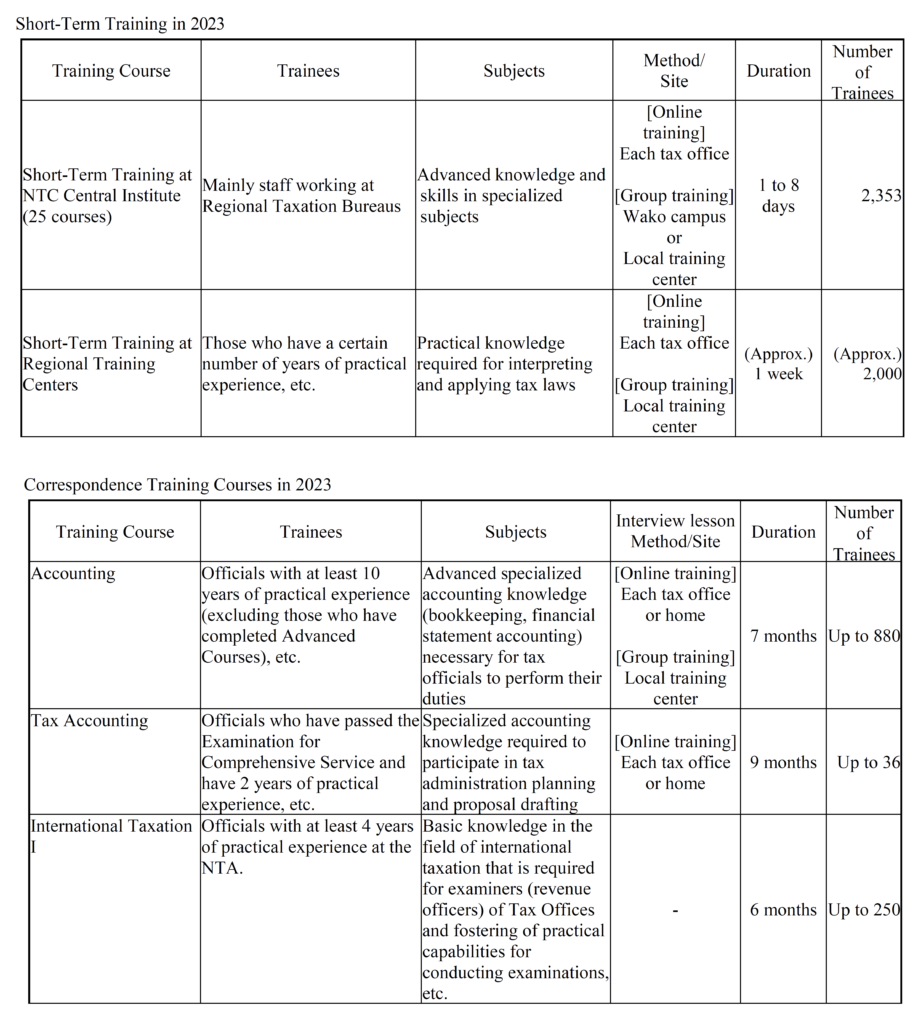

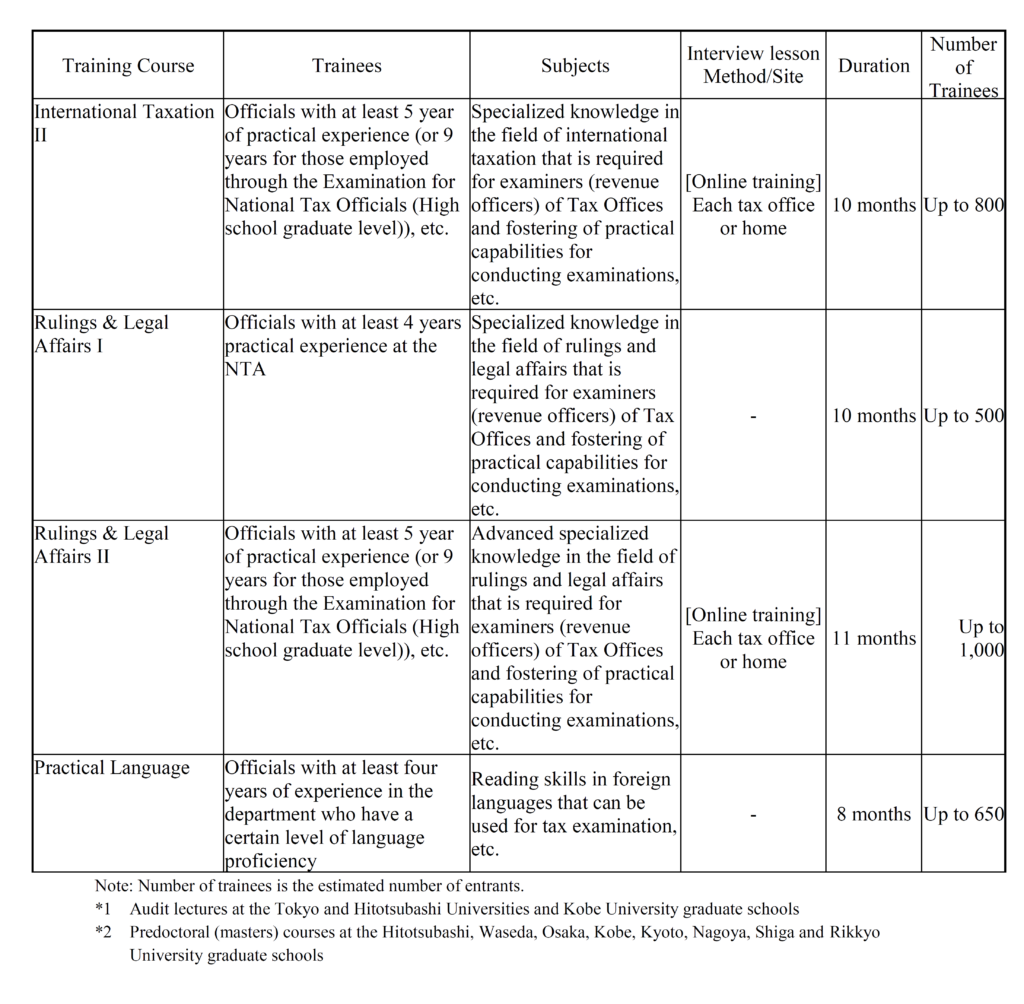

9-3-2 Training Courses 307

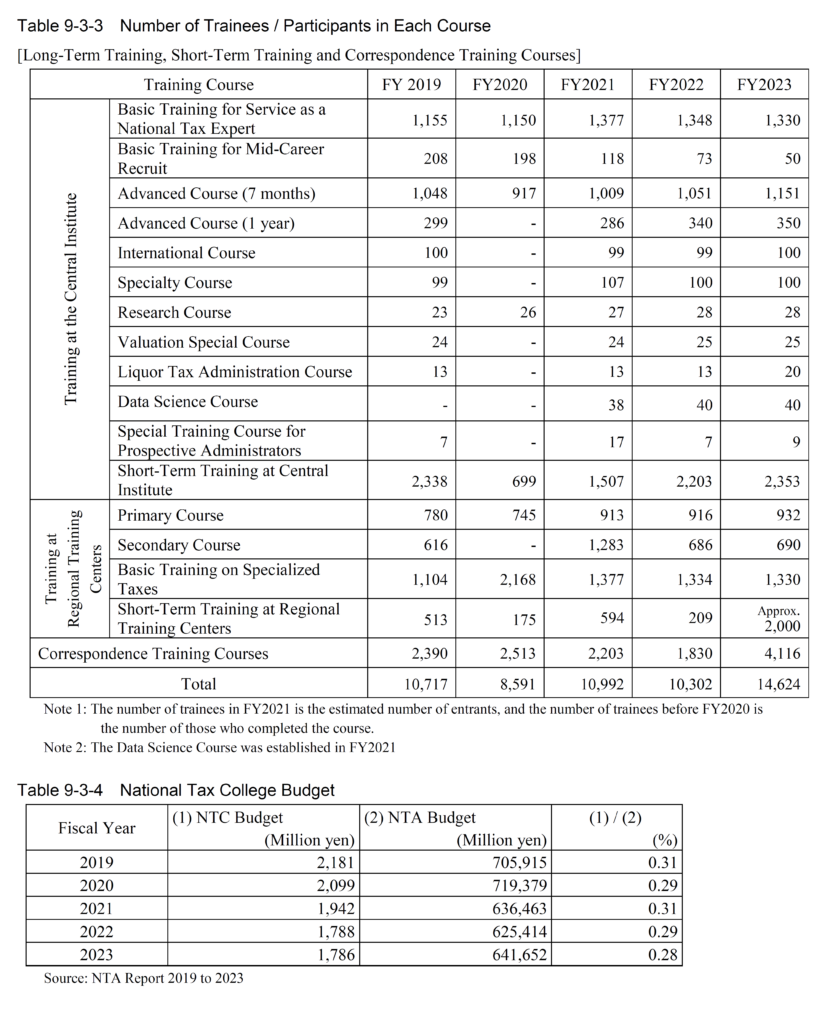

9-3-3 Number of Trainees / Participants in Each Course 311

9-3-4 National Tax College Budget 311

Part 10 Other Matters

Chapter 1 Inspections of Administrative Office Work Chapter 2 Evaluation of Performance

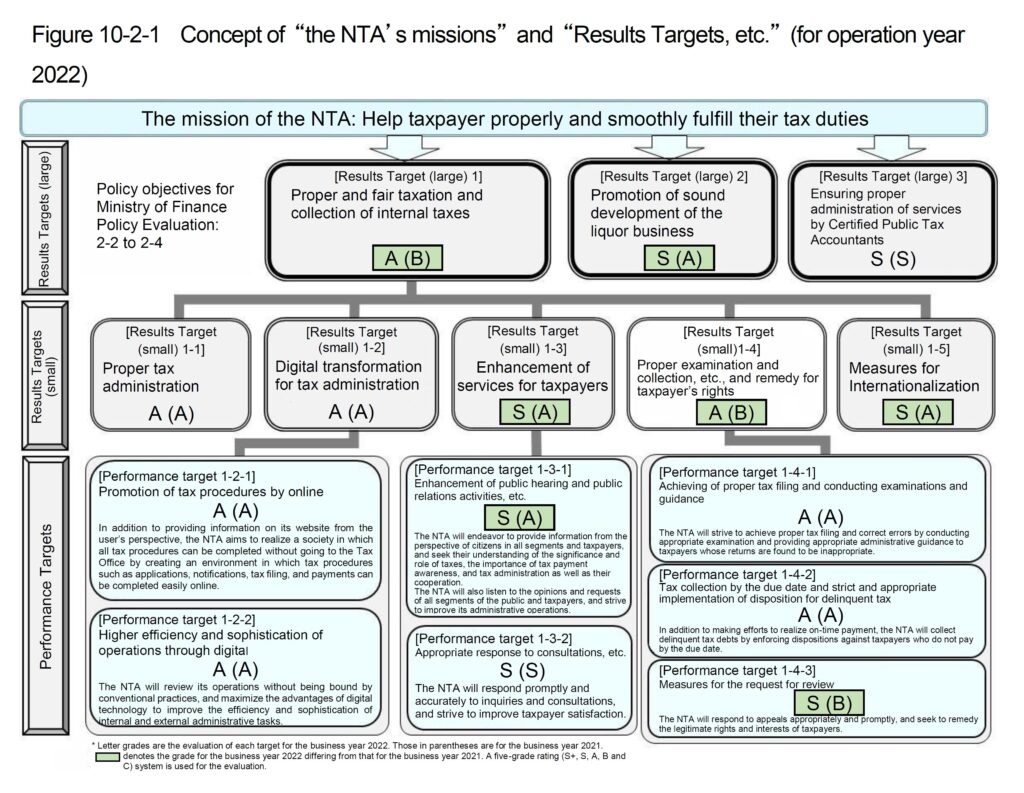

10-2-1 Concept of “the NTA’s missions” and “Results Targets, etc.”

(for operation year 2022) 315

Chapter 3 Disclosure of Official Information and Personal Information Protection Chapter 4 Proposals for Improvement

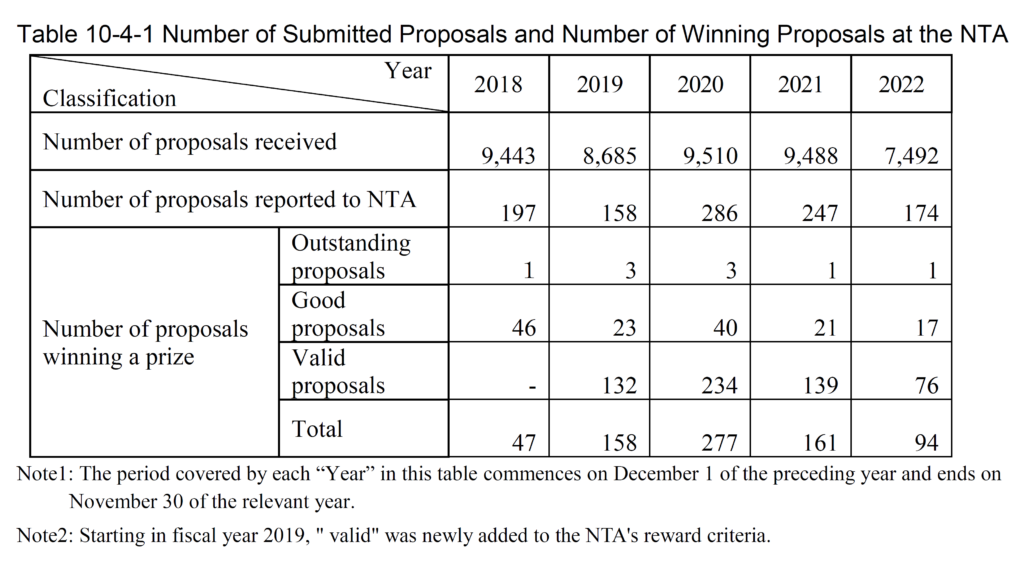

10-4-1 Number of Submitted Proposals and Number of Winning Proposals

at the NTA 324

INTRODUCTION

About the National Tax Agency (NTA)

The NTA is Japan’s tax levying and collecting agency and administers the national tax laws enacted by the Diet. The Agency was organized in 1949 as an external organization of the Ministry of Finance.

The NTA supervises 12 Regional Taxation Bureaus (including the Okinawa Taxation Office; the same applies hereinafter) and 524 Tax Offices throughout Japan. The NTA conducts tax administration planning, and supervises and oversees the administration of the Regional Taxation Bureaus and the Tax Offices. The Regional Taxation Bureaus are supervised and overseen by the NTA, and they in turn supervise and oversee the Tax Offices in their jurisdiction. In addition, the Bureaus are engaged in tax examinations and the collection of taxes from large taxpayers. Under the guidance and oversight of the NTA and Regional Taxation Bureaus, the Tax Offices represent the frontline enforcement organization as well as the administrative body that maintains the closest relationships with taxpayers.

In addition, the National Tax College trains tax officials, and the National Tax Tribunal is a special body engaged in reviewing requests for review from taxpayers.

2 Overview of the National Tax Organization

(1) Number of NTA Personnel

The number of personnel at the NTA remained at around 52,000 from the 1970s through the first half of the 1980s. Thereafter, the number increased, as the consumption tax was introduced in fiscal year 1989.

The number of personnel reached a peak of 57,202 in fiscal year 1997, which was the highest since 1989, and was 55,985 in fiscal year 2023.

(2) Organizational Structure of the NTA

The NTA supervises 11 Regional Taxation Bureaus, the Okinawa Regional Taxation Office, and 524 Tax Offices to process tax administration.

Source: NTA Report 2023 and Statistics from National Tax Agency

Part 1 Outline of Operations Chapter 1 Income Tax Section

1 Overview

In principle, income tax is imposed on annual income (for one calendar year) obtained by an individual. It is one of the major direct taxes, along with corporation tax.

1 Self-Assessment System

Like many other taxes, taxpayers in Japan have to calculate and report their taxable income and tax liabilities by themselves according to the tax laws (self-assessment system), unless their tax payments are completed through the year-end adjustment (see page31) by their employers for employment income.

If a return is not filed or contains errors, the tax authority can assess a tax amount based on a tax examination. In principle, however, under the self-assessment system, tax amounts are determined according to the returns filed by taxpayers.

This system was introduced in 1947, replacing the official assessment system. There were considerably difficulties in establishing the new system.

The self-assessment system requires taxpayers to perform continuous bookkeeping to compute their incomes. At the time, however, most taxpayers thought that they should pay taxes as assessed by the tax authority. Most people had no practice of keeping a record of their transactions, and so they hardly felt the need for such a practice. Furthermore, with the economic confusion after the war, people were in dire poverty and had little taxable income. In sum, the environment was not conducive to the introduction of the self-assessment system.

As a result, most taxpayers either failed to file returns or understated their incomes in their returns. Many people received assessment letters from the tax authority and the additional assessed tax exceeded that of their self-assessments.

This situation gradually improved. This reflected the rise in people’s income levels in step with the reconstruction of the Japanese economy, the stabilization of society overall, and the efforts to establish

Reference; “ Report On Japanese Taxation By The Shoup Mission “, September 1949, Appendix D, Section A and B

the practice of bookkeeping along with the introduction of the blue return system##. For example, while the amount of self-assessed tax payment through final returns filed for income tax and special income tax for reconstruction was 3.8 trillion yen for 2021, the amount collected through audits additionally related to income tax and special income tax for reconstruction for business year 2021 (July 2021 to June 2022) was 105.8 billion yen, which accounted for about 2.8% of the amount of self-assessed tax payment.

Reference: History of tax administration after the introduction of the self-assessment system

Income tax administration has been adjusted according to changes in the environment of income tax administration, such as amendments of tax laws, increases in the number of taxpayers, and qualitative changes among taxpayers. The existing system of income tax administration has been built up as a result of a series of reforms. Consequently, a brief historical review will be summarized before the explanation of the existing system of income tax administration.

The following is a review of how income tax administration has been conducted since the introduction of the self-assessment system.

(1) 1950

In the early period after the introduction of the self-assessment system (in 1947), taxpayers were not fully familiar with the purpose of this new system and the tax burden was relatively heavy for the low standard of living at the time.

Consequently, an enormous number of deficient returns were filed, followed by an extremely large number of corrective measures such as correction and determination after the due date. For this reason, tax administration was thrown into utter confusion.

To improve this situation, a notice system, which augmented the pre-filing examination system, was adopted in 1950. Guidance on the income amount under the notice system was carried out based on the results of a pre-filing examination.

Under this system, taxpayers received advance written notice of the amount determined by the examination. Based on this notice, the taxpayers were urged to file returns. This system can be described as a revival of the former official assessment system, but it successfully stopped the

This system was introduced based on the Shaup Recommendation, which allows those who keep a certain level of bookkeeping and file a correct tax return based on such bookkeeping to receive favorable treatment in the calculation of income and other matters.

confusion.

(2) 1957

The notice system mentioned above was abolished and replaced by the tax consultation system, in which taxpayers were required to visit the Tax Office and were provided with guidance to file appropriate returns.

This tax consultation system did not differ from the former notice system in the sense that guidance on returns was provided on the basis of the pre-filing amount determined by an examination. However, it did differ from the previous system in the sense that a relatively large degree of flexibility was allowed in its management.

(3) 1963

To promote the blue return system, a decision was made to cooperate with a number of private organizations to provide bookkeeping guidance to taxpayers.

(4) 1972

Pre-filing examinations were reduced in number to prepare for a future shift to a post-filing examination system. Tax consultation for white return taxpayers with particularly low incomes was entrusted to local tax authorities.

(5) 1974

The shift to the post-filing examination system began and the tax consultation system was abolished. A decision was made that Tax Offices would offer only appropriate advice, such as how to fill in return forms, when taxpayers asked for consultation on the calculation of income, etc.

(6) 1976

When the tax consultation system for taxpayers seeking advice during the final tax return period was abolished, the level of tax compliance declined significantly. In response to this, the tax consultation system was reinstated, thus allowing Tax Offices the opportunity to review taxpayers’ business activities and provide appropriate advice to taxpayers filing returns.

(7) 1977

With the adoption of the post-filing examination system, emphasis was placed on large income amount earners and malicious cases. Due to the increase in the duration of examinations for each case, the NTA introduced a short-term examination of actual income amount focusing on cases for which it

would be relatively easy to detect the actual conditions of the taxpayer.

(8) 1981

With the basic recognition that tax consultation is an important opportunity to make contact with large numbers of taxpayers and contributes to maintaining and enhancing taxpayer compliance, the NTA decided to provide for more tax consultation designed to give an adequate hearing to the business conditions of taxpayers. The goal was also to provide appropriate orientation and recommendations to taxpayers to file correct returns reflecting the actual state of their business operations, while considering general trends within their industries and related information.

(9) 1984

White return taxpayers who meet certain conditions were given the duty:

・To keep books;

・To maintain books and records in good order;

・To attach statements of revenue and expenses; and

・To file statements of gross income and expenses.

To establish this new system, a decision was made that appropriate orientation should be given to such taxpayers through a variety of public relations activities and explanatory meetings.

(10) 1989

With the introduction of the consumption tax, taxpayer education concerning this new tax was also to be conducted during income tax examinations. Since sole proprietors who were subject to consumption tax were to file a consumption tax return for the first time, consultations on consumption tax would be given at the time of income tax consultation for taxpayer convenience and efficient administration.

(11) 1991

Structural reforms of the NTA brought changes to tax examinations: income tax and consumption tax examinations were to be performed simultaneously; post-filing examinations were renamed as “field examinations;” short-term examinations of actual income amounts were abolished; and a new point examination that incorporated post-filing dispositions (office audits) into the field examination scheme was established.

(12) 1995

OCR-enabled tax return forms were created with the trial introduction of the KSK system.

(13) 1998

On the occasion of the 50th anniversary of the self-assessed income tax system, and together with governmental administrative and fiscal reforms, the Tax Consultation System was changed to a system whereby taxpayers are encouraged to fill in return forms by themselves and seek the advice of tax officials only when they do not know what to do. This new system was promoted nationwide.

(14) 1999

Automated tax return preparing machines were introduced nationwide, thus allowing taxpayers to use a touch-panel screen to prepare returns when filing for a tax refund.

(15) 2000

Experimental electronic filing began.

(16) 2002

In the final return for 2001, the income tax return form and instruction manual were revised overall to meet taxpayer needs for return forms that are easy to read and understand.

(17) 2003

For the final return for 2002, a section for completing income tax returns was opened on the NTA website to enable taxpayers to make the tax return there and then file the tax return forms directly at a Tax Office.

(18) 2004

The NTA introduced an online tax return filing and tax payment system called e-Tax at the Nagoya Regional Taxation Bureau from February 2004 and expanded its operations nationwide from June 2004. In addition, some Tax Offices provided tax return consultation services and accepted tax return forms as opening tax office on two Sundays of February in principle.

Furthermore, point examinations were abolished and focused examinations were introduced, in which unrecorded income is ascertained in a short period based on materials and information as well as through clarification of actual business conditions.

(19) 2005

The section of the NTA website for completing income tax returns was renamed as “Filing Assistance on the NTA website,” and functions for the preparation of final consumption tax returns and financial statements for blue returns were added.

(20) 2006

Functional improvements were implemented for the Filing Assistance on the NTA website such that tax return forms printed on a black-and-white printer instead of a color printer could be submitted.

(21) 2007

Functional improvements were implemented for the Filing Assistance on the NTA website such that taxpayers could send their tax returns by e-Tax directly using Basic Resident Register card (Japanese Public Key Infrastructure), etc.

(22) 2008

The NTA started to set up PCs at consultation sites so that taxpayers could use Filing Assistance on the NTA website to send their tax returns via e-Tax.

(23) 2009

Administrative work was combined under internal administration unification.

(24) 2011

All white return taxpayers were given the duty to keep and maintain books and records in good order. For the smooth implementation of this requirement, a decision was made that appropriate orientation should be given to such taxpayers through various public relations activities and explanatory meetings. Additionally, mutual disclosure of income tax filing data between national government and local government commenced.

(25) 2013

Measures were taken in response to the revision of the Act on General Rules for National Taxes, which clearly defined conventional operational treatment concerning examination procedures.

(26) 2015

Functional improvements were implemented for the Filing Assistance on the NTA website such that tablet terminals could be used to make final tax returns for income tax.

(27) 2016

Functional improvements were implemented for the Filing Assistance on the NTA website such that taxpayers could send their tax returns by e-Tax directly using My Number card (Public Certification

Service for Individuals).

(28) 2017

Handover of Income tax filing data from local government to the NTA started.

(29) 2019

With the filing assistance on the NTA website, the taxpayer enabled to use the following methods.

1 My Number Card method: By using the My Number Card for e-Tax, this method eliminates the need to enter an ID and password

2 ID and password method: For taxpayers who have not yet obtained a My Number Card, this method allows them to utilize e-Tax through the use of an ID and password as a temporary measure until the My Number Card is widely used.

Besides, a prepared return form can be transmitted through e-Tax with IDs and passwords method by using smartphone or tablet.

(30) 2020

With the filing assistance on the NTA website, e-Tax transmission by using smartphone with the My Number Card method became possible.

(31) 2021

Responding to the linkage function of Mynaportal##, on the NTA website “Tax Return Preparation Corner,” data such as life insurance premium deduction certificates can be obtained in a lump through the Mynaportal, and the data can be automatically entered into tax returns.

Mynaportal is an online service operated by the government. Users can search for administrative procedures for child care, nursing care, etc., apply online, and receive notices from the public administration.

In addition, the Business Operation Center has been established as an organization of the Regional

Taxation Bureaus, and the shift to the “Center-based system for internal administrative tasks,” which integrates internal business such as the input and examinations of tax returns, that had been performed at tax offices, has begun sequentially.

(32) 2022

By photographing the tax withholding slip for salary income by a smartphone camera, it became possible to automatically input the information into the tax return form on the Filing Assistance on the NTA website.

The Ministry of Internal Affairs and Communications has issued My Number Card since 2016.

In May 2022, a service that allows the taxpayer to obtain information on returns, etc., was launched. As a result, it became possible for the taxpayer, who prepared the tax return from his/her smartphone or personal computer and saved related data on the device, or filed the return online by e-Tax, to display, print, and view the tax return, etc., without making a request for disclosure pursuant to the provisions of the Act on the Protection of Personal Information.

(33) 2023

From January 2023, it is no longer necessary to submit a notification in the event of a change in the place for tax payment.

In addition, it became possible for the taxpayer to prepare financial statements for bule return and statements of earnings and expenses from his/her smartphone on Filing Assistance on the NTA website.

2 Taxpayers of Income Tax#

Japan adopts the withholding tax system in addition to the self-assessment system for income tax.

Those who pay certain types of income such as salaries, dividends, interest, fees, etc. (“withholding agents”) have to withhold a certain amount of tax when they make such payments and pay the tax amount to the tax authority. Both the self-assessment system and the withholding tax system are applied in a dual manner. The tax amount withheld is prepaid tax, so for salaried workers, if there is a difference between the tax on their annual salary income and the total tax withheld, they have to file tax returns to pay any amount owing or to obtain a refund. However, except for cases in which the amount of income other than salary from a single source exceeds a specific amount, the tax amount withheld is adjusted by a year-end adjustment and there is no need to file a final return. Furthermore, certain types of income, such as interest income, are subject to separate withholding taxation at source, and the relevant taxation is finalized by the withholding tax.

Income tax in Japan is thus administered by a combination of the self-assessment system and the withholding system.

3 Relationship Between Types of Income Earners and Divisions in Charge

Although taxpayers of income tax include residents and nonresidents, the explanations here focus on the taxation for residents.

Taxpayers belong to different social groups and have different ways of thinking about tax administration. Sources of income are complicated and multifarious. Income tax is perceived to be more burdensome than other kinds of taxes and taxpayers are particularly sensitive to fair administration. Whether or not fair taxation is assured for such a diverse range of taxpayers has a great impact on trust in tax administration as a whole and thereby on the tax compliance of the taxpayers.

For efficient tax administration, it is necessary to assess and classify a wide variety of taxpayers and adjust our division of labor.

In general, the classification of taxpayers is as follows.

(1) Owing to the difference in procedures in tax payment, withholding income tax and self-assessed income tax are administered separately. The Examination Group (Corporation) is responsible for withholding tax. This group is separate from the Examination Group (Individual), which is in charge of self-assessed income tax.

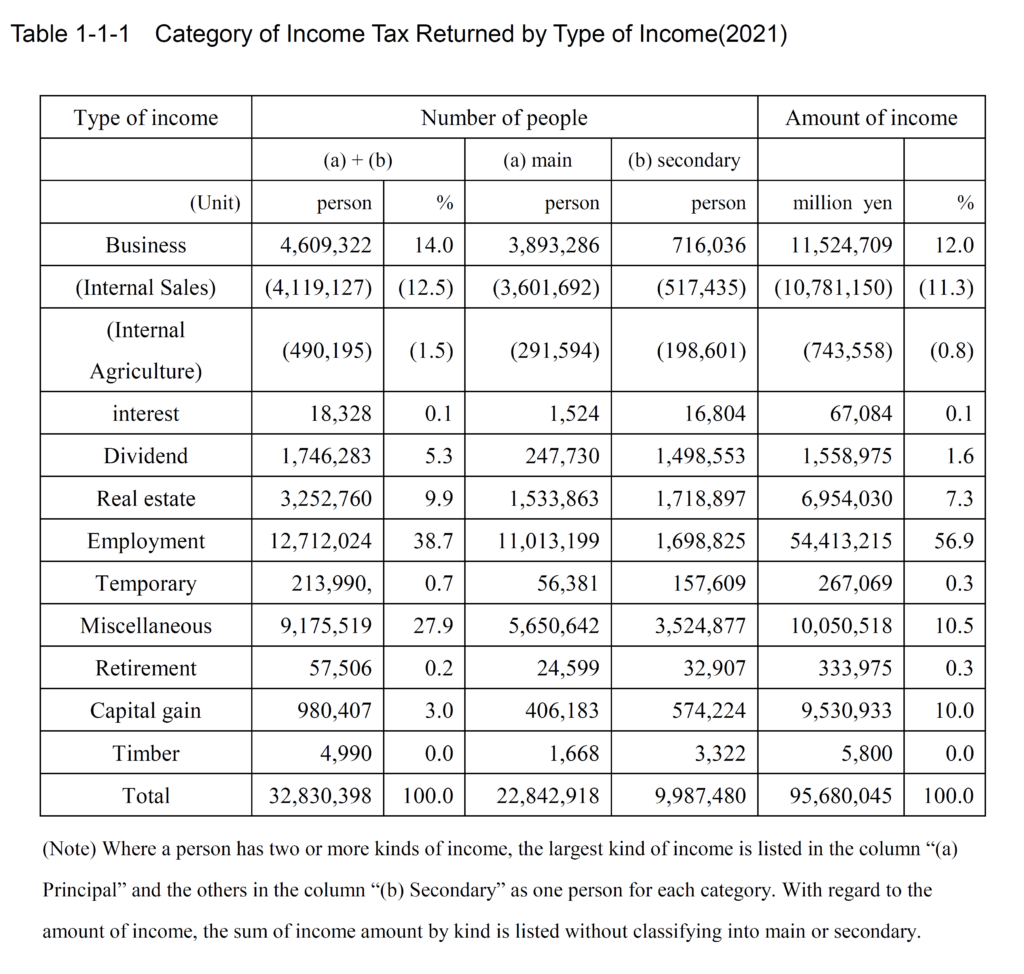

(2) For administrative purposes, taxpayers of self-assessed income tax are classified into business income earners, agricultural income earners, and other income earners (see Table 1-1-1).

(3) The Property Taxation Group is separately in charge of capital gains and timber income.

(4) The administration of information covers not only the needs of income tax examinations, but also those of corporation tax examinations and property tax examinations. Therefore, there are officers exclusively in charge of information.

(5) Business income earners are divided into blue and white return filers and classified by sales amount size. Agricultural income earners are classified by business size along with the division into blue and white return filers. Other income earners are classified by the value of assets possessed, etc. into taxpayers with large assets, taxpayers with large-scale real estate, and other taxpayers. This is done so that the volume of administrative work may be distributed effectively by giving priority to certain sectors.

(6) Criminal investigations are conducted against malicious tax evaders. These investigations are compulsory and similar to criminal investigations in areas other than taxes. For this reason, this type of investigation is separated from ordinary examinations and is under the jurisdiction of the Criminal Investigation Departments of Regional Taxation Bureaus.

Table 1-1-1 Category of Income Tax Returned by Type of Income(2021)

(Note) Where a person has two or more kinds of income, the largest kind of income is listed in the column “(a) Principal” and the others in the column “(b) Secondary” as one person for each category. With regard to the amount of income, the sum of income amount by kind is listed without classifying into main or secondary.

Section 2 Overview of Administration of Self-Assessed Income Tax

1 Basic Administrative Policy

The self-assessment tax system is sustained through the cooperation of taxpayers who keep accurate books and file correct returns.

The basic policy for income tax administration is to ensure correct returns and payment through the cooperation of taxpayers. In order to gain their cooperation, and while keeping fairness in mind, the

tax authority must detect and correct taxpayers who either carry out tax fraud or understate their income. Therefore, tax examinations are an essential function of the tax authority, and efficiency is a key part of this responsibility. The NTA conducts tax examinations focusing on those taxpayers who may omit large amounts of taxes, and whose turnover or income is high.

One other means to raise the compliance level is to encourage the spread of good bookkeeping practice through the promotion of blue tax returns. To this end, we make every effort to increase the number of blue return filers, and explain the importance of bookkeeping when we are in contact with taxpayers. In addition, we provide education in bookkeeping with the cooperation of private-sector organizations such as the Blue Return Association.

2 State of Self-Assessed Income Tax

There are many kinds of taxes in Japan and income tax has a major share among them. In the initial budget (general account) for fiscal 2023, it amounted to 21.0 trillion yen, or 30.3% of the total tax and stamp revue of 69.4 trillion yen. Income tax makes a crucial contribution to the government’s annual revenue structure.

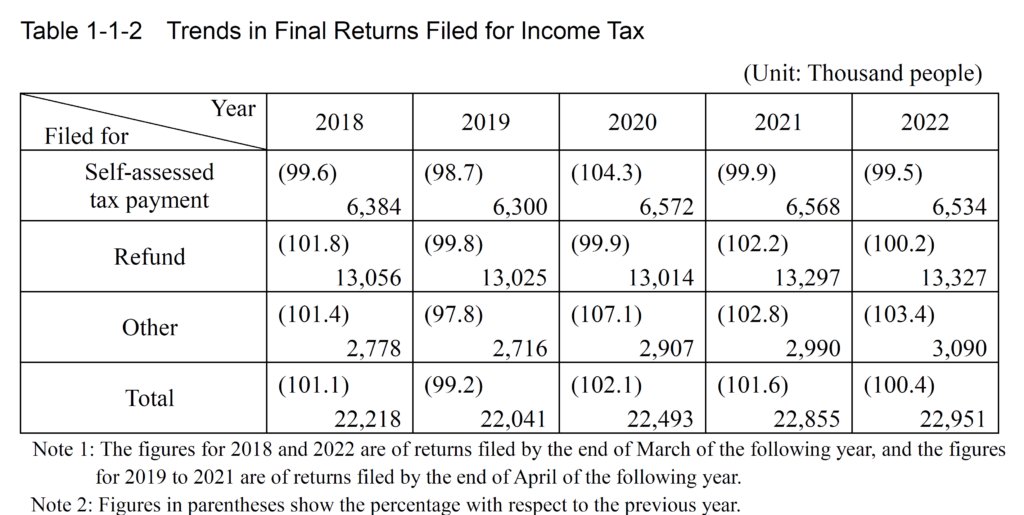

Taxpayers of income tax must file final returns unless their tax payments are completed through the year-end adjustment (see page 31). The number of taxpayers who filed final returns for income tax for 2022 was 22.95 million as of April 30, 2023. Of these people, those who submitted returns showing payable self-assessed tax amounts numbered 6.53 million. They declared 3.07 trillion yen of taxes on income totaling 46.31 trillion yen. Of all the taxpayers who filed final returns, 13.3 million filed for the refund of overpaid amounts of withholding tax and the remaining 3.09 million submitted returns without showing payable self-assessed tax amounts.

Table 1-1-2 Trends in Final Returns Filed for Income Tax

Note 1: The figures for 2018 and 2022 are of returns filed by the end of March of the following year, and the figures for 2019 to 2021 are of returns filed by the end of April of the following year.

Note 2: Figures in parentheses show the percentage with respect to the previous year.

3 Detail of Each Activity

It is important to efficiently distribute the workload, so income tax administration is categorized and managed as follows.

• Self-employed and Other Business Income Earners

- Blue return taxpayers (further classification by sales volume)

- White return taxpayers (further classification by sales volume)

• Agricultural Income Earners - Blue return taxpayers (further classification by business size)

- White return taxpayer (further classification by business size)

• Other Income Earners - HNWIs (High Net Worth Individuals)

- Large-scale real estate owners

- Others

Tax administration based on the abovementioned categories of taxpayers will be described in this section. (Tax administration for capital gains and timber income will be described in Chapter 3, Section 3, numbers 4 and 5.)

(1) Information Files, Review of Returns, and Identification of Non-Filers

There are three means used to ascertain the correctness of income. The first is performed by the taxpayers themselves and includes the submission of documents such as notifications of business

opening, final income tax returns, income statements, balance sheets, statements of assets and liabilities, and records of overseas assets. The second is performed by the Tax Offices using transaction information. This information is limited to certain types of transactions and is not comprehensive, but payment records and the like are quite effective in checking taxpayers’ returns. The third is a tax examination by a Tax Office.

Most of the information required to confirm the correctness of income is in the hands of the taxpayers themselves. Taxpayers are the ones who have full knowledge of their own income, so it is most desirable for them to individually confirm their income. In this way, the final tax returns are not only forms used to ascertain the amount of taxes due, but they are also tools that provide the minimum information necessary to check taxpayers’ returns. In this sense, the self-assessed income tax system is vital as the foundation of the income tax system, and for it to function well, there must be adequate assurance that taxpayers maintain true records on their transactions, and file tax returns properly based on these records.

The difficulty of ascertaining the correctness of income also depends on how income is derived. In addition, ease of collecting information varies among industries and professions.

Tax Offices possess huge amounts of information collected by tax officials and submitted by taxpayers, etc.

Transaction information is classified according to individual taxpayers, and stored in individual taxpayers’ examination files (hereafter “files”). This is used for checking the tax obligations of taxpayers with no returns or the tax amounts stated in filed tax returns.

To detect non-filers, in addition to using the abovementioned information, some Tax Offices act on their own initiative to examine whether tax returns are being properly filed by taxpayers who do business in designated areas, such as busy streets.

Notes:

- “Information” includes information returns submitted by payers of interest, dividends, salaries, and rent on real property; ordinary gathered information submitted by corporations as statements on commercial transactions; and examiner collected information, which tax officials collect during the course of their examinations. If a taxpayer is found to have colluded with a trading partner to understate sales revenues, field examiners will collect information that relates to the fraudulent activity of the partner.

- Most of the information collected at a Tax Office is electronically processed by an audit information system to efficiently classify taxpayer information.

- The review of returns involves referencing the content of tax returns against the integrated information on the taxpayer and performing detailed analysis and examination.

(2) Field Examinations

Field examination (special examination, general examination) is to conduct questioning and inspections, etc. at taxpayers’ homes and business establishments, etc., targeting cases in which large amount of additional charges or malicious fraudulent calculations are anticipated. We also clarify the actual state of a taxpayer’s business and thoroughly examine problem areas in taxation. To this end, we make use of our organizational capacity in special examinations and general examinations, depending on the subjects under examination. Implementation examination (point examination) is to practice on-site examination in a short period of time targeting individuals who are anticipated to have failed to report as a result of analysis of material information and the content of reports The allocation of human resources is determined by the Chief Examiner through careful consideration of the type and size of the business, the difficulty of the case, and the necessity of an examination of third parties relating to the examinee’s transactions. In particular, a special examination is conducted on individuals who are anticipated to have a large amount of tax evasion, ensuring a reasonable number of days (approximately 10 days or more per case).

The Chief Examiner instructs the examiner in charge to study various matters such as points of particular concern in the examination, the use of information, and the examination methods before it is launched, and to make reports on progress and results during the examination so the Chief Examiner can give advice necessary to achieve a desired result.

Officers in charge of field examinations apply their general knowledge of the types of business concerned as well as their examination skills and experience, while paying particular attention to the points noted below.

a. To collect information from documents available within the Tax Office, such as past examination records, prior to beginning the field examination.

b. To adopt examination techniques suitable for the type and condition of the business concerned, by focusing on the points emphasized by the Chief Examiner.

c. As a general rule, to inform the taxpayer in advance that he/she will be subject to a tax examination.

d. To correctly understand the actual condition of the taxpayer, such as the books, records and other documents on his/her premises, the form and manner of transactions, and finances.

e. To make full use of all information they possess.

f. To perform, when necessary, field examinations of counter parties.

g. To perform, when necessary, effective joint examinations.

h. To examine items related to consumption tax and withholding tax when the taxpayer being

examined is a taxpayer of consumption tax and a withholding agent.

i. To examine income for all respective years to be examined.

In business year 2022, 46,000 field examinations were conducted. Undeclared income totaled 559.4 billion yen, with 101.5 billion yen in additional tax revenue collected including penalty taxes (see Table 1-1-3).

Table 1-1-3 Number of Field Examinations on Taxpayers of Self-Assessed Income Tax Conducted

(3) Desk Audit

Other than field examinations, if taxpayers erroneously calculate their income, incorrectly apply the tax law such as tax credits, etc., or do not submit the accompanying documents for a tax return, the examiners ask such taxpayers for an explanation either over the telephone or in writing, or by submission of an attachment. Where necessary, a taxpayer will be required to submit an amended return. If the taxpayer fails to respond, the tax authority will correct his/her assessment.

Since July 2021, an Operation Center has been established in Regional Taxation Bureaus, and a shift to the center-based system for internal administrative tasks (integrated processing of internal business which had been handled at Tax Offices) has been making progress sequentially, and the Operation Center is in charge of the post-processing operations that can be processed by telephone or written documents. (Refer to P. 267 for information on the center-based system for internal administrative tasks.)

(4) Promotion of the Blue Return System

The NTA has consistently encouraged the use of the blue return system. The number of blue return taxpayers had reached 5.48 million as of April 30, 2019.

Meanwhile, the NTA has been strengthening various measures designed to improve bookkeeping capacity for those who lack the ability to properly maintain their own books or who cannot afford to employ a certified tax accountant, while engaging in initiatives to increase the number of blue return taxpayers.

i Measures to increase blue return taxpayers

Officials in charge of income tax always encourage the filing of blue returns when they are in contact with taxpayers. The Associations of Blue Return Taxpayers, Chambers of Commerce and Industry, Societies of Commerce and Industry, Certified Public Tax Accountants Associations, and other private organizations are also actively promoting the use of blue returns.

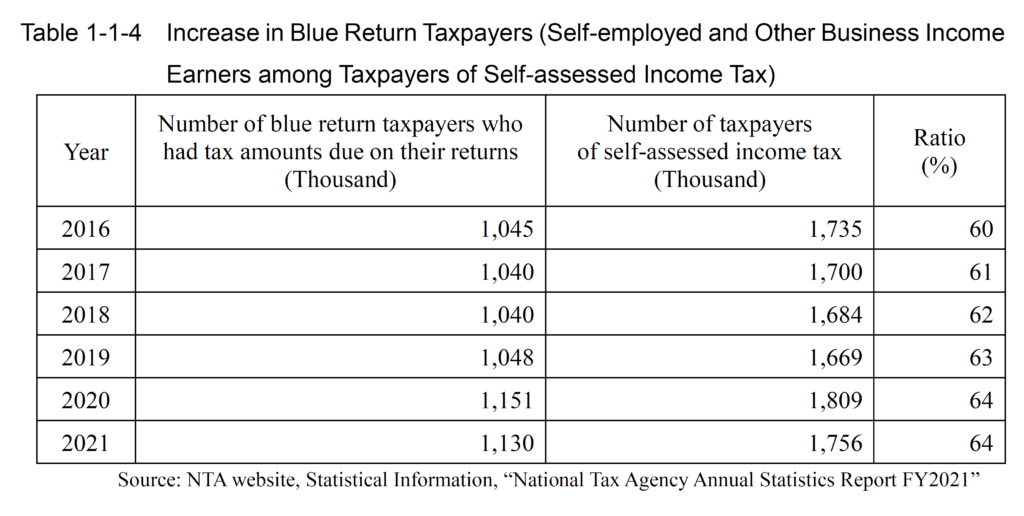

Blue returns for 2021 were filed by roughly 64% of taxpayers of self-assessed income tax who earn business income, and the NTA is continuing its efforts to increase the number of blue return taxpayers (see Table 1-1-4).

Table 1-1-4 Increase in Blue Return Taxpayers (Self-employed and Other Business Income Earners among Taxpayers of Self-assessed Income Tax)

Source: NTA website, Statistical Information, “National Tax Agency Annual Statistics Report FY2021”

ii Education and guidance for blue return taxpayers

With the object of increase of the convenience for the taxpayer, securement of proper tax filing, and improvement of tax filing level, bookkeeping briefings for new blue return taxpayers as well as financial results briefings, in which points to note about tax returns and matters related to financial results, etc. are explained, are held. Besides, entrusted private organizations provide free

advices about the manner of bookkeeping as well as procedures for settlement of accounts and tax returns at the guidance of bookkeeping.

(5) Bookkeeping Guidance for White Return Taxpayers

The tax reform in 1984 introduced a bookkeeping obligation for white return taxpayers, and the tax reform in 2011 expanded the coverage of bookkeeping and record-keeping systems to include all business income earners, etc. To promote this objective, the NTA strives to spread knowledge of the system by providing information and takes every possible opportunity to give guidance on bookkeeping methods. This is done with the cooperation of local governments and private organizations. For example, explanatory seminars on bookkeeping and the settlement of accounts are held and individuals are given specific guidance on bookkeeping instructions.

(6) Tax Return Preparation Assistance

When the season for filing final returns (from February 16 to March 15 of each year) draws near, the NTA head office, Regional Taxation Bureaus, and Tax Offices initiate a large-scale campaign using posters, TV programs, newspapers, websites, etc. to notify the public that:

• The filing period is coming; and

• That taxpayers should prepare their final returns by themselves using information technology (IT), and properly file them.

There were 22.95 million final returns filed for 2022.

However, not all taxpayers can prepare returns without assistance. Tax laws are amended almost every year to change the way to calculate income and tax amounts.

Therefore, responding to taxpayers’ questions and inquiries in a thorough and courteous manner is very important for the self-assessment system to take root.

Therefore, Tax Offices hold explanatory seminars before and during the season for filing final returns, mainly focusing on how to fill in the forms, and consultation meetings on filing tax returns are held nationwide. Tax Offices usually hold these meetings as a joint effort with local governments, Certified Public Tax Accountant Associations, Chambers of Commerce and Industry, Societies of Commerce and Industry, and other relevant private organizations.

Furthermore, since the tax returns for 1998, the NTA has adopted the policy that taxpayers should prepare their returns by themselves, and the tax authority will advise them if they request further help.

During the final tax return season in 2020, the number of tax consultations at Tax Offices, local governments, Certified Public Tax Accountants Associations, Chambers of Commerce and Industry, and Societies of Commerce and Industry totaled 7.19million.

(7) Method of Filing Tax Return Consultation i Business income earners

Many blue return business income earners are capable of preparing their returns without any assistance, or have entrusted the preparation of final returns to certified public tax accountants. However, a considerable number of such business income earners still need some advice in preparing returns.

Consultation and guidance for blue return business income earners are often given by consulting organizations other than the Tax Offices. For example, Associations of Blue Return Taxpayers mainly give their members orientation on bookkeeping and the settlement of books, while Chambers of Commerce and Industry and Societies of Commerce and Industry offer this type of orientation mainly to small-scale taxpayers.

On the other hand, most white return business income earners have relatively small businesses and often lack sufficient bookkeeping knowledge. This means that many of them require assistance in filing their final returns. Therefore, we give advice to taxpayers regarding how to fill out the statements of gross income and expenses by themselves so that they can file correct returns.

Furthermore, since 2005, the NTA has been providing ICT-based services to enable taxpayers to prepare appropriate tax returns, by sequentially adding functions for preparing income tax, consumption tax, and gift tax returns, amended tax returns, financial statements for blue return, and requests for correction, etc., to Filing Assistance on the NTA website.

ii Other income earners

The NTA also provides tax consultation for other income earners.

Especially in recent years, the number of salary earners and pensioners who request refunds for tax withheld at source has been increasing, and more and more people are making use of opportunities for tax consultation at local governments and Certified Public Tax Accountant Associations as well as the Tax Offices.

For the convenience of such salary earners and pensioners, as well as for more effective consultations, since 1997, the NTA has provided an assistance service on its website on how to easily fill out the income tax return form for refund claims. A new function for calculating the refund amount for those who declare a deduction for medical expenses or special credits for housing loans was added in 1998. In 2003, the NTA started to provide a service that allows taxpayers to prepare tax returns documents on their computers connected to the Internet and submit them online. In 2006, the NTA added a function to its website that allows the filing of tax returns electronically. Since 2019, the NTA has made it possible to make electronic declarations by using smartphones, aiming to promote declarations through the use of ICT. For fiscal 2022, 18.70million income tax return filers used ICT, and the percentage of taxpayers using ICT was 81.5%.

(8) Tax Return Processing after the Filing Season

The amounts of income and tax declared on the returns are input as system data and stored. Moreover, final returns are checked so that necessary measures can be taken for returns that have been filed at Tax Offices outside the applicable jurisdiction or for returns that are missing required attachments.

Chapter 2 Withholding Income Tax Administration

Income tax in Japan is premised on the self-assessment system. In the case of certain types of income, however, the payer withholds the income tax on the amount paid at the time of payment and pays the amount withheld into the National Budget. This is known as the withholding tax system.

As for details on the system, refer to the “Withholding Tax Guide 2022” (posted on the NTA website: https://www.nta.go.jp/publication/pamph/gensen/shikata_r06/01.htm).

1 Basic Administrative Policy

The ultimate goal in the administration of withholding tax is to accurately identify withholding agents and to have these agents correctly withhold income tax and pay the amount withheld by the due date.

The Japanese withholding tax system has a number of distinctive features. For example, many employees whose taxes are withheld from monthly (or daily) payments (salaries in Japan are usually paid on a monthly basis) do not have to file income tax returns. This is because necessary adjustments are made at year-end by the withholding agents (the salary payers). The taxation of interest income, dividend income, and capital gains derived from transfers of listed shares is completed by the withholding tax.

All procedures such as calculating, withholding, and paying tax are performed by the withholding agents. A lack of proper administration and guidance of withholding agents would cause a sense of mistrust in the withholding tax system among taxpayers, which would involve a possible adverse impact on all taxes. Therefore, it is necessary to strive for proper administration at all times, in order to retain the taxpayers’ trust in this system.

The income tax amounts withheld are entrusted funds by nature, and as such require particularly proper and exact administration. In addition, from the viewpoint of international taxation, withholding tax functions as the last resort in domestic taxation. These characteristics make the significance and role of the withholding income tax system very important.

For this reason, the administrative work on withholding tax is conducted based on the three basic principles noted below.

a To accurately identify withholding agents for fairness

Since the withholding tax is quite far-reaching, covering salaries, retirement allowances, and remuneration and fees, there are a great number of withholding agents and they widely vary in size and category. This makes it difficult to monitor these agents closely and thus may result in an imbalance in taxation.

For this reason, constant efforts are made to ensure fairness in taxation as a whole. One such method is to maintain an accurate identification of withholding agents, and take every opportunity, through proper guidance and examinations, to encourage agents to fulfill their obligations.

b To deepen withholding agents’ understanding of the system by guidance

Administration of the withholding tax system depends on how well the withholding agents understand the system. By taking every opportunity to contact withholding agents, efforts are made to give proper guidance according to the type, status, and size of the business in question. It is important to thoroughly familiarize them with the pertinent laws and regulations, directives, etc., and to educate them to become excellent withholding agents.

c To effectively operate guidance and examination tasks by proper management of the fulfillment of withholding duties of withholding agents

In order to ensure fairness in taxation as a whole, it is necessary to provide full guidance to withholding agents who fail to fulfill their obligations in a proper manner, and to carry out thorough examinations on agents who do not respond properly to guidance. In order to cope with the increasing administrative work with the limited number of staff available, efficiency is required in providing guidance and conducting examinations.

For this purpose, efforts are made to formulate and implement a system that will facilitate the selection of withholding agents that are truly in need of guidance or examination. The means of doing this include making use of internal records, accumulating information, and adequately managing withholding agents in the fulfillment of their duties.

2 Outline of Management of Administrative Work

The administration of the withholding tax aims at having withholding agents fulfill their duties properly. For this purpose, it is of the first importance to accurately identify the withholding agents. Furthermore, it is also important to provide appropriate guidance to encourage them to perform their

duties properly. Finally, fairness in taxation should be sought by conducting strict examinations to the agents who do not fulfill their obligations properly.

The administration of withholding tax is performed according to the foregoing principles. The actual work is described below.

(1) Gathering Information on Withholding Agents i Internal information

During a predetermined period of each year, withholding tax related documents, etc. are checked against basic records of corporation tax and income tax in order to determine whether or not information on withholding agents has been missed and/or if changes have been properly processed.

ii External information

To properly monitor withholding agents, we cross-check the internal withholding tax records with various external data to identify withholding agents that are difficult to identify with internal records, such as branch offices, public interest corporations, associations without juridical personality, schools, etc.

iii Prompt and accurate processing of changes

If a change is found concerning a withholding agent, the matter is handled in a prompt and accurate manner, in an effort to avoid creating mistrust.

(2) Administration of Withholding Income Tax Payments

Based on the payment data submitted by withholding agents when they pay the withheld amounts at financial institutions, The NTA makes assessments and decisions regarding underpayment penalties on withholding regarding payments made after the due date.

The NTA also monitors withholding agents by checking internal records such as final tax returns, etc. and collected outside information, as well as by analyzing their withholding income tax payment records. These methods make it possible to detect withholding agents that are not appropriately performing their withholding obligations at all times.

In resolving non-payment cases, the NTA is pursing efficient implementation by the focus of large-amount delinquents, delinquents for the past year, and habitual delinquents, then establishes Office of Withholding Tax Centers across Japan adopting the intensive managing system of sending the letter

of inquiry about non-payment to non-payment taxpayer and providing telephone notification, further, tax offices use the entire resources as necessary.

Note: As a result of the introduction of the KSK system, it has become possible to transfer the Statement (Tax Payment Slip) of Collected Income Tax submitted to financial institutions, etc. to the NTA in data form after OCR processing at the Bank of Japan, etc. The KSK system was introduced in 2001 at all Tax Offices throughout Japan.

(3) Guidance on Withholding Tax i Guidance for payment

Guidance for payment is given to withholding agents who have failed to pay on time. The purpose of such guidance includes determination of the amount of tax payable and making a payment inquiry.

In concrete terms, this guidance consists of:

a Making an inquiry of delinquent withholding agents either in writing or by telephone;

b Guidance by visiting the agents; and

c Guidance during an examination.

ii Guidance at the time of year-end adjustment

At the end of the year, employers calculate the amount of income tax on the annual salary of each of their employees and contrast the annual tax amount and the sum of income tax withheld during the year, then settle the discrepancy. As such, this is the most important of the withholding procedures for employment income.

For this reason, in order to enable a person obliged to withhold tax to properly implement the year-end adjustment, the NTA sends explanatory booklet and other documents, creates a special page on the NTA website concerning the year-end adjustments, discloses videos and various reference information, and, upon request, sends officials to explanatory meetings held by relevant private organizations, etc., as lecturers, and has them explain certain procedures for calculating the tax amount in the year-end adjustments using explanatory booklet, tax tables, and other materials.

Furthermore, the NTA makes an effort to hold explanatory sessions efficiently and in a way that meets the needs of withholding agents. The explanatory booklet and other documents are sent to withholding agents, and also published on the NTA website.

iii Explanatory seminars on revisions of laws and regulations

When laws, regulations, directives, etc. relating to withholding tax are amended, booklets and

other materials regarding such revisions are sent to withholding agents and timely explanatory seminars on the revisions are held, so that the agents will have the opportunity to thoroughly understand the substance of the revised laws, regulations, etc.

iv Guidance for new withholding agents

Necessary documents such as the withholding tax tables, various forms and explanatory booklets are promptly distributed to new withholding agents. For persons in charge of withholding tax, guidance on withholding methods and important points relating to the preparation of relevant documents are provided individually or in groups at an appropriate time.

v Guidance during the period of filing final income and other tax returns

During the season for filing income tax and other tax returns, a notice requesting withholding agents to discharge their duties properly is sent with the return forms. During the tax consultation period, desks are set up at Tax Offices for consultations on withholding tax.

vi Guidance by type of industry

Explanatory booklets are prepared for and distributed to withholding agents who belong to the types of business in which common problems arise with regard to withholding tax. When a common failure is detected among withholding agents in a specific type of business and a correction is expected to be made through guidance, explanation on correct payment is made by asking suitably the relevant withholding agents or representatives of corporations to visit the Tax Office.

vii Guidance through related private organizations

When relevant private organizations such as Corporations Associations, Blue Return Taxpayers’ Associations, etc. hold meetings, senior officials of the Tax Office attend such meetings to provide guidance concerning withholding tax. Matters relating to withholding are carried in the bulletins, notices, etc. of these organizations.

viii Guidance through answering questions

If questions are raised or inquiries are made by withholding agents, a prompt and accurate reply will be made so that adequate withholding will be performed afterwards.

(4) Examinations

Examinations of withholding agents concerning withholding tax can be roughly classified into the two categories outlined below.

i Simultaneous examinations (Withholding tax examinations carried out concurrently with examinations concerning self-assessed income tax, corporation tax, and consumption tax)

This type of examination is performed with consideration given to the burden on withholding agents and administrative efficiency for the Tax Offices. If a withholding agent is a payer of self-assessed income tax/consumption tax or a payer of corporation tax/consumption tax, a withholding tax examination will be conducted concurrently when the examination is carried out on the tax base for the self-assessed income tax/consumption tax or corporation tax/consumption tax.

In such a case, officers in charge are required to be knowledgeable not only about income tax and corporation tax, but also about withholding tax.

ii Examinations (Field examinations and examinations for confirmation)

Field examinations concerning withholding income tax are conducted on corporations that are under the jurisdiction of the Large Enterprise Division but not subject to simultaneous examination, as well as withholding agents not liable for self-assessed income tax or corporation tax (religious corporations and other public interest corporations, government ministries, agencies and their branches, etc.), and payers to nonresidents, etc. They are also carried out for the purpose of in-depth examinations focused mainly on the withholding income tax of withholding agents belonging to an industry or business category having issues regarding withholding income taxation.

The selection of targeted withholding agents is made from various viewpoints based on internal records such as corporation tax returns, other data and information, and examination records, etc.

Examinations for confirmation are conducted on withholding agents who are not covered under withholding tax field examinations or withholding agents for whom the correction of errors and irregularities can be expected through short-term examinations. Such programs aim to determine the actual conditions of the withholding agents and encourage proper performance of their withholding obligations through summary contacts such as visits to their offices. Examination procedures are generally similar to those used for field examinations.

Table 1-2-1 The Number of Withholding Agents (Unit: Thousand cases)

Note: Figures are as of end of the respective business year (June 30 of the following year).

Chapter 3 Property Tax Administration

Section 1 Outline of Property Tax Administration

“Property tax” is a generic for inheritance tax, gift tax, registration and license tax, income taxes on capital gains and timber income, land value tax, etc. Inheritance tax, gift tax, income tax (on capital gains and timber income) are charged on the transfer of assets owned by individuals, and registration and license tax is to be imposed upon filing a registration, etc. Moreover, among asset holdings, land value tax is imposed on land holdings.

1 Inheritance Tax and Gift Tax

Inheritance tax is imposed on those who acquired property by inheritance or bequest, while gift tax is levied on the donee in a voluntary conveyance of property. Gift tax is imposed on property that was given before the donor’s death. As a result, gift tax supplements the function of inheritance tax, and relevant provisions are included in the Inheritance Tax Act, which thus covers two different tax items.

2 Income Tax (on Capital Gains and Timber Income)

When an asset is transferred, income tax is imposed on capital gains. Here the word “transfer” covers not only onerous activities, such as selling and buying, but also specific gratuitous activities, such as giving property to corporations. When timber is transferred or standing timber is sold, the profits (timber income) are subject to income tax.

3 Registration and License Tax

Registration and license tax is a kind of distribution tax, focusing on profits to be made by making registration or obtaining licenses for establishing and transferring property rights, obtaining certifications, and starting businesses. For registration and license tax, the registering institution determines the tax amount and confirms its payment amount. In principle, there is no requirement for various procedures in the Tax office such as receiving tax returns. As a result, tax offices’ administrative work is limited to consultation administrative work related to registration and license tax.

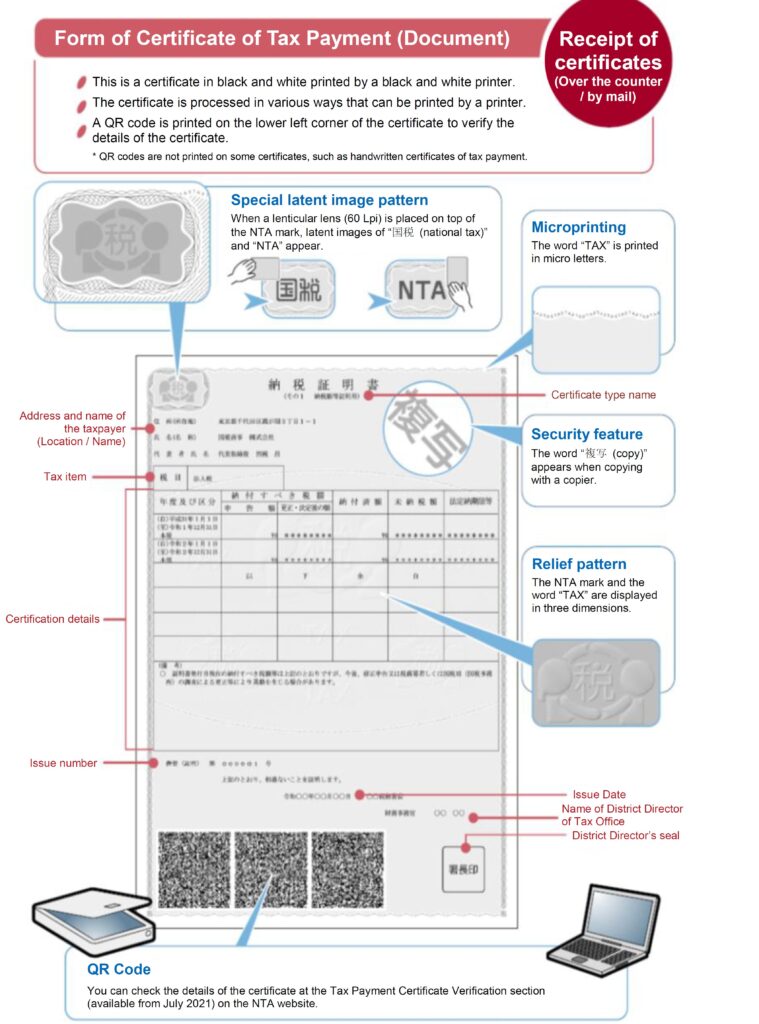

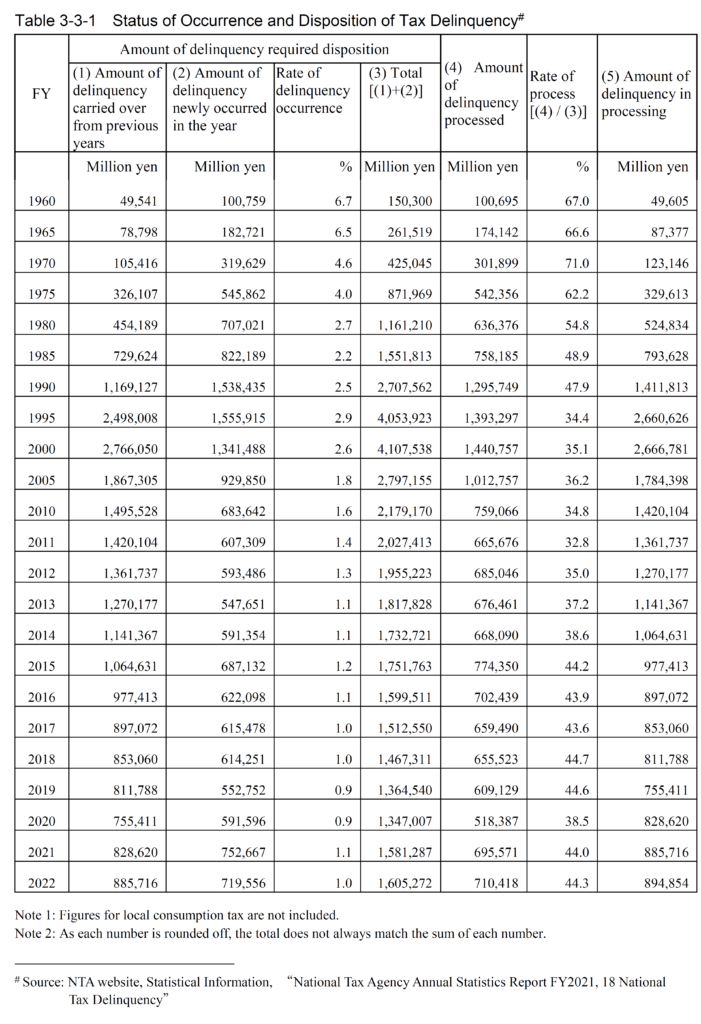

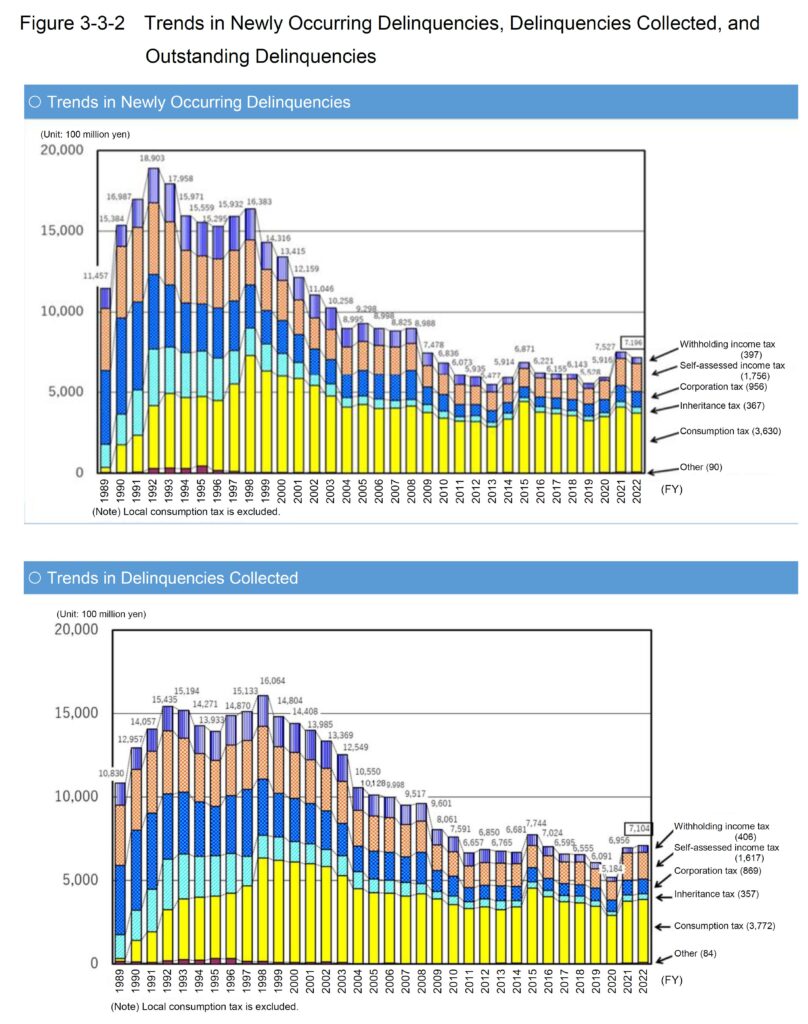

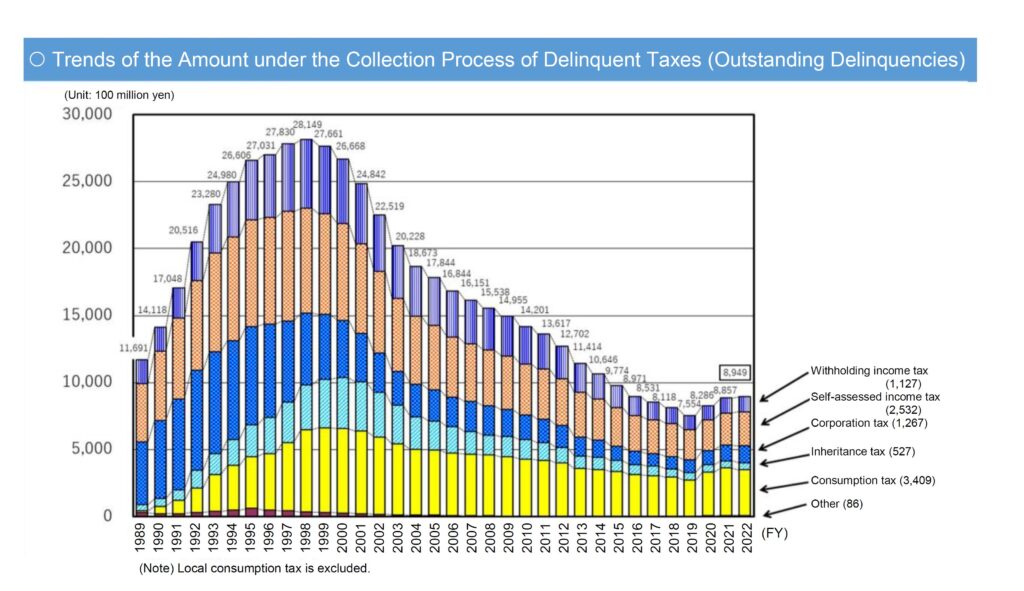

4 Land Value Tax